Market Outlook

This is the last stage of the cycle I'm interested in buying.

1. Where are we in the cycle?

2. Why is this the last stage I want to buy?

3. Risk & taking profit

4. A few Altcoins I want to buy

(⚠️Bullish propaganda)

1. Where are we in the cycle?

1. 4-year Cycle

2. What if this time is different?

---

1. 4-year Cycle

- Range and Cycle Pattern + Stages

- Time

- Parabolic resistance

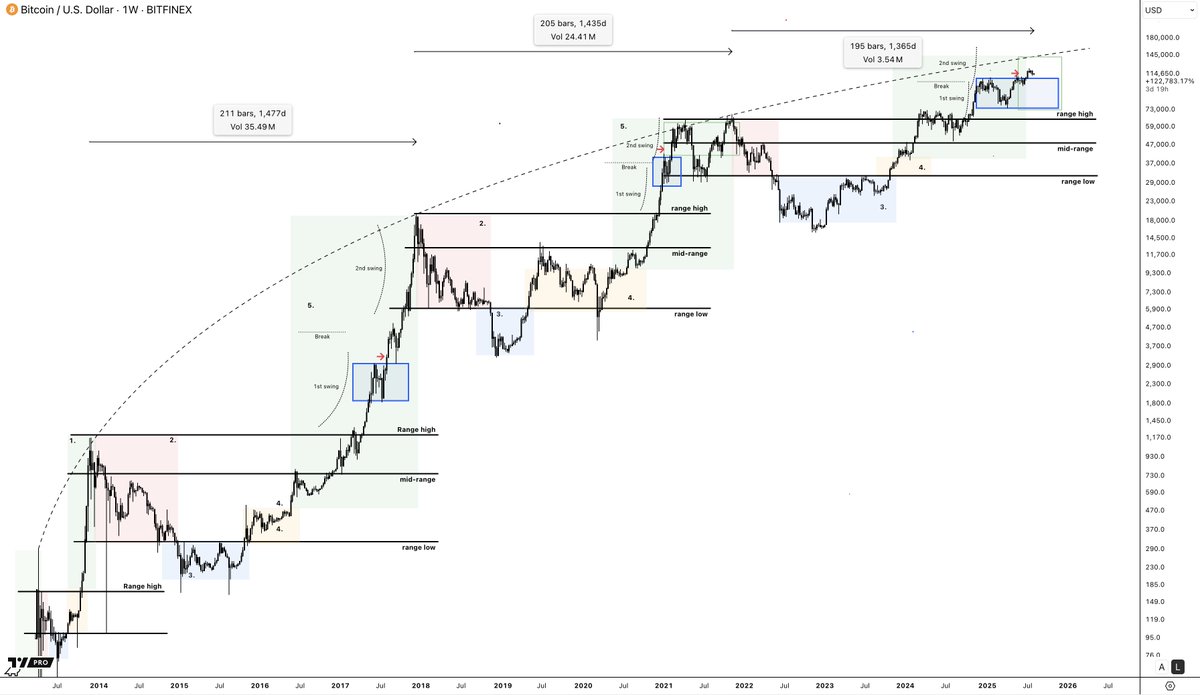

