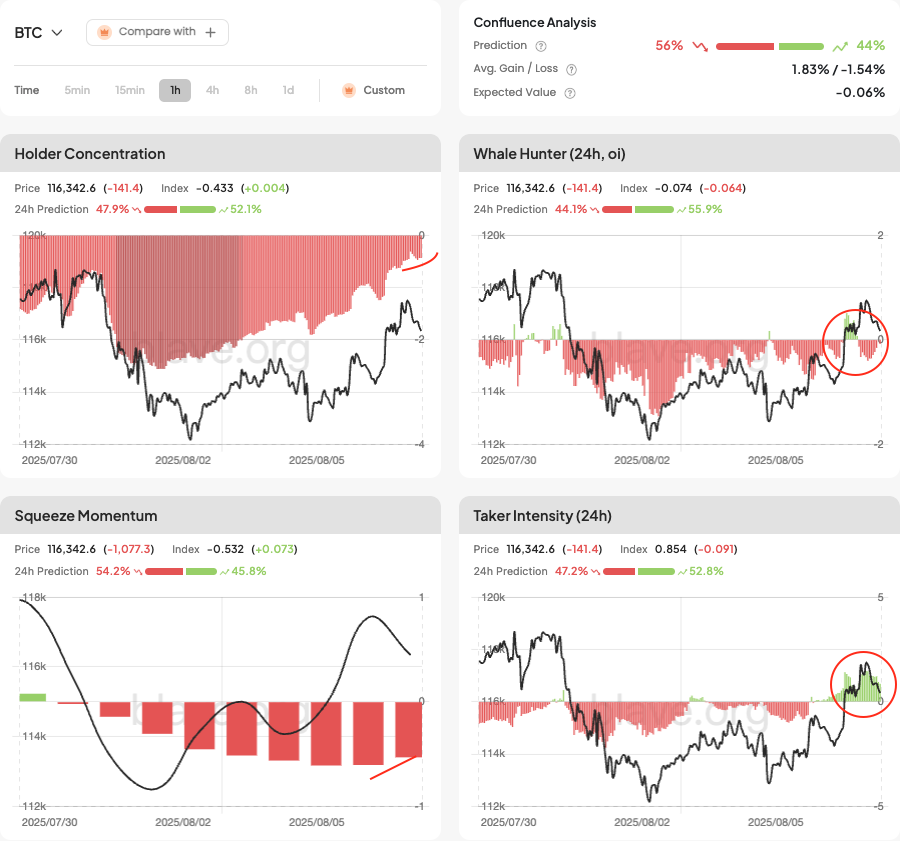

The market direction index showed a slight recovery and indicated a bullish signal, but market traders remain cautious. The concentration of BTC short positions is on a downward trend, and today, whales tend to be closing their long positions while retail investors are engaging in upward chasing buys. The short-selling momentum has begun to decline, suggesting an initial structure for a long transition from the short-selling trend, and there is a possibility of a sharp rise in the market following the adjustment of the forces' volume (wash trading).

