Staking your HYPE usually meant giving up liquidity.

But what if you could earn yield, stay fully liquid, and never manage validators again?

That's exactly what @kinetiq_xyz offers, a liquid staking layer of @HyperliquidX

Let's dive into why $kHYPE is a game-changer for stakers & DeFi users on Hyperliquid

A 🧵👇

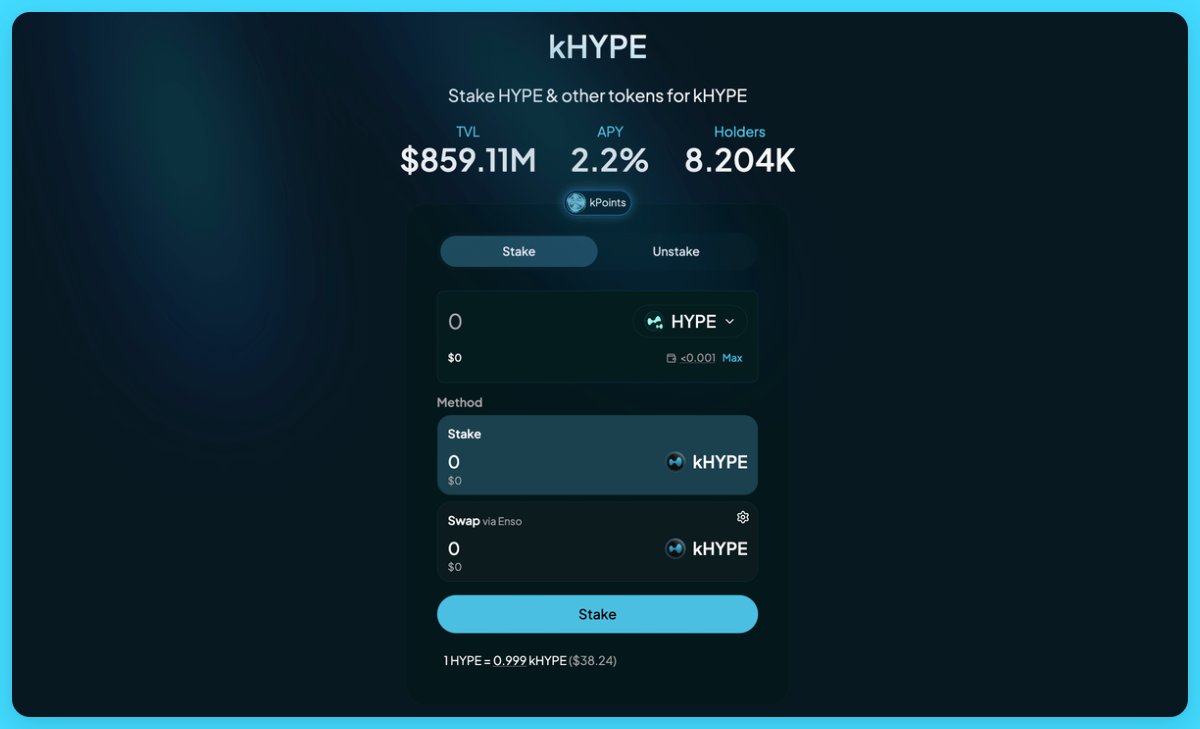

At its core, Kinetiq lets you stake $HYPE and receive %kHYPE, a liquid staking token that:

🔹 Earns staking rewards (2%+ APY)

🔹 Tracks validator performance via StakeHub

🔹 Is composable across DeFi platforms

No lockups, no re-delegations, no friction. Just pure capital efficiency.

