What are the safest stablecoins?

Surprisingly, not the ones you'd think.

That’s according to a nonprofit rating agency with SMIDGE rating criteria. 🧵🔽

I’ve spent a long time looking for a stablecoin rating system, but most were never truly independent.

Either the agency was promoting its own coin, or getting paid to boost others.

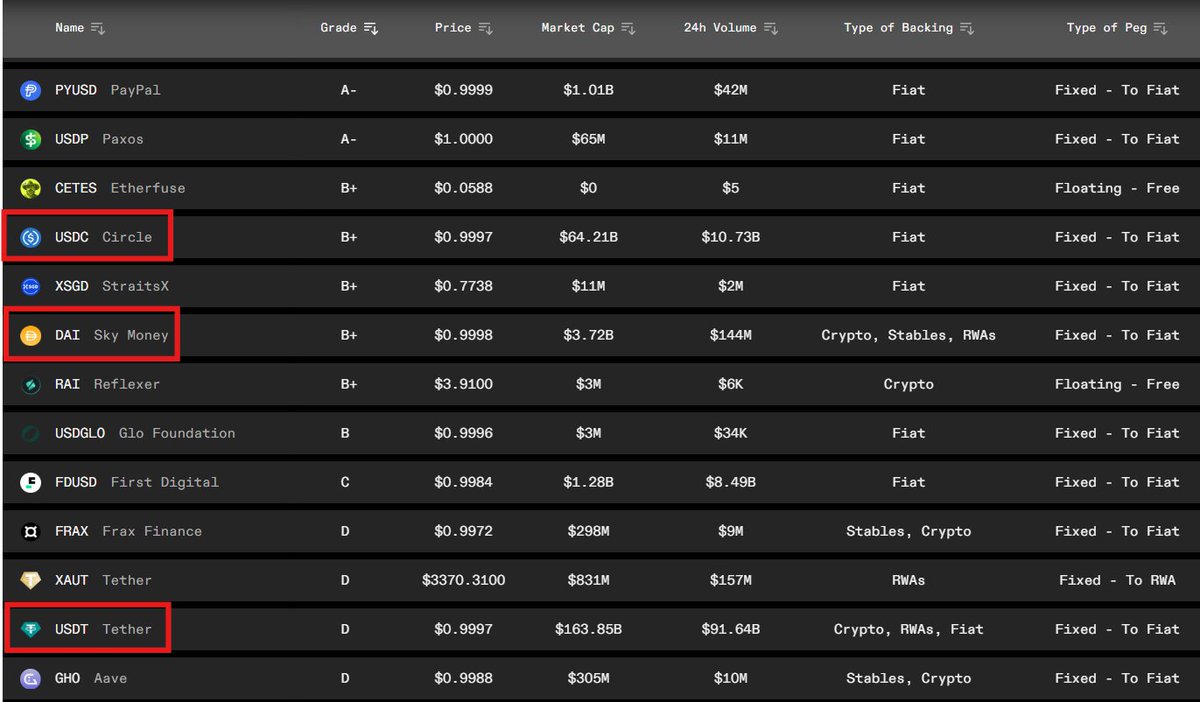

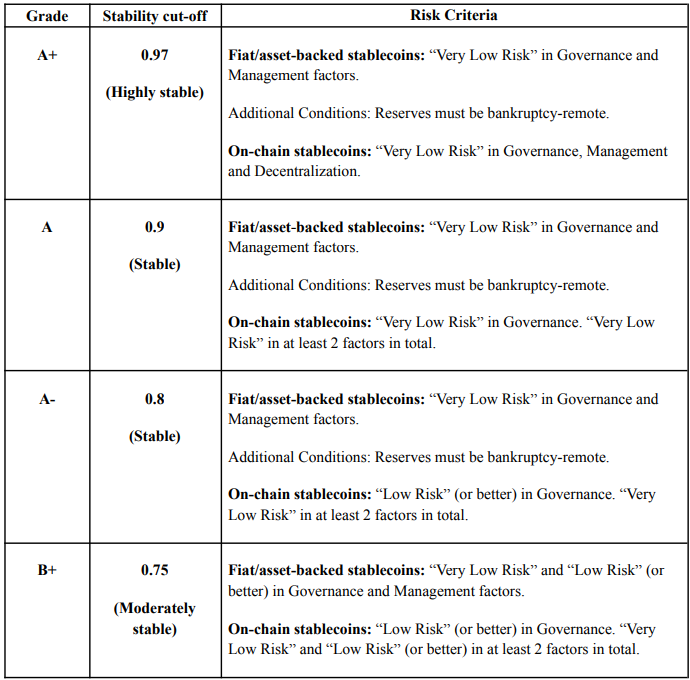

$USDC is ranked 8th with a B+ rating.

$DAI is 10th, also rated B+.

And $USDT? Way down at 16th place with a D rating.

These rankings clearly don’t reflect market cap, there’s far more USDT in circulation, but it scores poorly.

But that’s not surprising.

We don’t always use what’s safest, we use what’s best marketed or easiest to access.

