$ETH is quietly heading towards 4000, and $LDO is following up with a buyback plan!

A proposal for a dynamic buyback of up to 70% for $LDO.

Recently, node operators have been very active, with common ETH reserves including Liquid Collective and Bitgo. Lido also had news of layoffs recently, cutting 15% of its workforce, a significant reduction.

Lido has proposed a new dynamic buyback plan.

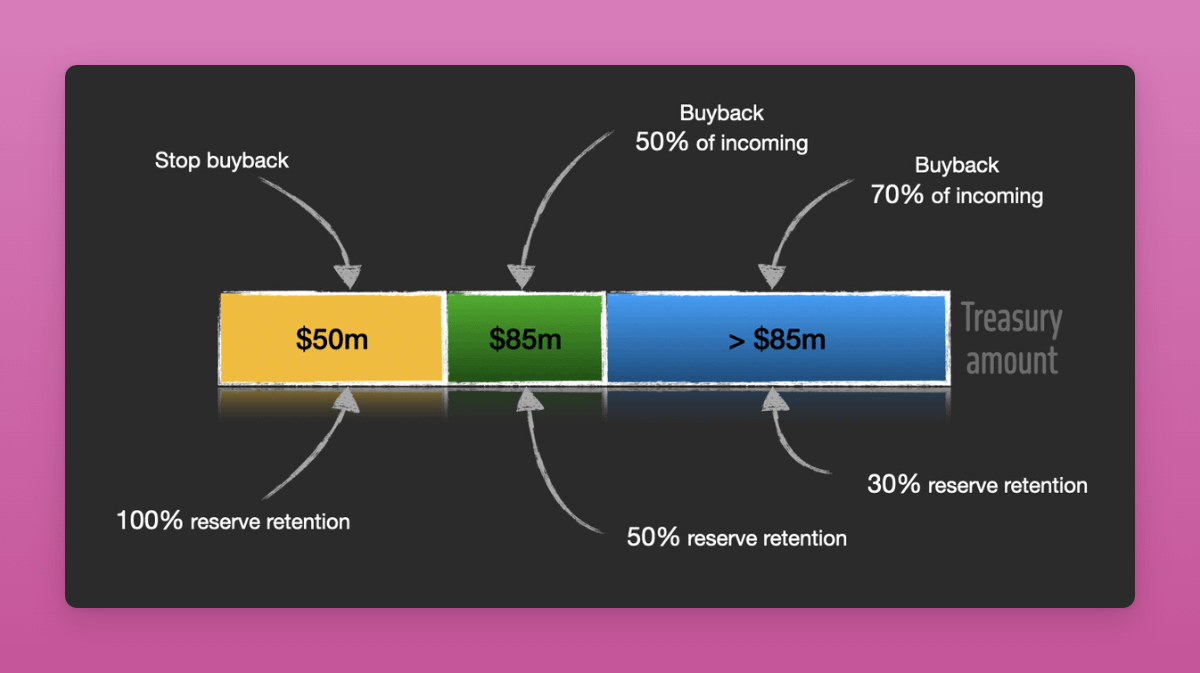

Since the asset value of stablecoins and stETH exceeds 145 million USD, and stETH is in a dormant state, the proposal is:

💡70% of new incoming assets → $LDO buyback

The other 30% will be used for operations and strategy.

The entire plan has a threshold of 50 million USD and 85 million USD; if exceeded, it will be a 70% buyback, and if below 50 million USD, the buyback will stop.

The $FLUID buyback plan with an annualized return of 10 million USD is currently brewing.

More DeFi projects are expected to follow suit soon.