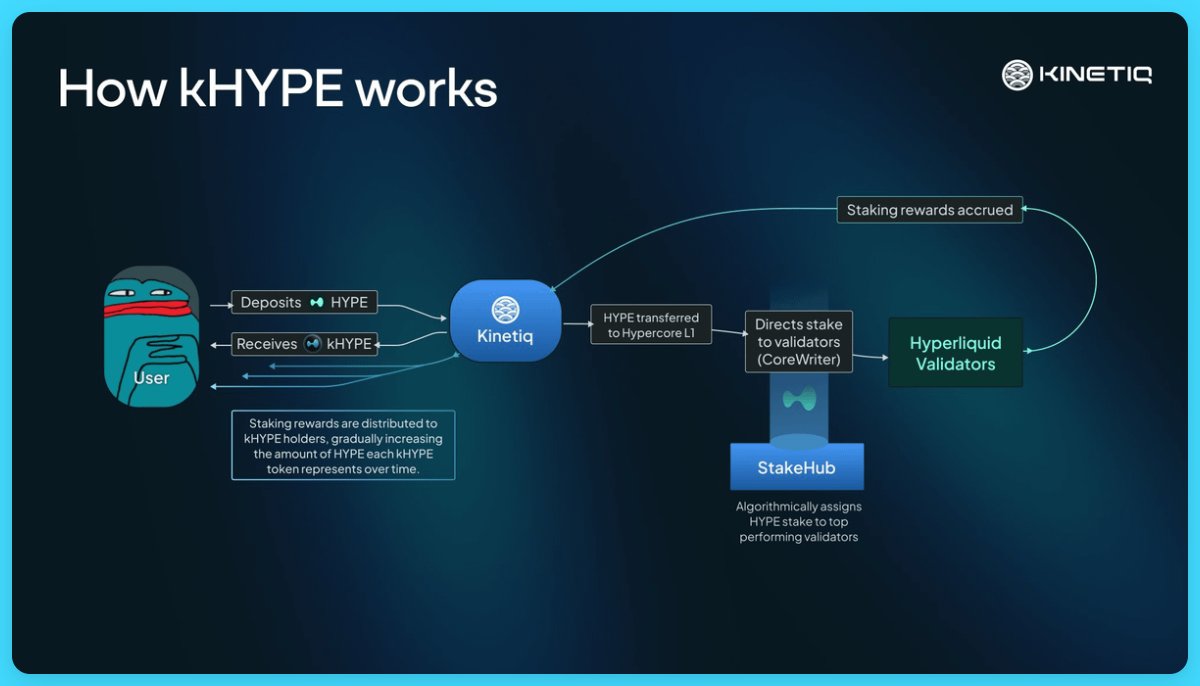

How it works:

You stake $HYPE via @kinetiq_xyz

Behind the scenes, Kinetiq routes your stake to the top validators on @HyperliquidX, ranked & rebalanced automatically by StakeHub, its autonomous scoring engine.

You receive $kHYPE, which accrues yield over time.

Why $kHYPE > native staking:

🔹 Stay liquid

🔹 No manual validator selection

🔹 Rewards accrue automatically (no rebasing)

🔹 Use across DeFi (lending, trading, collateral)

🔹 Stake once, earn forever

All while securing and decentralizing @HyperliquidX

Powering it all: StakeHub

StakeHub scores every validator on:

🔹 Reliability

🔹 Security

🔹 Governance

🔹 Economics

🔹 Longevity

Your stake moves automatically to the best-performing validators, keeping rewards high and risk low.

StakeHub is a step in the right direction to ensuring that Kinetiq Staked HYPE –– $kHYPE is the most secure option for those who choose to liquid stake their HYPE.

This also makes $kHYPE the optimal choice for collateral (e.g. Lending and Borrowing, margin on exchanges built atop of Hyperliquid, etc), and a paired asset (e.g. kHYPE-HYPE, kHYPE-USDC, etc) across all of Hyperliquid DeFi, as both stakers and operators can rest assured that the stake is managed in a transparent, secure, and decentralized way.