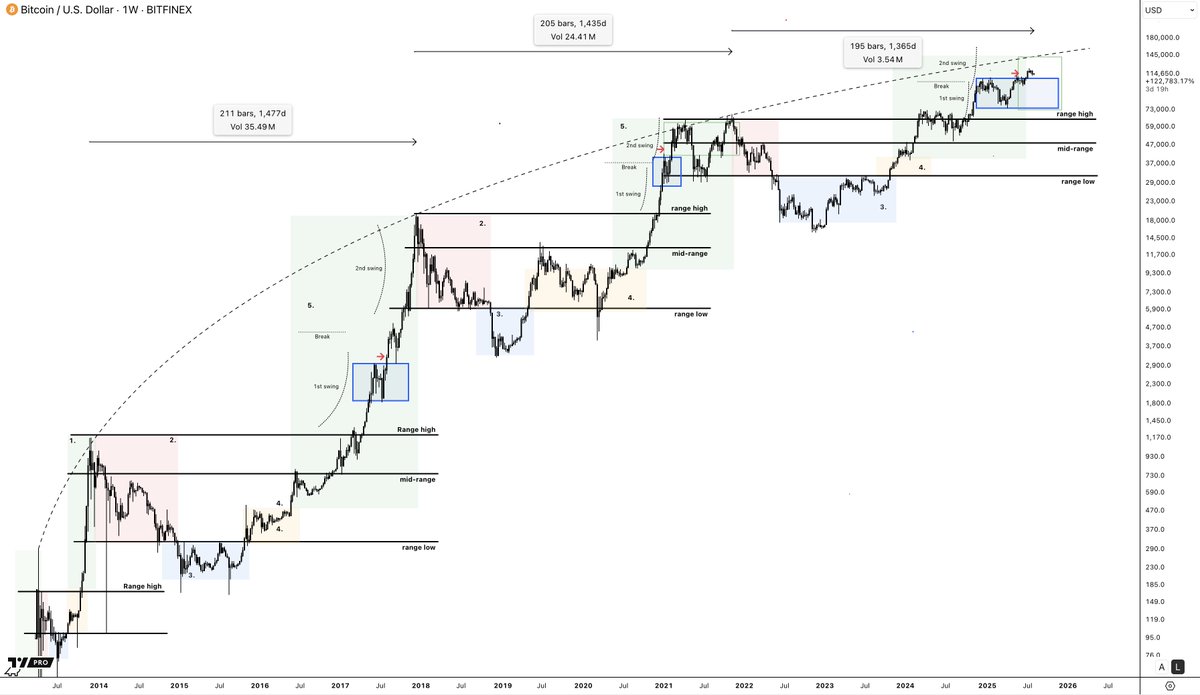

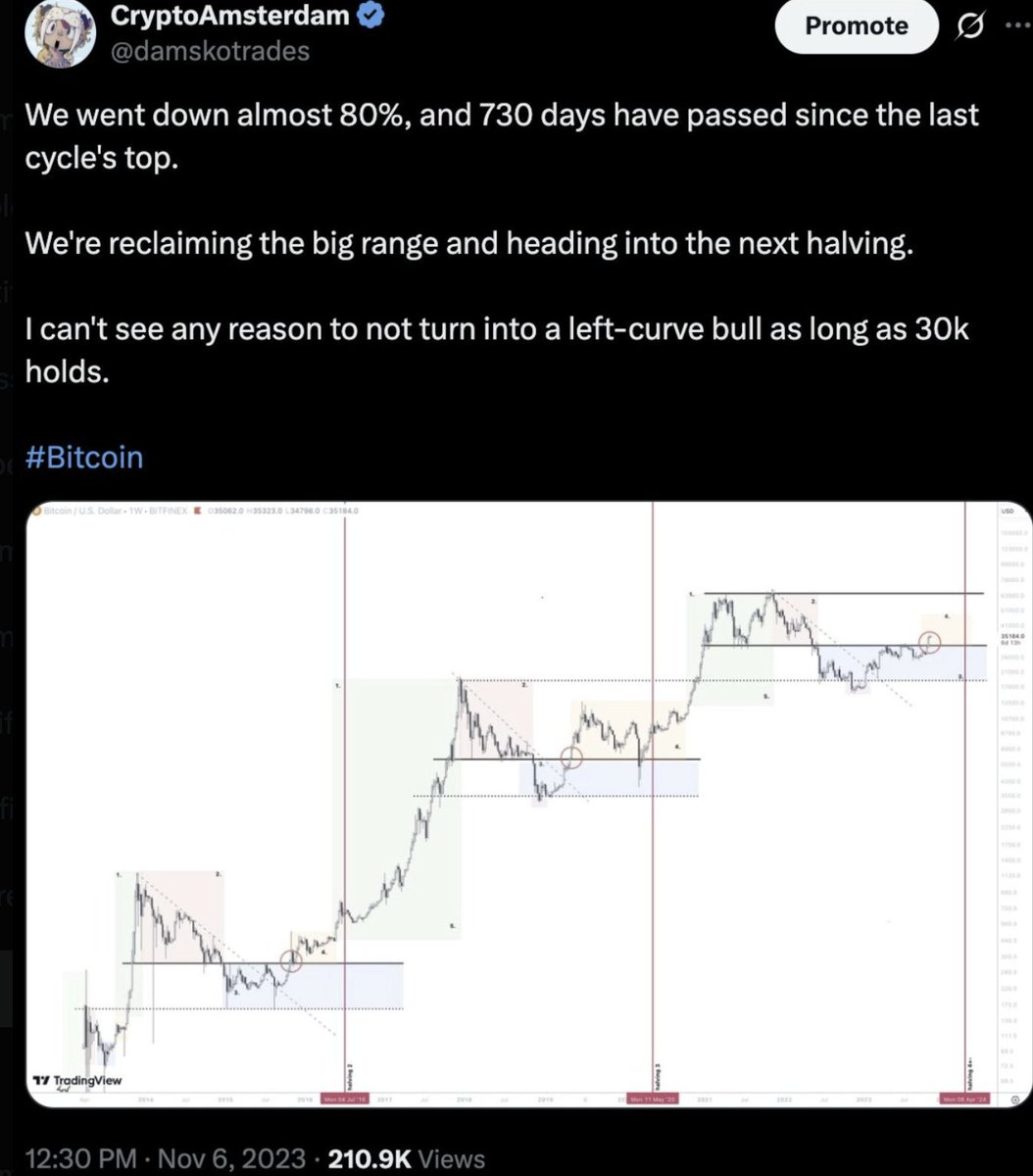

- Range and Cycle Pattern + stages

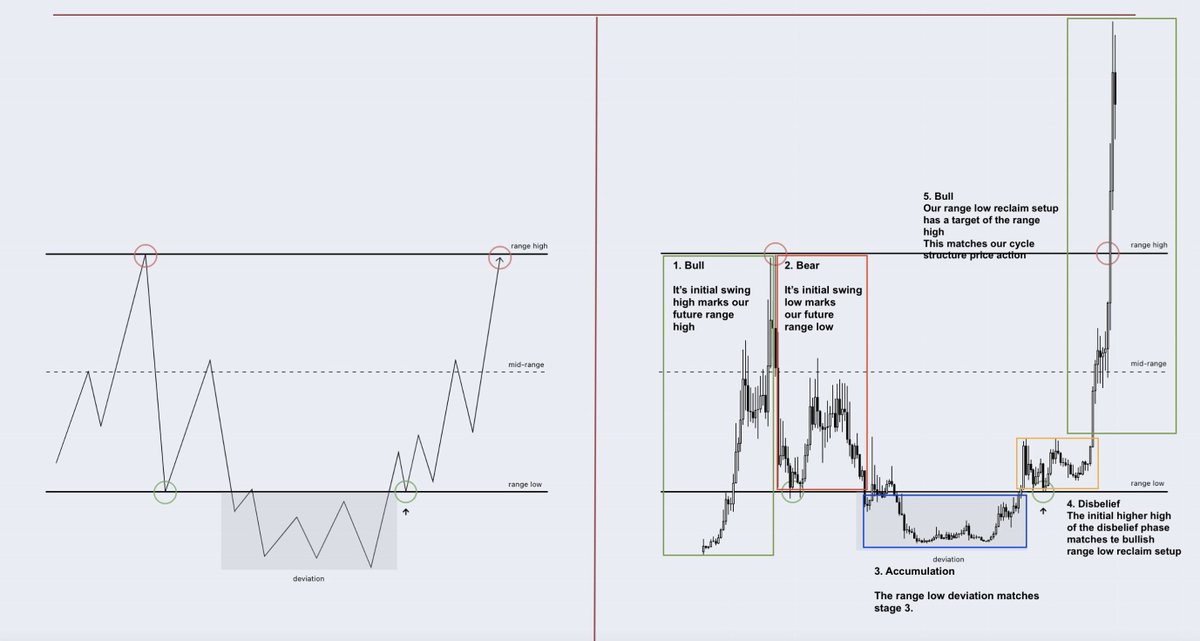

Bitcoin (and most other crypto charts) are following similar range and cycle patterns.

