It’s fundamentals season, and Spark is in an uncommon position where it is cash flow positive at launch.

I’ve written a blog post to cover how Spark makes money and how things relate to the Sky ecosystem.

Below is a summary. Let’s dive in. 🧵👇

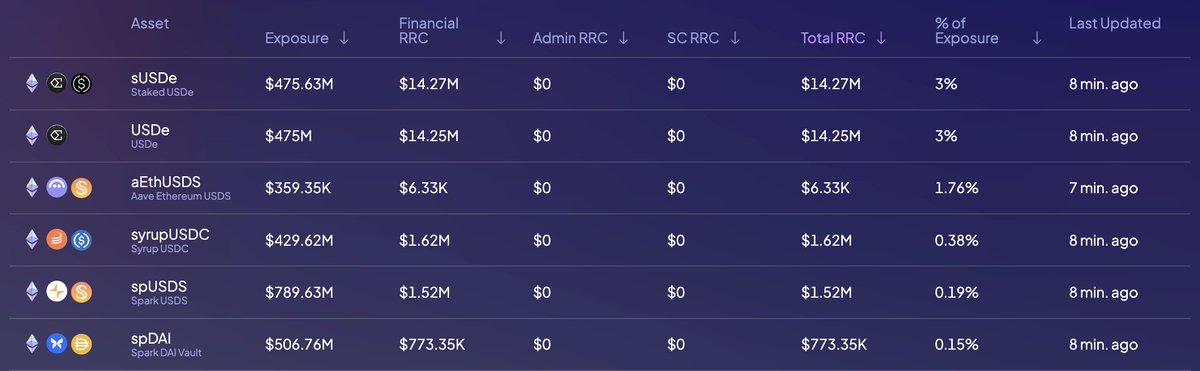

Spark has deployed $3.4 billion into yield-generating strategies split between SparkLend, Coinbase (Morpho), Ethena, and Maple.

This strategy is yielding approximately 7% APY, and after paying Sky's "Base Rate" of 5.05%, Spark is retaining a 2% net-interest margin or approximately $68 million per year.

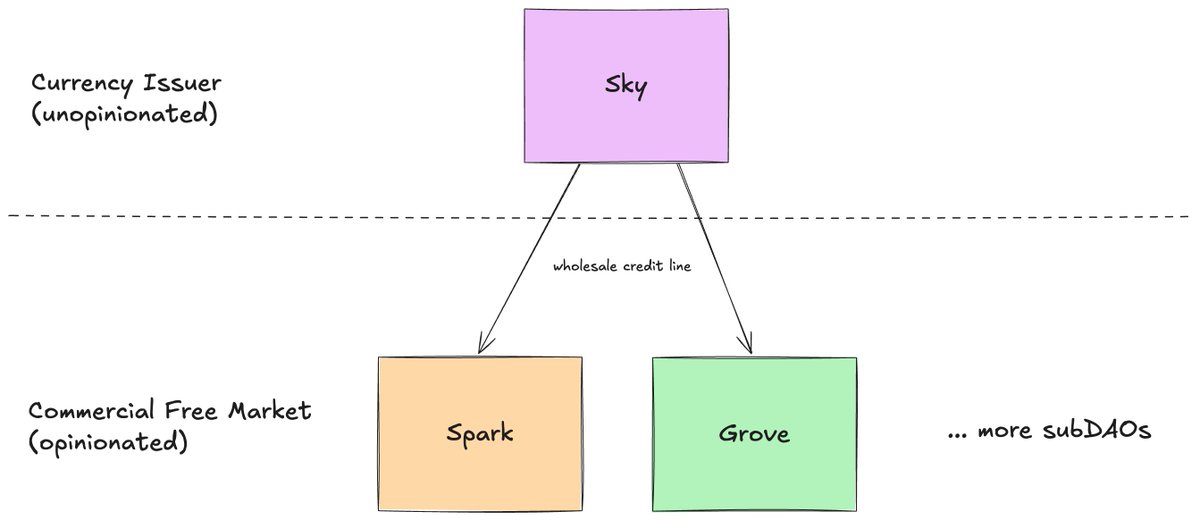

The Sky ecosystem is attempting to do DAOs for real by outsourcing all growth-oriented decision-making to a competitive marketplace of subDAOs (aka Stars).

Rather than have an entrenched group of insiders deciding what to do, Sky has subDAOs compete to deliver the best yield.