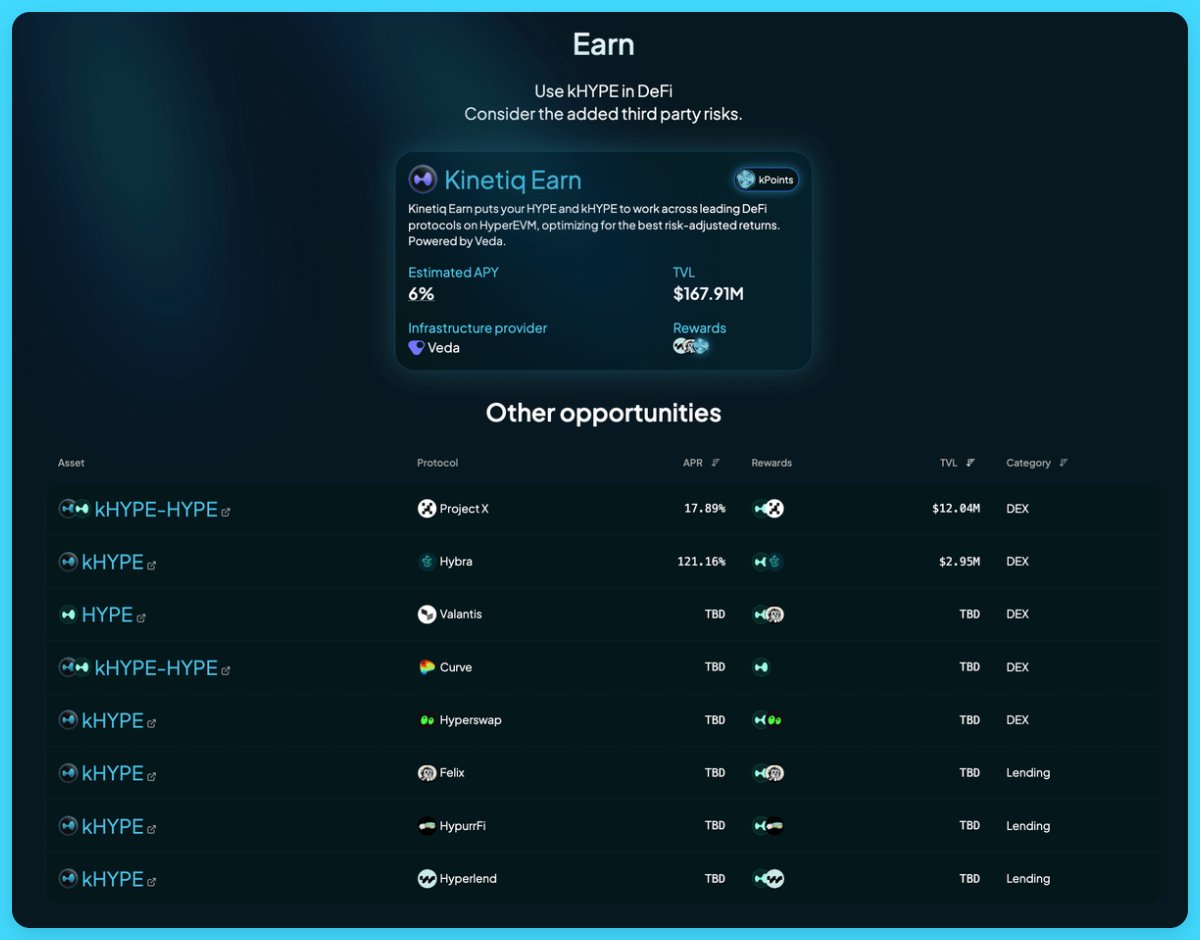

What can you do with $kHYPE?