> Stage 1: bull (higher highs and lows)

> Stage 2: bear (steep lower highs and lows)

> Stage 3: accumulation (equal highs and lows)

> Stage 4: disbelief (initial macro higher high and trend shift)

> Stage 5: bull (higher highs and lows)

In confluence with the macro range.

> Stage 3 accumulation range often forms below the macro range

> Stage 4 disbelief starts, and the macro higher high forms in confluence with the range low reclaim.

Every time it plays out a bit differently after the reclaim and push to the range high, but this is the rough map I use to scale in and out.

Looking at the macro Bitcoin chart, we’ve already completed stages 3 and 4, and we’re deep into stage 5, with the range low reclaimed and the range high broken.

Usually, we print 2 legs into price discovery, and so far have completed one.

Time-wise, we’re about 1,365 days into the 4-year cycle, which, if the old pattern holds, puts us deep into the late stage.

Lastly, there’s the parabolic (diminishing returns) resistance line, the one that’s capped every cycle in the past decade. It’s hard to perfectly draw it, but it helps complete the picture.

> Range pattern: range low reclaimed, new highs broken; done.

> Cycle pattern: late stage 5, but the second leg is missing

> Time-wise: very late in the cycle

> Parabolic resistance: little room left before

I don't think it's smart to bet against this time being different, so I already secured some profits and will in the coming months if the market rallies hard into that level.

2. What if this time is different?

Simultaneously, while thinking ‘this time being different’ is one of the most dangerous sentences and things to do in trading, I also believe that this time — or the next — will actually be different.

Here's why and how I'll play this difficult position.

> Why?

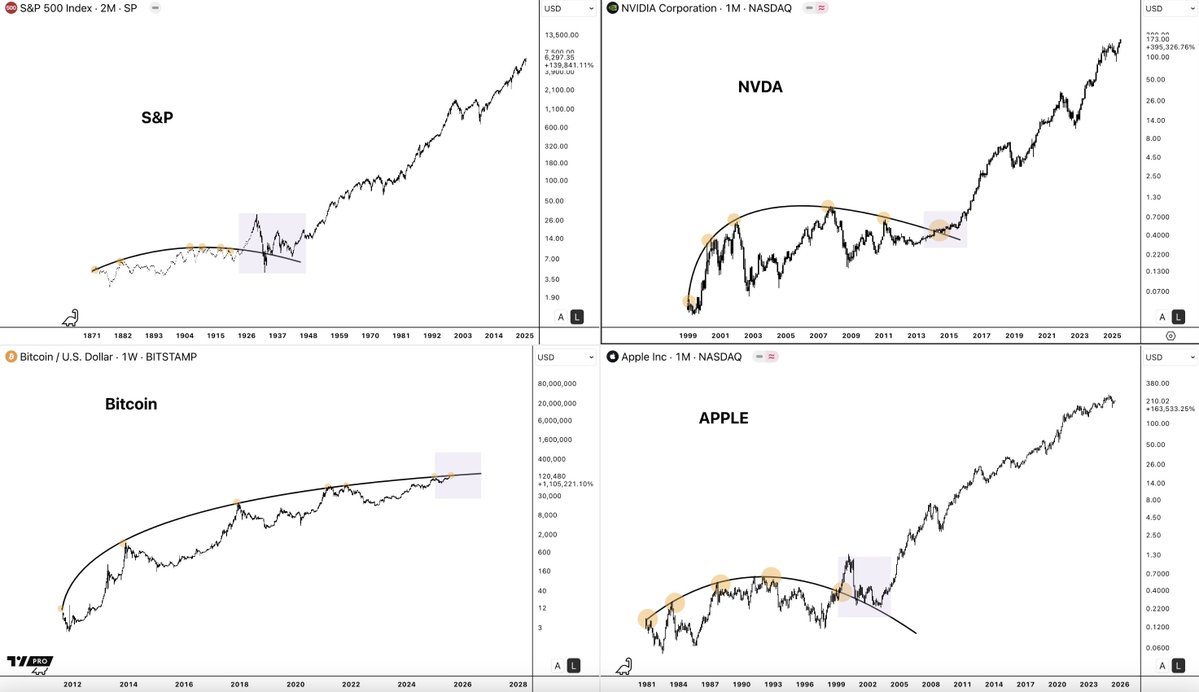

Many of the other older and successful assets, like the ones on the chart below, had a similar initial period with cycles and a parabolic line that capped the growth each cycle.

