good post. Launchpads were a pretty common narrative back in 2021 but in a different format; these days they are more decentralized and more open/easy to launch tokens. the comparisons of $pump vs. $hype are very different and it's not just 'they both make revenue'

I don't think enough people truly understand the economics of perp DEXes vs launchpads.

1/ Two different zero-sum games

- Launchpads monetize the creation moment of the coin, while perps have continual lifetime streams through funding rates / fees / general trades that they do.

- While the act of trading is zero-sum, the service (matching, hedging, maker/taker fees) drives continuous services.

- Perps also scale linearly with deeper books and better tooling, whereas launchpads don't have that elasticity; a cut in launch tax won't lead to more tokens being pumped out.

2/ Very different key drivers

- The *entire market*, in general, is a bull market phenomenon - i.e., in a depression, trading volume compresses, *everyone* makes less money.

- However, launchpads are GREATLY tied to bull market phenomena, whereas perp exchanges still see decent revenue in bearish markets.

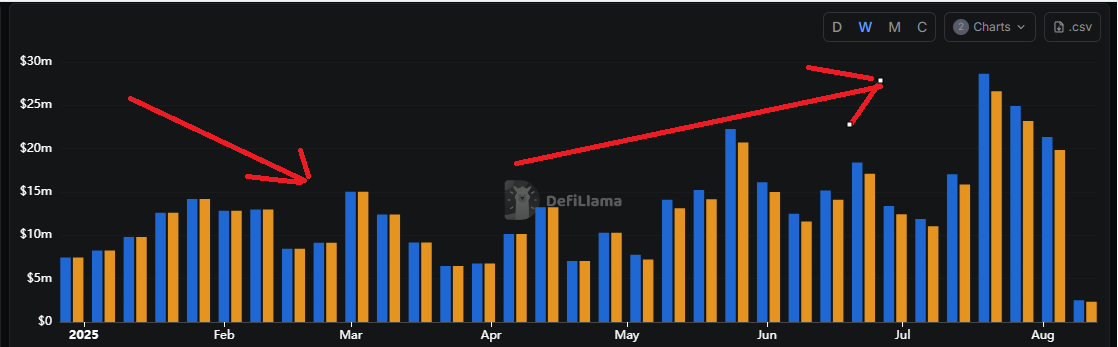

Attached are the revenue comparisons for the same time period. You can see fees greatly come down in April (lull), and then pick up in June / July (uptick in volume) for Hyperliquid.

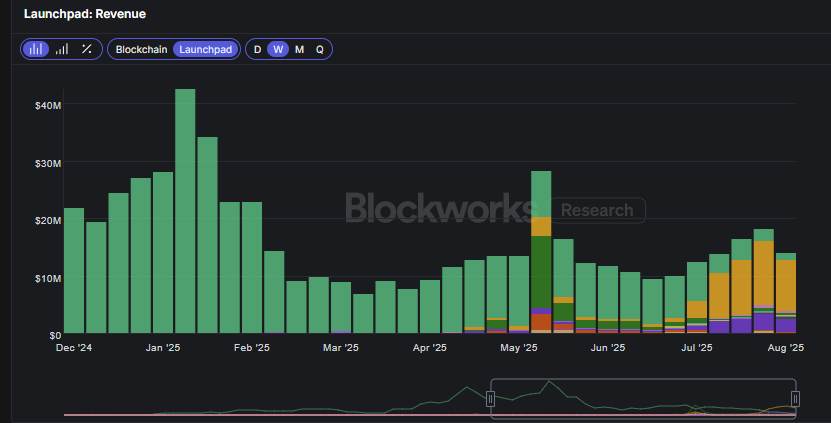

You can see a similar trend in launchpads; however, note that the increase in revenue for launchpads didn't come up in June / July.

- This boils down to a few different things; one is the type of asset being traded; another is, like I mentioned above, the event that generates fees for each product, and more importantly, the conditions that necessitate such events.

- Launchpads basically necessitate a perfect blend of risk on + new capital inflow that hasn't been burned due to the duration / rug risk of the asset class of memes + an actual demand to trade said types of assets.

- Whereas perps just need *volatility*.

3/ The assets themselves are very different.

- Theoretically, embedding your own AMM onto the launchpads would make revenues more defensive, HOWEVER, this is where the differences in assets break down.

- A lot of people like to generalize and cynically say "everything is a meme" - what they mean by this is everything is some sort of function of risk, and in a risk-on environment, *everything goes up*.

- However, launchpad coins face the bigger risk because 1) low hurdle rate = millions are created = no one knows what to trade.

2) Easily bundled and scammed, leading to money permanently leaving the ecosystem.

3) Generally one-and-done type trades - no constant trading unlike with BTC / ETH.

Anyways, there's a lot more to go through, but if you do some thought experiments, the end result is pretty much the same.

Bolting an AMM onto a launchpad means you'll end up building some sort of full-fat DEX, in which you'll compete with order flow between other routers.

Without the evergreen BTC/ETH volume base; perp DEXes thrive on volatility, whereas launchpads thrive on novelty, but volatility is the real TAM here.

As such, all of this is to say, I don't actually believe in "memes" as a sustainable revenue source and this is why launchpads, while cash cows for the bull, will always need to underwrite the inevitable bear market churn.

Whereas perp DEXes will experience low volume periods, but clear 8-9 figs daily easily;

And as such, in my opinion, the TAM, from largest to smallest, is:

- Perp DEXes

- Trading tooling (Photon, Axiom)

- DEXes

- Launchpads

Going by absolute numbers, yes launchpads may be on top. But accounting for time-weighted returns, and sustainability of business lines, in my opinion, stuff like Axiom owns the end users, which is way more profitable.

16.27K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.