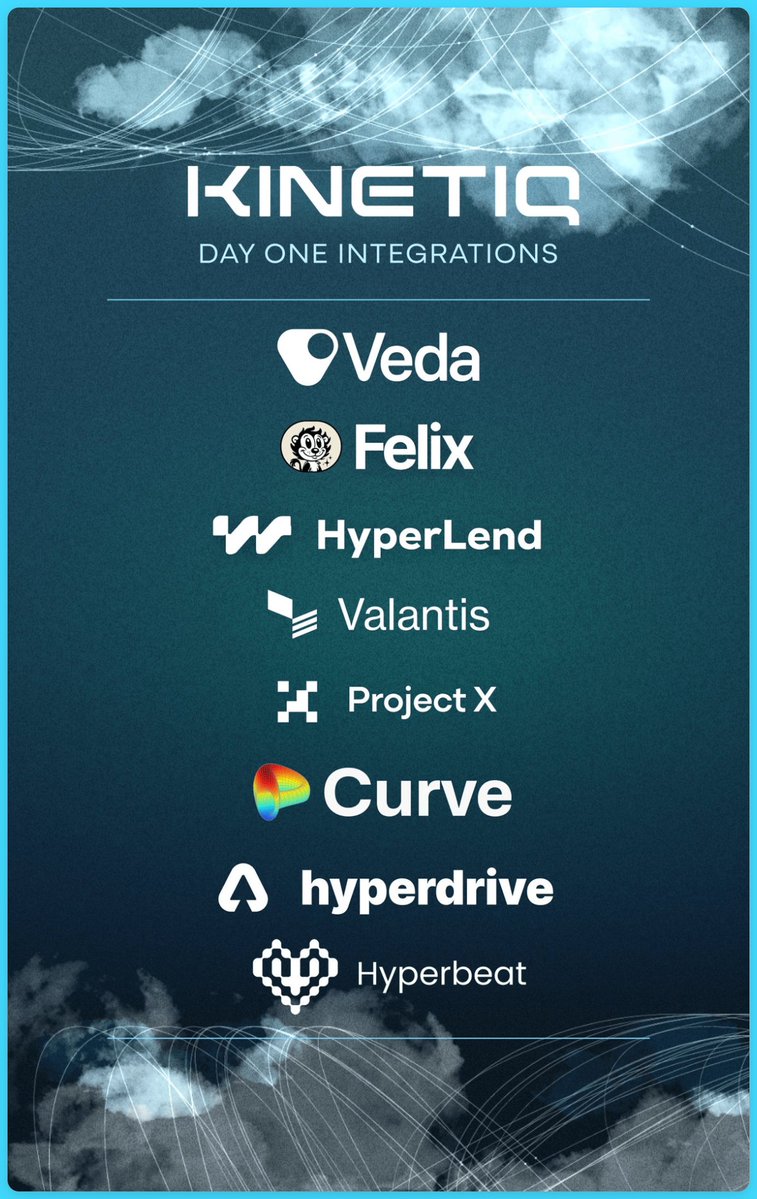

Thanks to integrations across the @HyperliquidX ecosystem, kHYPE becomes a DeFi powerhouse:

🔹 Collateral in CDP stablecoins ($feUSD, $USDXL, $USDHL)

🔹 Lending/borrowing (Felix, Hyperlend, HypurrFi)