Until something fundamentally happened, and they entered their 'super cycle':

> SPX: America became the world's superpower

> APPL: iPhone 3 was born

> NVDA: AI growth exploded

> Bitcoin: ETFs, pro Bitcoin governments, reserve currency, institutional fomo???

I believe Bitcoin will break this line, and breaking such a long resistance line will bring a totally new cycle structure and type of price action.

Our 4-year cycles are based on this line, capping the price; when this breaks, it will change.

> How I handle this situation:

I will not bet against this time being different by scaling out a large part of profit when we rally into the line and start hitting the 4-year cycle top metrics in terms of time and the 2nd leg into ATH (plus some altcoin metrics I'll cover later)

I will bet on this time being different in the (relative) near future (this or the next cycle) by building a separate Bitcoin allocation, which I have already started doing. I'll add to this stack from here on by increasing the amount of Bitcoin I'll take out of my Altcoin profits this cycle (50% fiat and 50% BTC).

2. Why is this the last stage I want to buy?

&

3. Risk & taking profit

In crypto, money flows in a certain order — it’s not just “bull market, everything pumps.”

Bitcoin → Major Alts → Rest of the Alts

The further into the cycle, the crazier it gets.

Bitcoin owns up most of the cycle — over 80% of the time, BTC and dominance go up while alts suffer.

It’s only in the tail of the 4-year cycle (assuming it's similar enough to somehow play out similarly) that money flows into alts and dominance drops.

Here you can see how Bitcoin dominance goes up almost throughout the entire cycle, which hurts Altcoins, until we reach the final leg into price discovery.

I’m not trying to time the exact top. Even though dominance looks incredibly weak now, we could still see some more volatility, maybe even taking out the highs, especially if Bitcoin breaks that parabolic resistance.

Main thing for me: Each part of the cycle needs its own focus:

- How much total exposure

- What to allocate into

- What to sell, and when to take profits.

