Part 3 - Altcoin Market Analysis: The Rise of XRP and Other Stories.

In the context of Bitcoin and Ethereum leading the market, capital flow and attention are also beginning to spread to the altcoin market. The Altcoin Season Index is showing signs of an increase, indicating that capital is starting to rotate out of the top two assets in search of higher profits. Among the altcoins, #XRP has emerged as one of the most prominent stories of July 2025, driven by a series of significant financialization events.

1. The Case for XRP: The Boom Thanks to Legal Clarity and Financialization.

The price of XRP has experienced a spectacular surge, surpassing the $3 mark and trading at its highest level since the 2021 bull cycle. Its market capitalization at one point exceeded $210 billion, solidifying its position as one of the three largest cryptocurrencies.

The main driver behind this remarkable growth did not come from a new technological breakthrough, but from two key factors: legal clarity and financialization. After years of being overshadowed by the lawsuit with the U.S. Securities and Exchange Commission (SEC), Ripple's settlement of the lawsuit has removed a significant psychological and legal barrier, especially in the U.S. market. More importantly, July 2025 saw the launch of a series of exchange-traded products (ETPs), including ETFs, related to XRP on major U.S. exchanges. Asset management companies like ProShares, Volatility Shares, and Tuttle Capital have launched products, including leveraged funds, providing traditional investors with an easy and managed way to invest in XRP.

The introduction of these products has created a significant demand shock. It has "financialized" XRP, transforming it from a utility token primarily discussed in the context of cross-border payments into a tradable investment asset easily accessible in the portfolios of individual and institutional investors through traditional brokerage accounts. However, challenges for XRP remain numerous. Below is an analysis of the challenges for XRP if it wants to maintain its position on the leaderboard.

....

2. Long-term outlook for XRP and counterarguments

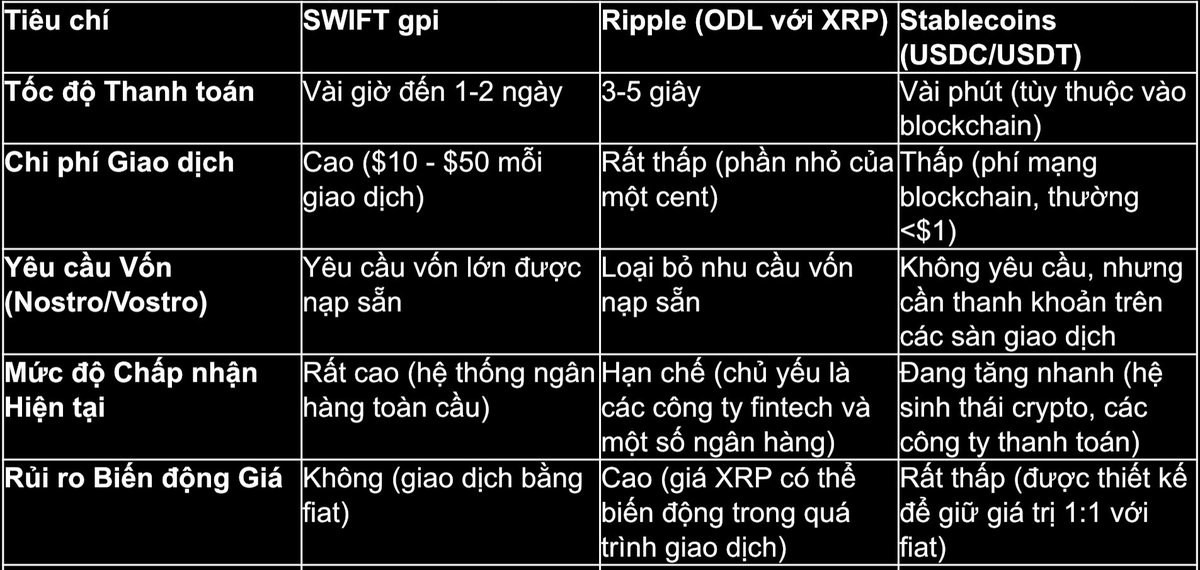

While the excitement in the market is undeniable, a scientific analysis requires considering the counterarguments to the long-term fundamental story of XRP. Ripple's core argument has always been that XRP, through its On-Demand Liquidity (ODL) service, will revolutionize the cross-border payment market worth trillions of dollars by providing a faster and cheaper solution compared to the traditional SWIFT system. However, this argument faces two major challenges.

First, the biggest competitor to XRP in the cross-border payment space may not be SWIFT, but stablecoins. Stablecoins like USDC and USDT offer a simpler and more intuitive solution for cross-border value transfer: they maintain a 1:1 value peg to the US dollar, eliminating the inherent price volatility risk of XRP. Data from McKinsey shows that annual stablecoin transaction volumes have surpassed $27 trillion, with estimated daily actual payment volumes ranging from $20 to $30 billion. This figure significantly overshadows the transaction volumes reported through Ripple's ODL. Furthermore, major financial institutions and payment companies like Worldpay are actively integrating stablecoins into their operations, indicating a potential path to adoption that could be faster and broader than that of XRP.

The second challenge is the "Velocity Problem." Analysts argue that since an XRP transaction only takes 3 to 5 seconds to complete, a relatively small amount of XRP can be reused multiple times in a day to handle a very large transaction volume. This means that there is not necessarily a need for an extremely high XRP price (e.g., hundreds or thousands of dollars per token) for the network to support a significant portion of the global payment market. This argument directly challenges pricing models based on the assumption that XRP's market capitalization must increase to correspond with the total value of the transactions it processes.

11.08K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.