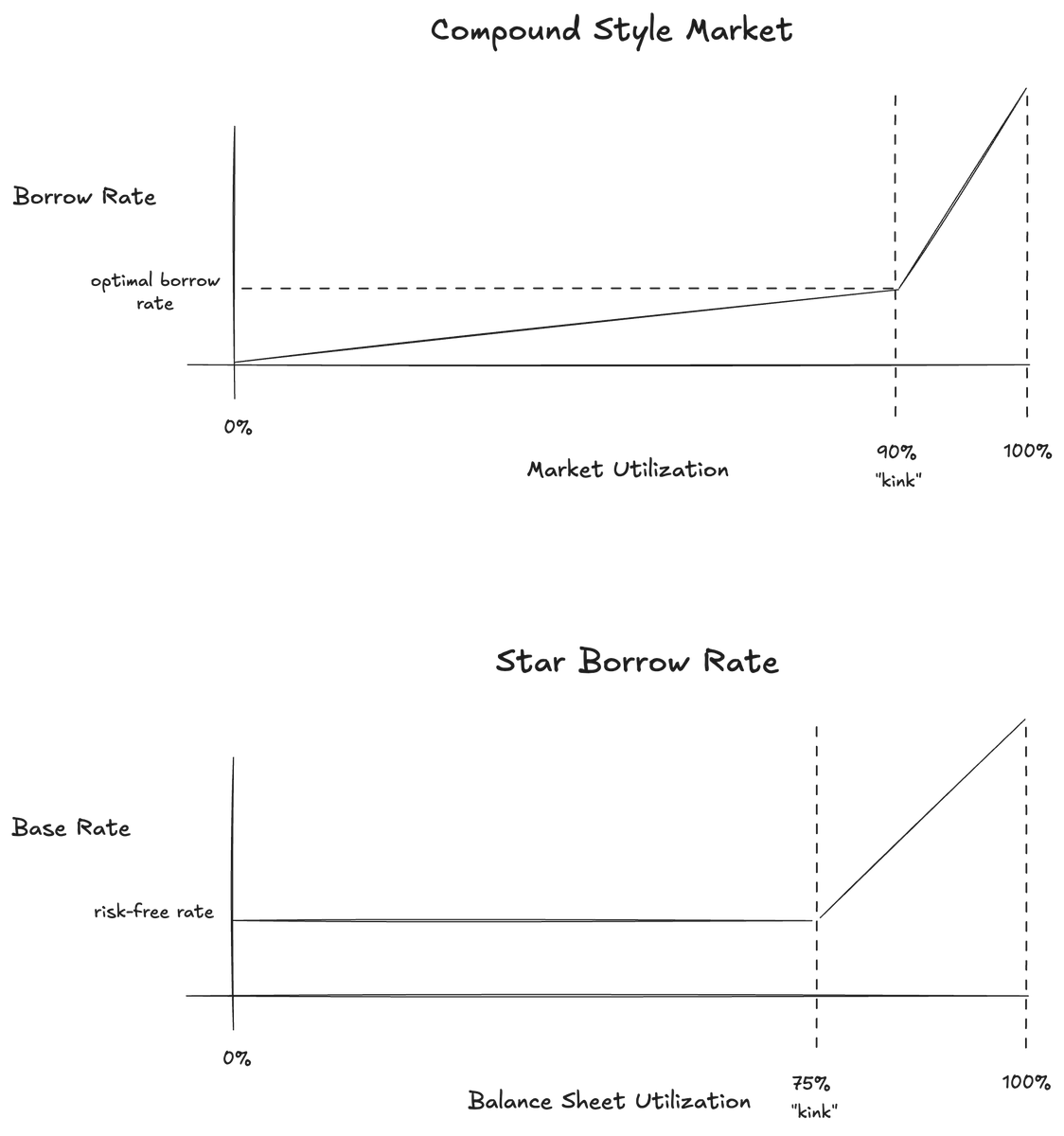

It does this by having a market-driven "Base Rate" which goes up or down based on balance sheet utilization. Similar to the Compound-style utilization rate curve, but covering the entire balance sheet instead of just one asset.

Stars can deploy into many opportunities, but not everything is of equal risk.

To account for these differences in risk, Sky requires Stars post junior capital to cover any potential losses.

This puts the Star’s equity at risk for every decision, so they have skin in the game.

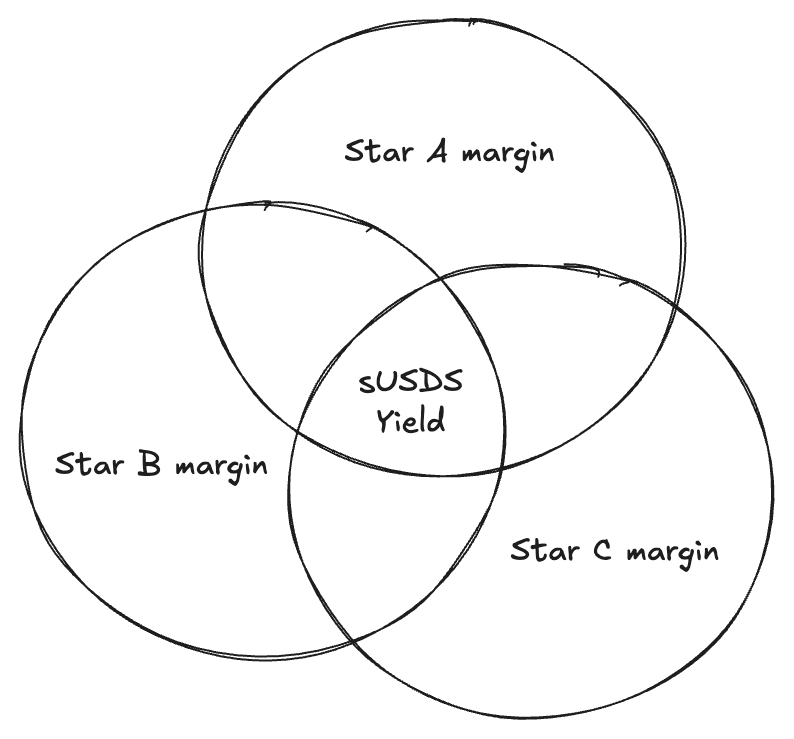

You can think of a Star as a machine that converts undifferentiated yield into benefit for sUSDS holders because the Savings Rate is anchored to be 0.3% below the competition-driven Base Rate.

The structure of the system ensures that Stars can be successful, but they need to find unique differentiation and keep innovating.

Spark's long-term differentiation comes from SparkLend, Savings, Brand, and some soon-to-be-announced products.

2025 is shaping up to be a big year. LFGT

Read the full post:

Other references:

13.67K

85

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.