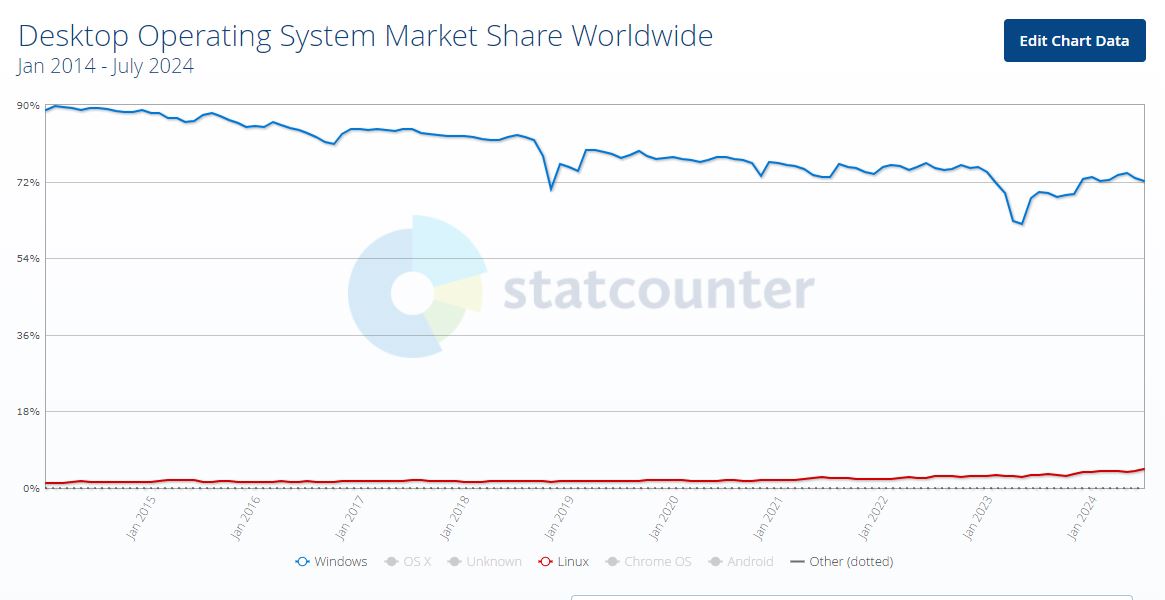

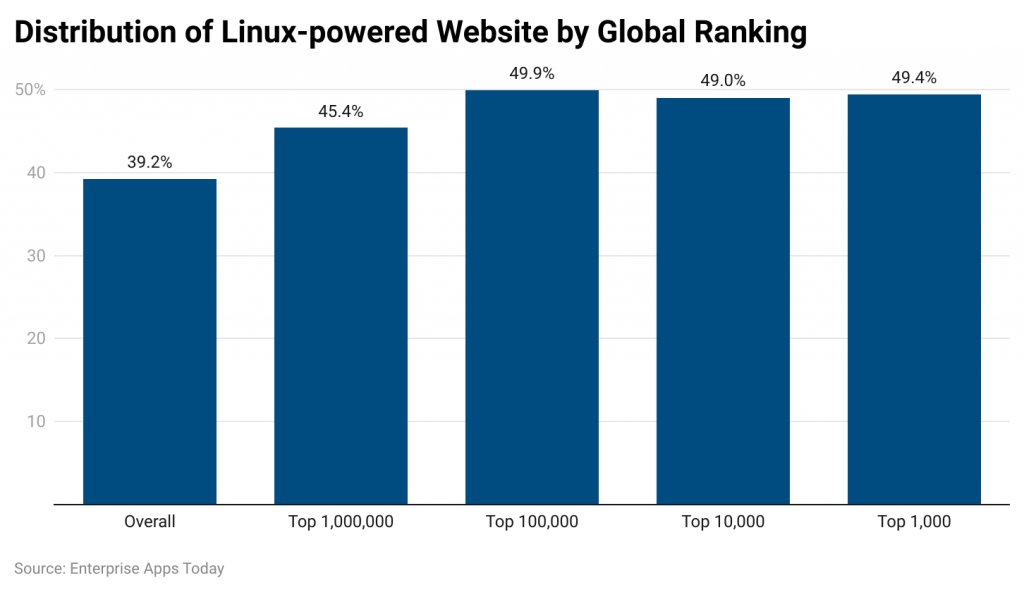

Most people use Windows because it’s simple, but Linux is the safer OS.

And in professional settings, servers, websites, Linux dominates with over 50% market share.

So retail not using Linux doesn’t mean much, but pros mostly using it does.

Same goes for stablecoins. Don’t follow the crowd. Follow those who know what they’re doing.

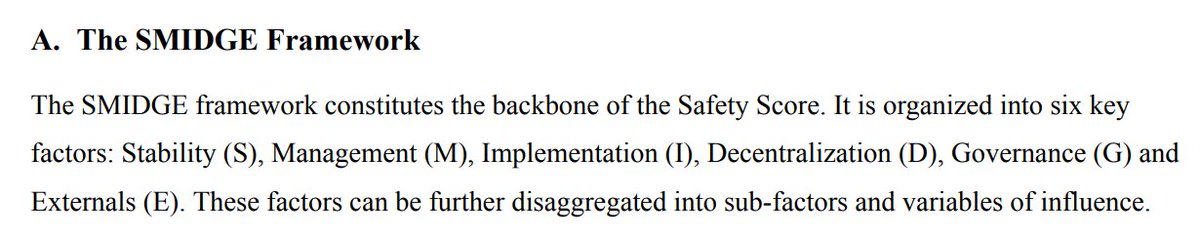

Bluechip’s rating model is based on six criteria, grouped under the acronym SMIDGE:

+ Stability: Transparent, high-quality reserves

+ Management: Strong team and governance

+ Implementation: Audits and bug handling

+ Decentralization: Real vs. perceived decentralization

+ Governance: Decision-making process

+ Externals: Regulation and macro risks

USDC got a B+ mainly because it hasn’t yet proven “bankruptcy-remoteness.”

Circle also hasn’t provided strong guarantees on how reserves would be handled in a crisis.

Bluechip says it could move up to A– if Circle can show its reserves are protected from bankruptcy.

USDT D rating is more serious.

The main issue is Tether’s lack of transparency on what’s really backing its reserves, and how those assets are managed.

Even with some recent improvements, Bluechip maintains its D rating.