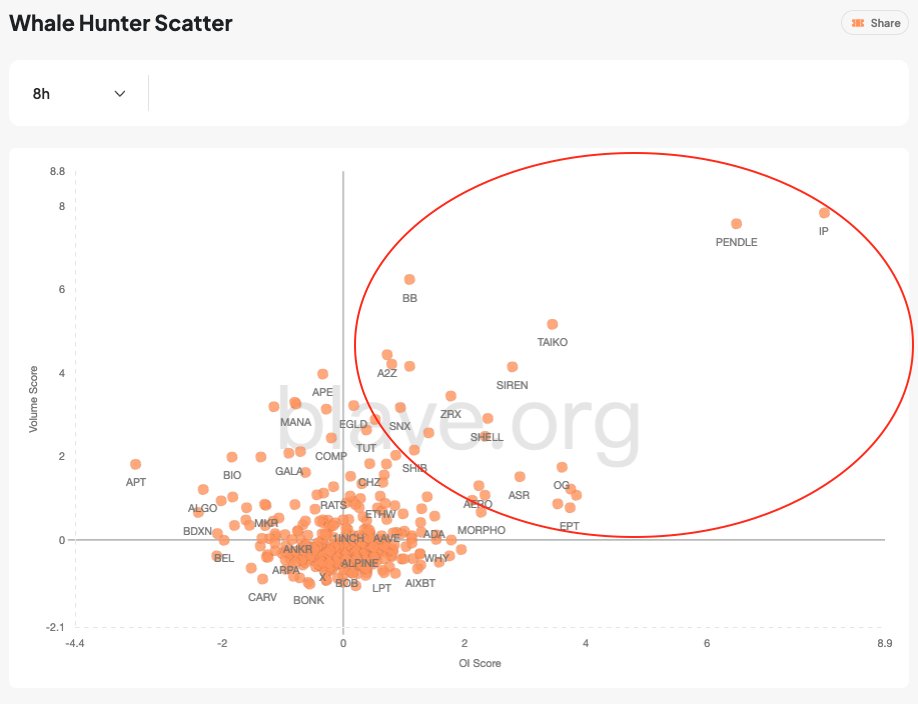

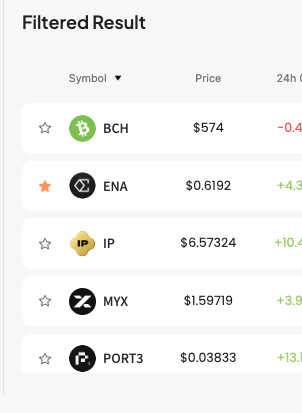

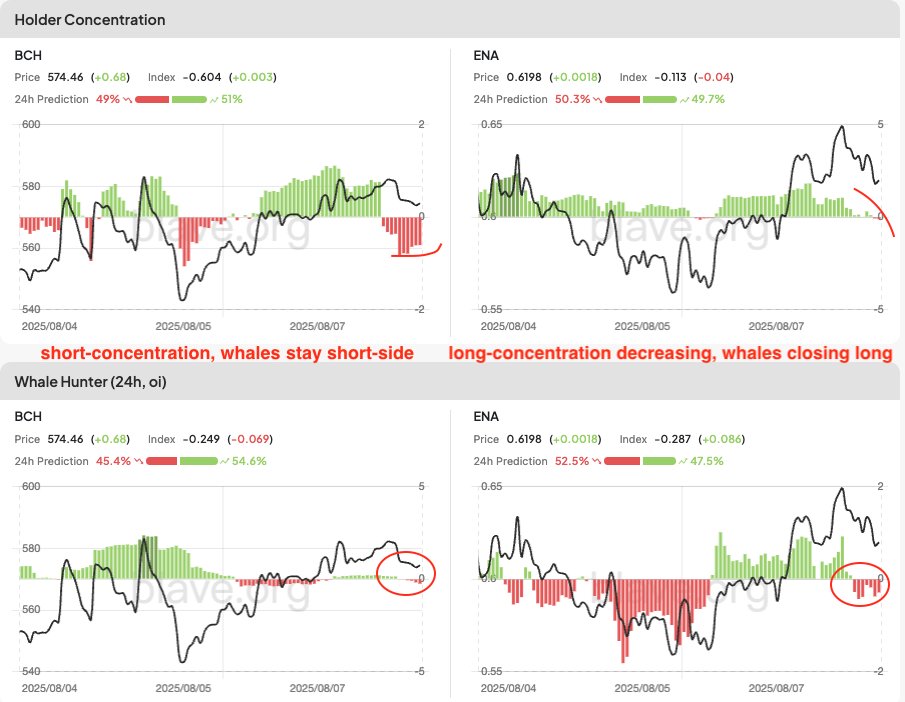

According to the whale alert distribution, distinct whale buying pressure has been detected for $PENDLE, $IP, and $XRP in the short term. On the other hand, tokens suitable for short-selling in the short term, such as BCH, ENA, and MYX, have been selected through the overheating condition filter. Among these, ENA and BCH show clear signals favorable for short-selling from a data perspective, so continuous monitoring is necessary.

Show original

29.39K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.