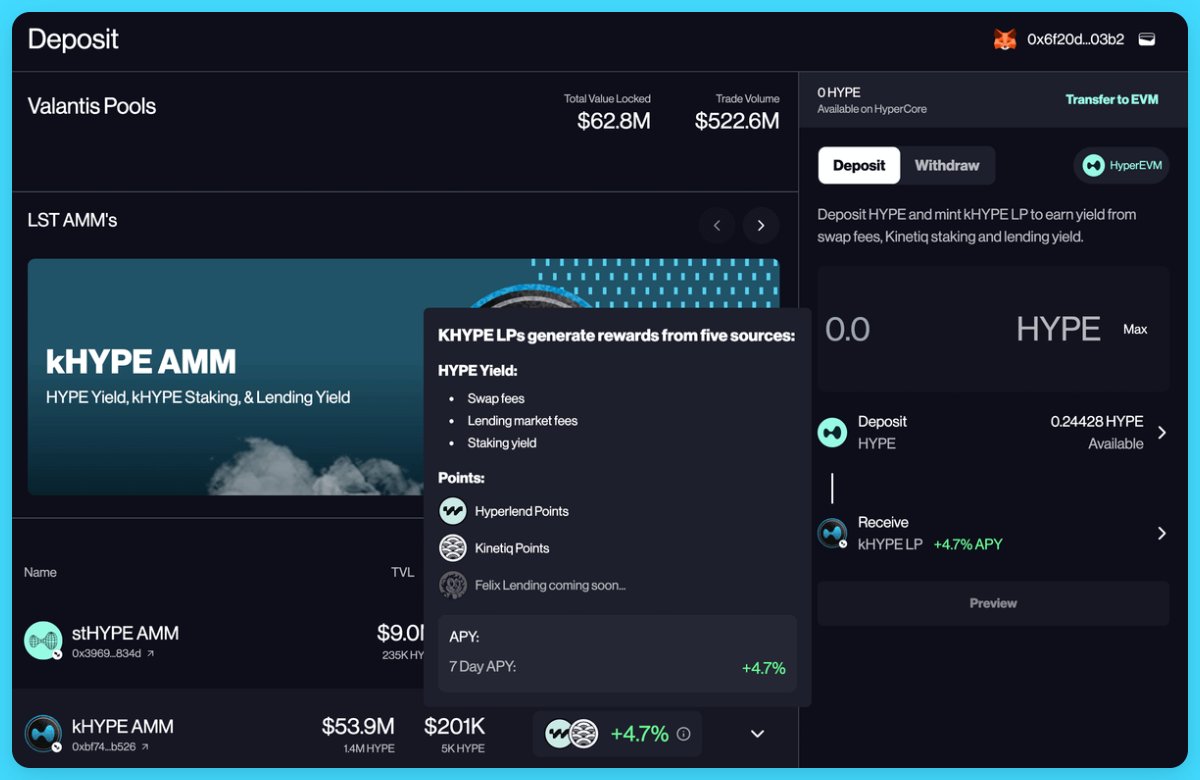

🔹 LP pairs on AMMs (Pendle, Valantis, Laminar)

