With the number of tokens deployed on Abstract increasing, I think a quick primer on how providing liquidity works. The more you know about liquidity on AMMs, the better trading experience for your token.

First, we will go over how AMMs work and how tokens are actually traded.

Unlike traditional exchanges that use order books, AMMs uses liquidity pools. Each pool contains two tokens, enabling trading between them.

If your memecoin is called MEME and paired with ETH, the trading pool will have both MEME tokens and ETH.

For example, let's say there is 1000 MEME tokens and 10 ETH in the pool.

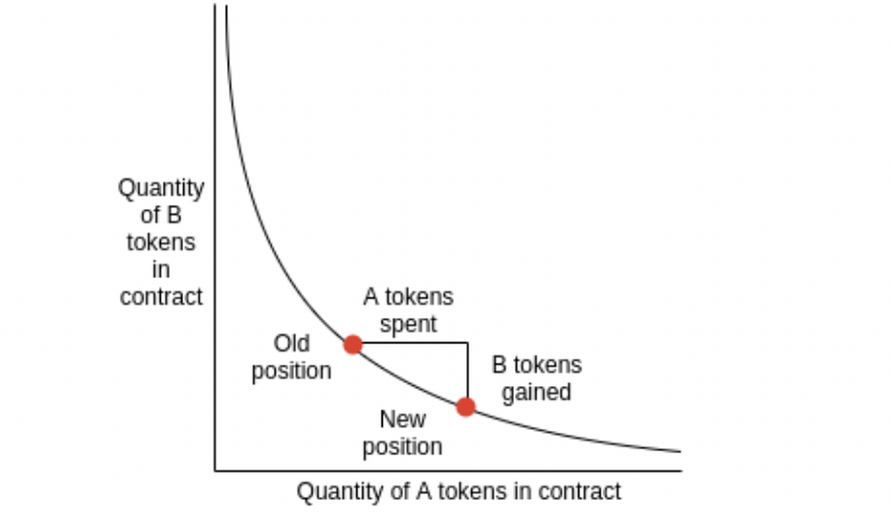

Buying MEME means, giving ETH to the pool (increasing the amount of ETH in the pool) and receiving MEME in return (decreasing the amount of MEME in the pool).

If everyone is buying MEME, after a certain about of time, the pool composition may look like this: 400 MEME / 14 ETH.

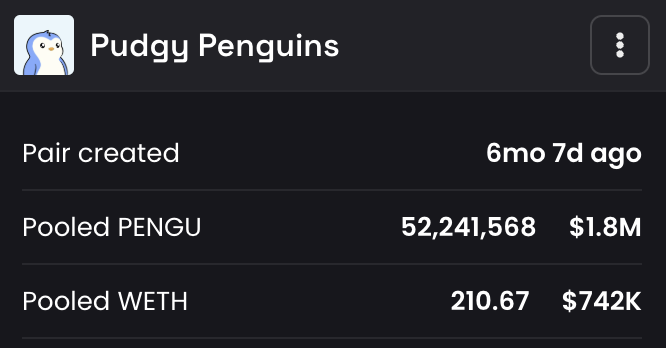

You can see here, there is 52M PENGU with 211 ETH in this pool.

This is the fundamental principle of AMMs, it simply is a rebalancing of the ratios between the 2 tokens in the pool.

Price impact occurs because large trades significantly change the token ratio in the pool, causing unfavourable prices for traders ("slippage").

For the above example, buying 600 MEME at once will cause large slippage since there is such little liquidity of MEME in the pool (you're trying to buy 60% of the pool meaning the ratio is changing severely).

Liquidity is simply how much of MEME + ETH there is in the pool.

Low Liquidity = High Slippage (small trades have big impact).

High Liquidity = Low Slippage (larger trades have minimal impact).

As someone deploying a token, you have one main goal: maintain high liquidity to minimise slippage.

To start providing liquidity for your token:

Create a liquidity pool on Abswap by depositing enough of your token and enough ETH. This ratio will initially determine your initial market cap and dictate how trading will go.

Initial liquidity sets the starting price: e.g., depositing 1 ETH and 1,000,000 MEME means your initial price is 1 MEME = 0.000001 ETH. However, since there's only 1 ETH of liquidity paired with MEME, price will be quite volatile as small buys (ie 0.1 ETH will move the pool ratio significantly).

Balancing Liquidity & Rebalancing:

Over time, as MEME price moves, your liquidity balance shifts.

If MEME's price increases significantly, your pool will have less MEME and more ETH.

Rebalancing involves adding/removing liquidity to maintain healthy token ratios and minimise extreme price swings.

For example, to avoid high Slippage, regularly add liquidity as your memecoin gains popularity + maintain deep liquidity pools (the deeper the liquidity, the lower the slippage). Adding liquidity means providing both MEME token AND/OR ETH depending on how your token is trading.

General best practices for token liquidity:

- Provide ample initial liquidity (large float of your token + at least several ETH to start). This is the most important step.

- Regularly monitor and adjust liquidity to prevent extreme volatility.

- Align incentives with larger players to provide LP as well.

If your team isn't willing to put up their own capital to provide liquidity and facilitate smooth trading, why would others want to trade your token?

13.18K

113

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.