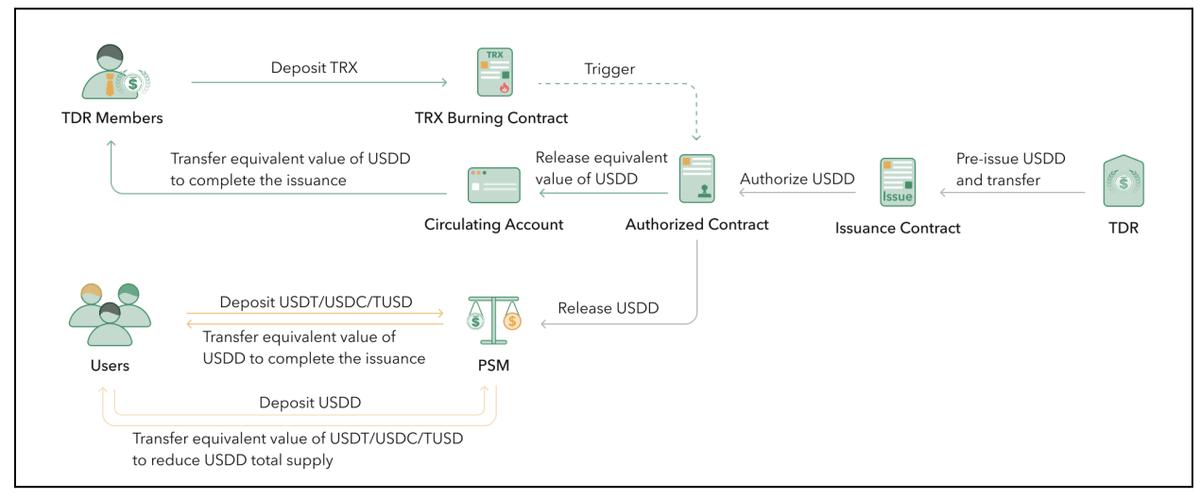

Bluechip’s top stablecoin is $RLUSD, issued by Ripple via Standard Custody (regulated by NYDFS).

It’s 100% backed by U.S. Treasuries and segregated deposits at BNY Mellon.

That highly liquid and legally protected structure earns it an A rating.

Second is $LUSD, one of my personal favorites.

It’s fully decentralized and backed solely by ETH.

It has a robust collateral model and performs well in liquidity crises. Its transparent design makes it a reliable and clear choice.

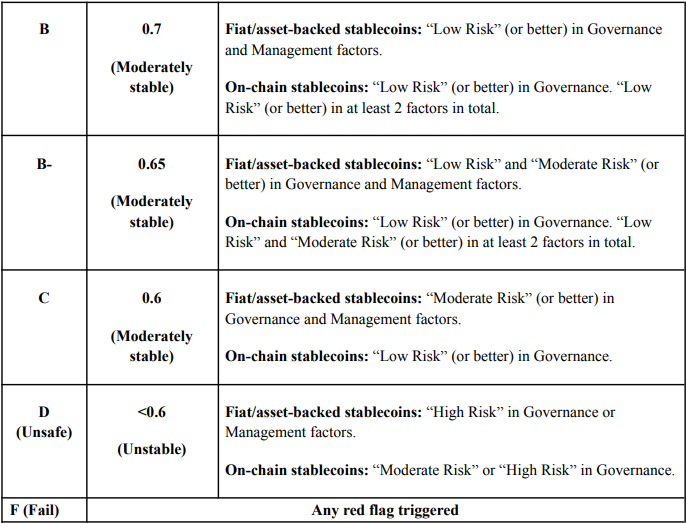

On the other side, $USDD ranks among the worst.

Issued by TRON, it carries a high depeg risk and little clarity on its actual reserves.

That lack of transparency creates constant uncertainty and elevated risk for users.

That's a wrap!

Mention some CTs friends:

@0xJok9r

@belizardd

@AlphaFrog13

@zucl1ck

@Mr_Lumus

@poopmandefi

@defiprincess_

@Hercules_Defi

@Only1temmy

@TweetByGerald

@0xAndrewMoh

@Haylesdefi

@DeRonin_

@kem1ks

@cryppinfluence

@0xDefiLeo

@alphabatcher

@DOLAK1NG

@splinter0n

23.24K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.