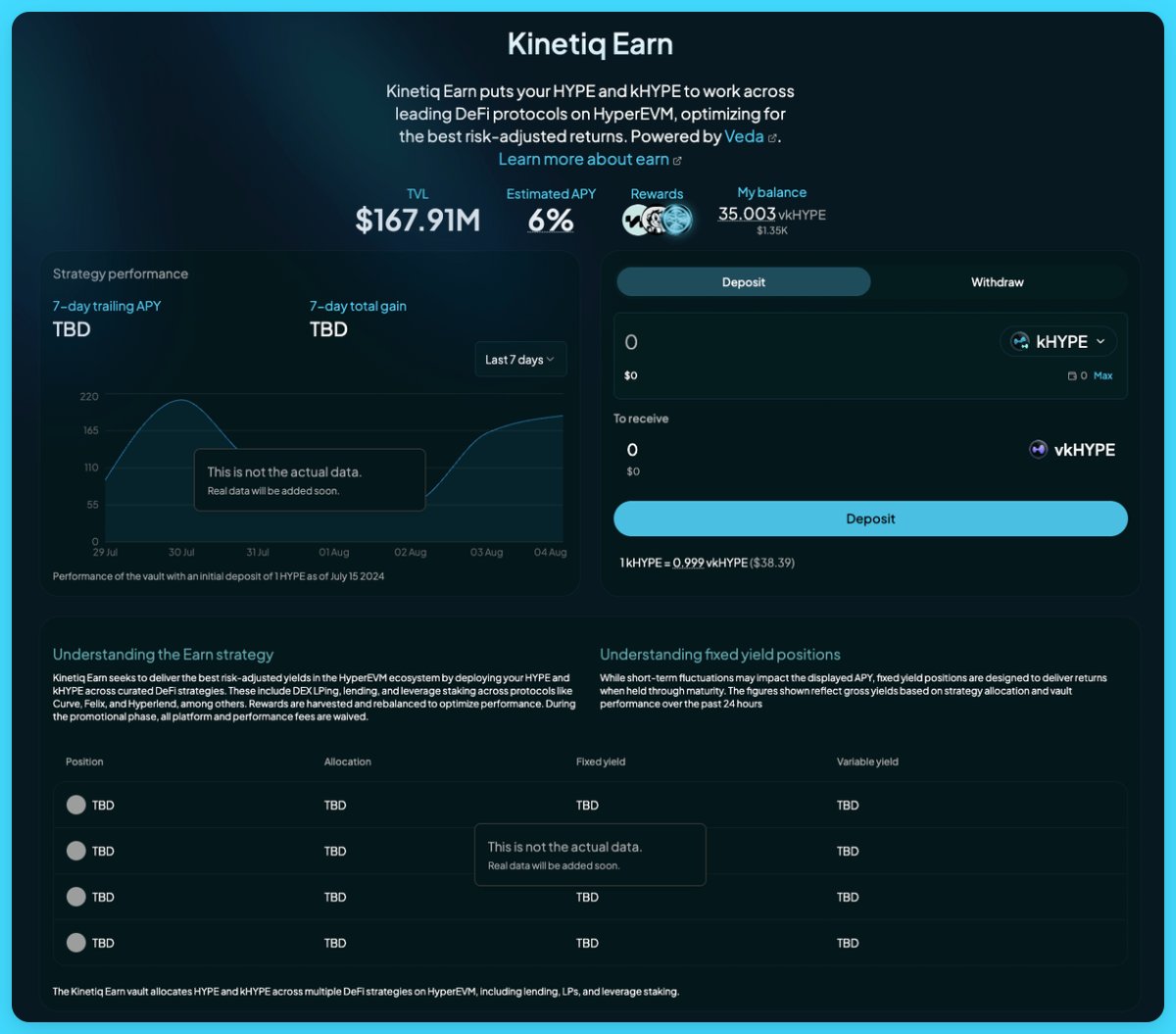

Want to earn even more?

@kinetiq_xyz has teamed up with @veda_labs to launch the Earn Vault, an automated $kHYPE yield strategy

🔹 Curated by top risk managers

🔹 Diversified yield across DeFi

🔹 LP token ($vkHYPE tracks your growing balance)

100% passive. 0% hassle.