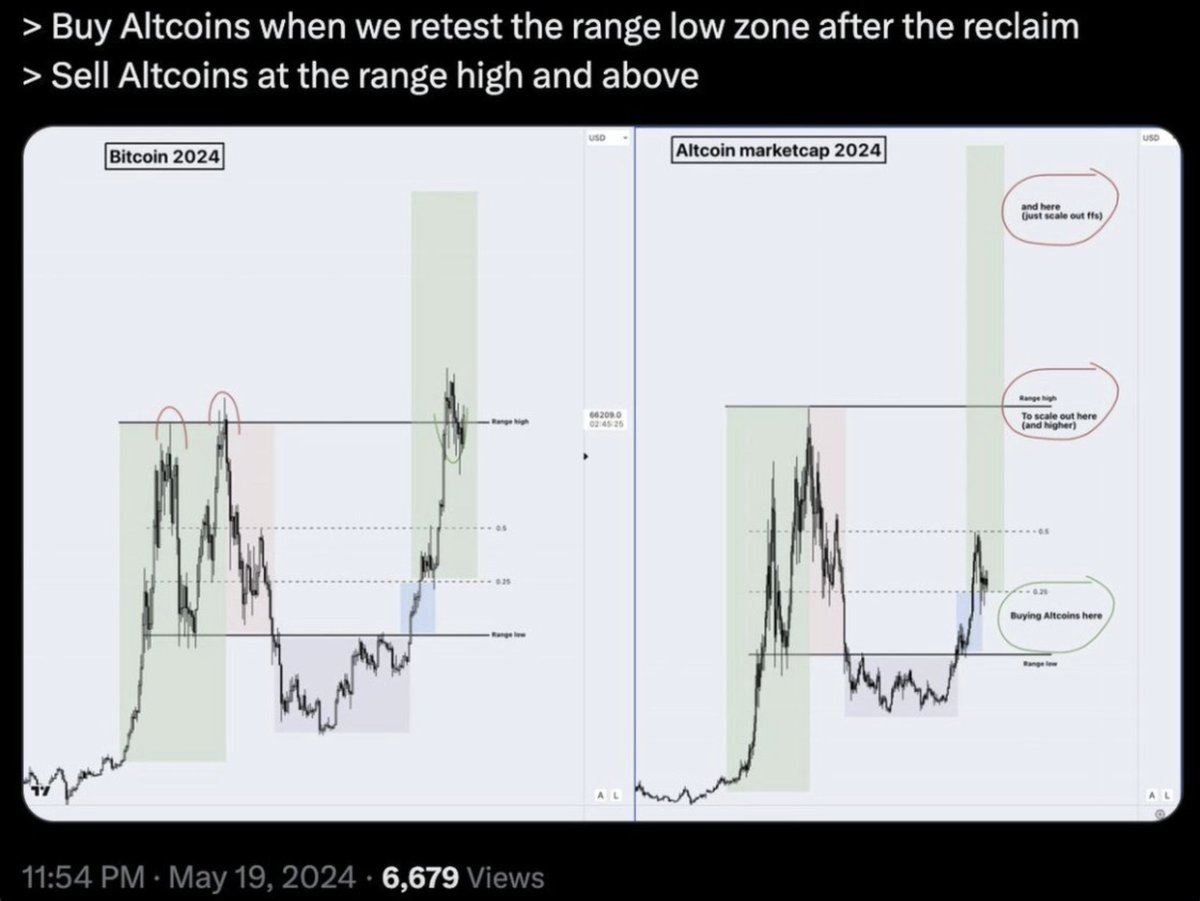

Before we dive in, here’s a quick rundown of my entry and profit-taking strategy:

/ Based on Range and Cycle structure.

> Range buying: I scale in aggressively during stage 3, below the macro range, when equal highs and lows start forming, and after a reclaim of the range low.

> Range selling: I start scaling out slowly at the upper part of the range, and more near the range high.

> Cycle scaling in: Stage 3 and 4, using the range structure.

> Cycle scaling out: Very slowly once we go parabolic into price discovery above the range in stage 5. I continue scaling out as the price gets more vertical.

I use individual altcoin (or BTC) charts, but also broader ones like total crypto market cap and total altcoin market cap.

Now, we know things move in the order of Bitcoin first, majors after, and the rest of the Altcoin at the very end.

Similar patterns (cycle + range) just lag behind each other. So every part of the cycle should have a different focus on what you are buying and selling.

> When Bitcoin in 2023 reclaimed the range lows, aggressively scaled in, focusing on Bitcoin, and I picked Solana as my main major Altcoin.

> When the Total 3 hit the range lows (total altcoin market cap influenced by majors), I added Solana, and simultaneously, when it hit the range highs, I started to scale out my initial parts on the majors. (

Of course, this goes deeper. For example, I took some profits on Solana when it started to hit the upper part of the range and the range high, but cut more when it broke back into the range and broke market structure.

Profits went to fiat, but the trimmed position was rotated into another major — since I still expect new highs on Total 3, and I’ll scale the rest out once that goes into price discovery.

I moved those funds into Ethereum when it reclaimed its range lows.

Right now, as shown in the first two charts, dominance is in its typical top zone for this part of the cycle. At the same time, the 'Others' chart (total altcoin market cap excluding top 10) is sitting at range lows — a spot where alts usually lift in the final part of the cycle.

So based on my system, while it was already time to slowly secure some profits on Bitcoin and majors, this is also the last part of the cycle where I’m interested in buying.

I’m focusing on altcoins — using their individual range and cycle charts, plus the position of the 'Others' chart and how it historically performs late in the cycle.

So bull markets aren't just simply oh buy and be all in, and sell and try to aim for the total top.

You can scale out on certain assets while scaling in on others. You can use your total view of the cycle (late part) to decide the total amount of risk in crypto, though, which should be lower now than in 2023 in my opinion.

One cycle, multiple big bets, different plans.

Of course, there are more tokens I'm looking at and will post these on my timeline, but these are some clear examples of range low plays to better understand my strategy.

Thanks a lot for reading.

If you enjoyed it, feel free to give it a retweet!

Thanks, Amsterdam. 🫡

21.49K

177

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.