The flywheel of DeFi Summer is starting to spin ⚡️

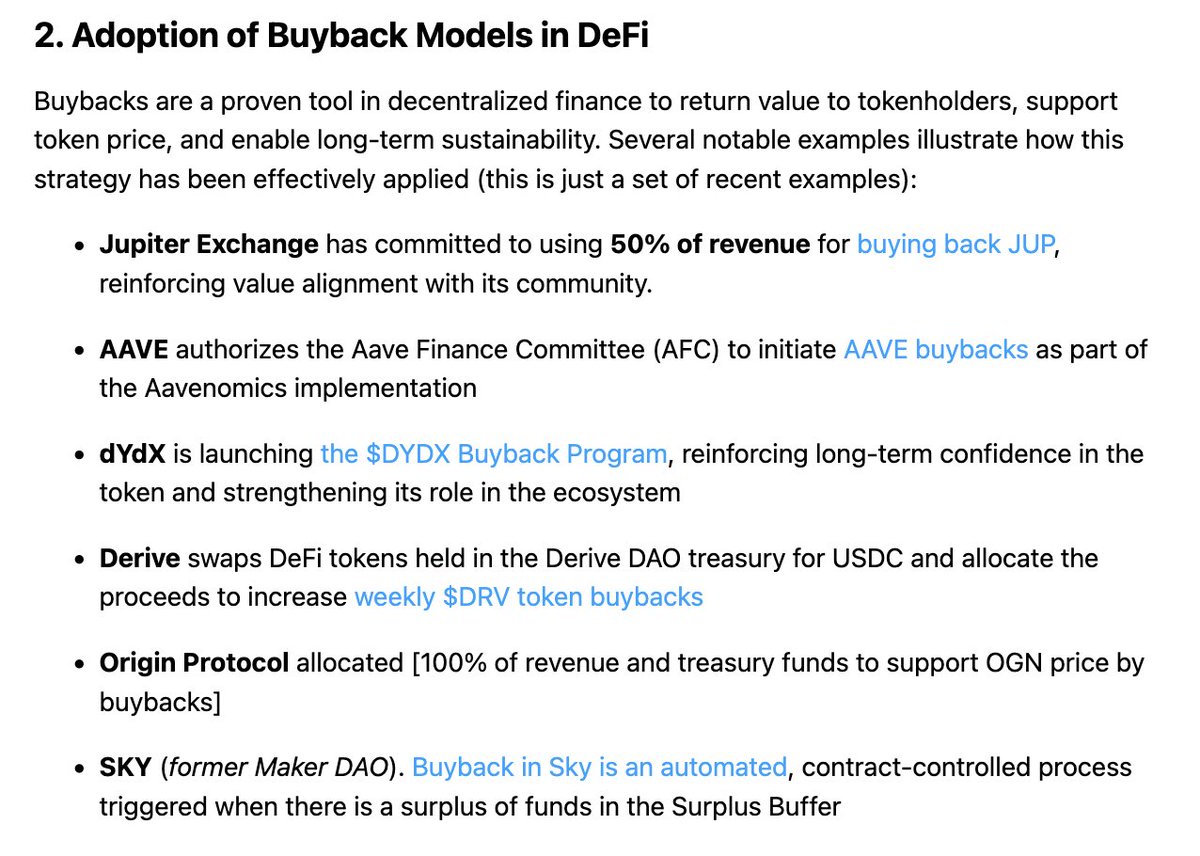

In the comments, @DefiIgnas also shared several projects currently conducting buybacks, including $JUP, $AAVE, $DYDX, $OGN, $SKY, etc.

Lido DAO proposes a dynamic buyback of up to 70% for $LDO

With over $145M in stables and stETH sitting idle, the DAO is looking to return value to holders.

These assets generate no revenue. Time to put them to work.

The proposal:

• 70% of NEW incoming assets → $LDO buybacks

• 30% retained for ops & strategy

Why like this?

To ensure the DAO doesn't run out of development money.

There are some 'safeguard thresholds' the DAO should not cross.

- If Treasury sits between $50M and $85M, buybacks drop to 50%.

- If the liquid treasury falls below $50M, buybacks stop.

Great to see a DeFi giant being serious about longterm token value.

Still needs to be discussed and voted by the DAO.

----

Current treasury assets:

• $17M USDC

• $11.9M USDT

• $12.2M DAI

• 28,640 stETH (~$105M)

I hope to support the proposal as an Lido DAO delegate.

If you hold LDO, consider delegating to me:

0x3DDC7d25c7a1dc381443e491Bbf1Caa8928A05B0

38.81K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.