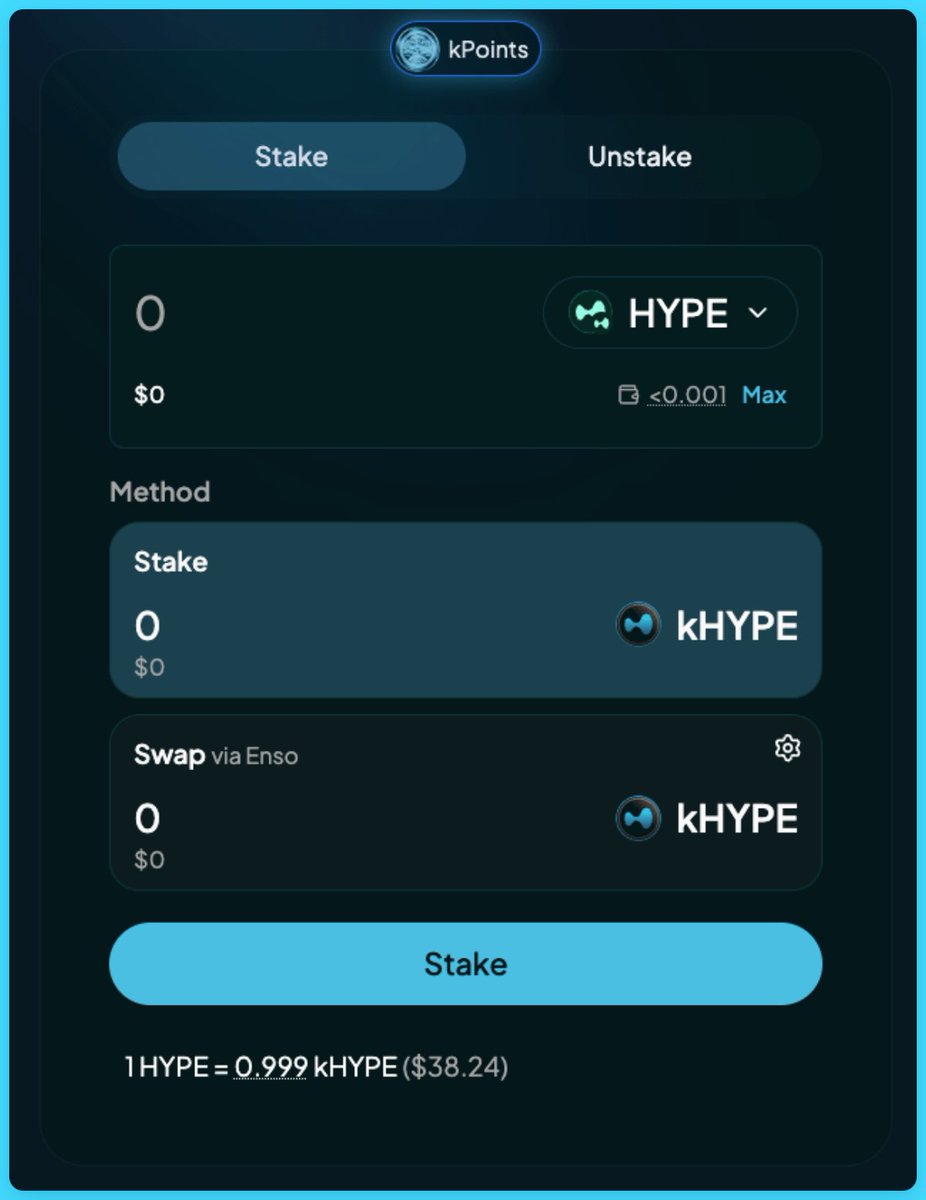

Getting started is simple:

🔹 Stake min. 5 $HYPE on the Kinetiq dApp

🔹 Receive kHYPE instantly

🔹 Use it in DeFi or vaults

🔹 To unstake: either wait 7 days/sell on the open market

Everything is seamless, liquid, and built for scale.

Now, getting to the juicy part: kPoints

🔹 kPoints reward active users weekly.

🔹 Use Kinetiq → earn kPoints → get rewarded.

🔹 Distributed every Thursday, based on snapshots.

🔹 800,000 kPoints distributed per week.

A powerful incentive layer for early and long-term users.

Lastly, covering how I'm personally maximizing on kPoints 👇

First, buy all the $kHYPE you want, and you can split it by:

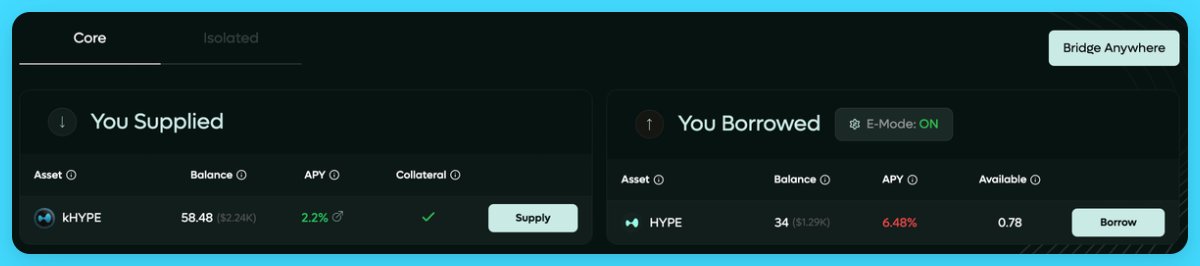

🔹 Lending on:

👉 @hyperlendx:

👉 @HypurrFi:

👉 @felixprotocol:

🔹 Borrowing stables against $kHYPE & locking it in @liminalmoney ( and/or @0xHyperBeat ( vaults and/or buying $HYPE to re-loop & maximize exposure:

🔹 Locking some in Kinetiq Earn for $vkHYPE + Kinetiq, Felix, and Hyperlend points:

🔹 Depositing on @ValantisLabs for kHYPE LP + Hyperlend, Kinetiq, and Felix (soon) points:

🔹 LPing with $HYPE/$USDT0 on @prjx_hl:

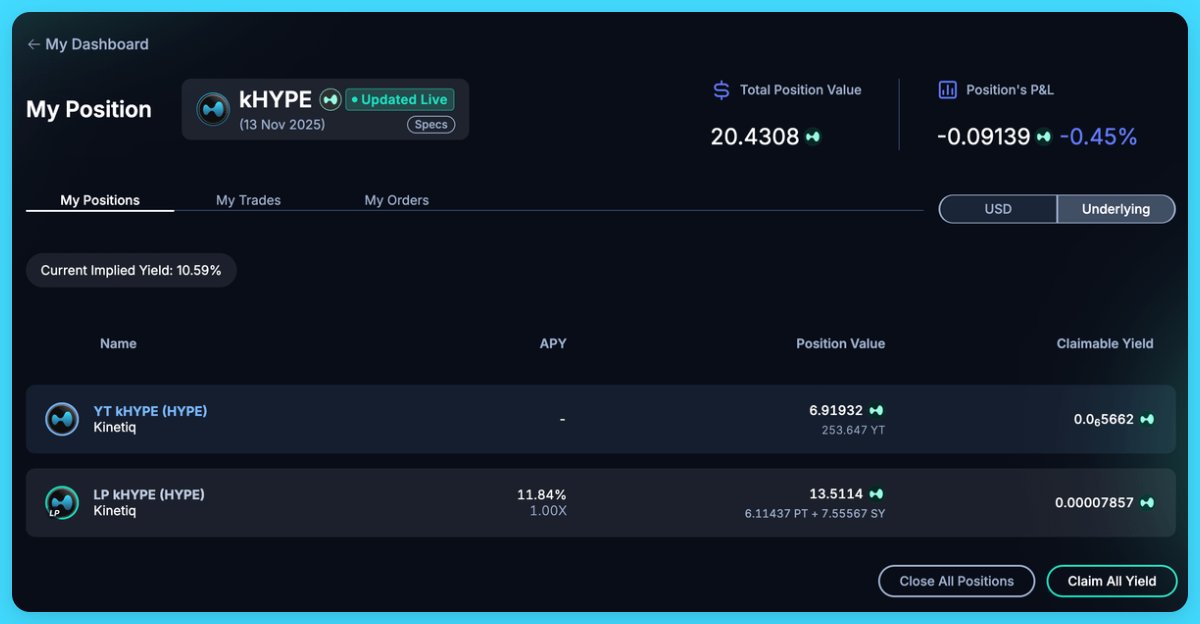

🔹 LPing on @pendle_fi to earn up to 35x on Kinetiq points (YT kHYPE) & stable yield (PT kHYPE/ kHYPE LP):

Overall, I believe staking shouldn’t force you to choose between yield, liquidity, or performance, and with @kinetiq_xyz solving exactly that, we can now stake smarter, stay liquid, and grow our yield passively, all while supporting the @HyperliquidX ecosystem as a whole.

With that, while I wrap up this post for the time being, I'm sure most of you are wondering what @pendle_fi's PT & YT tokens are all about, all while wondering if it's better to stake on @ValantisLabs or @0xHyperBeat

I'll be covering these topics in the coming 🧵's, but in the meantime, make sure to L+RT this post, and I'll be back with more!

4.49K

78

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.