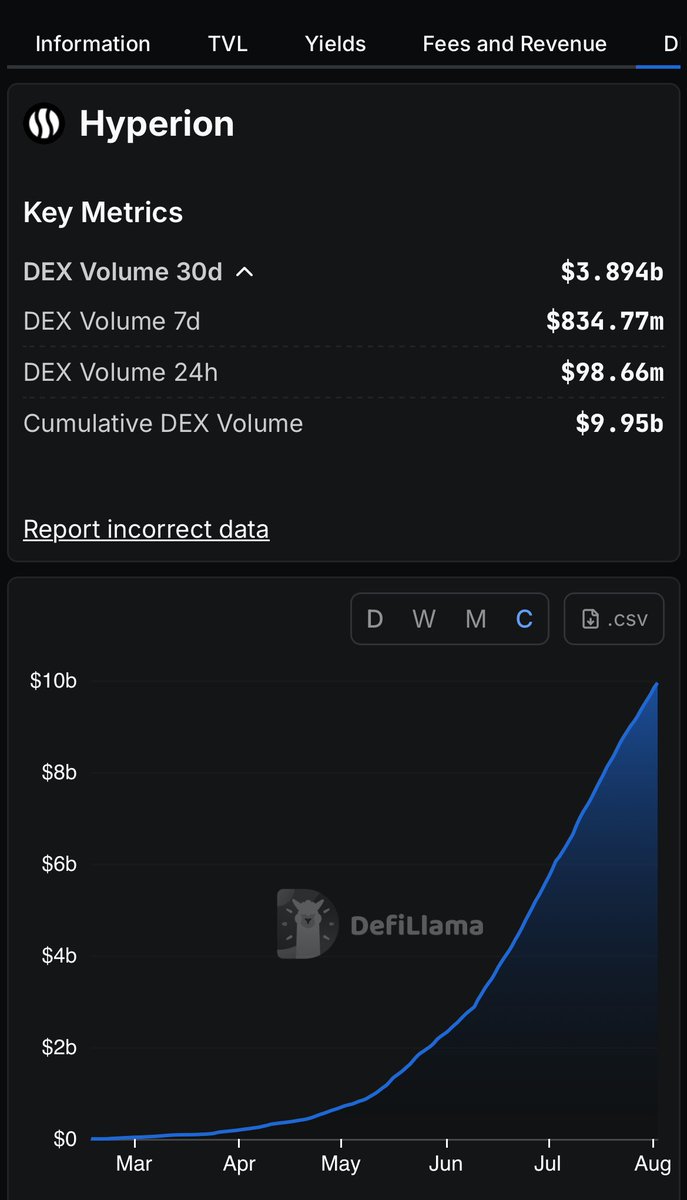

Recently, I looked into Hyperion's data, and it's quite interesting:

The 30-day DEX trading volume is close to $3.9 billion, almost reaching $10 billion, and it's growing rapidly!

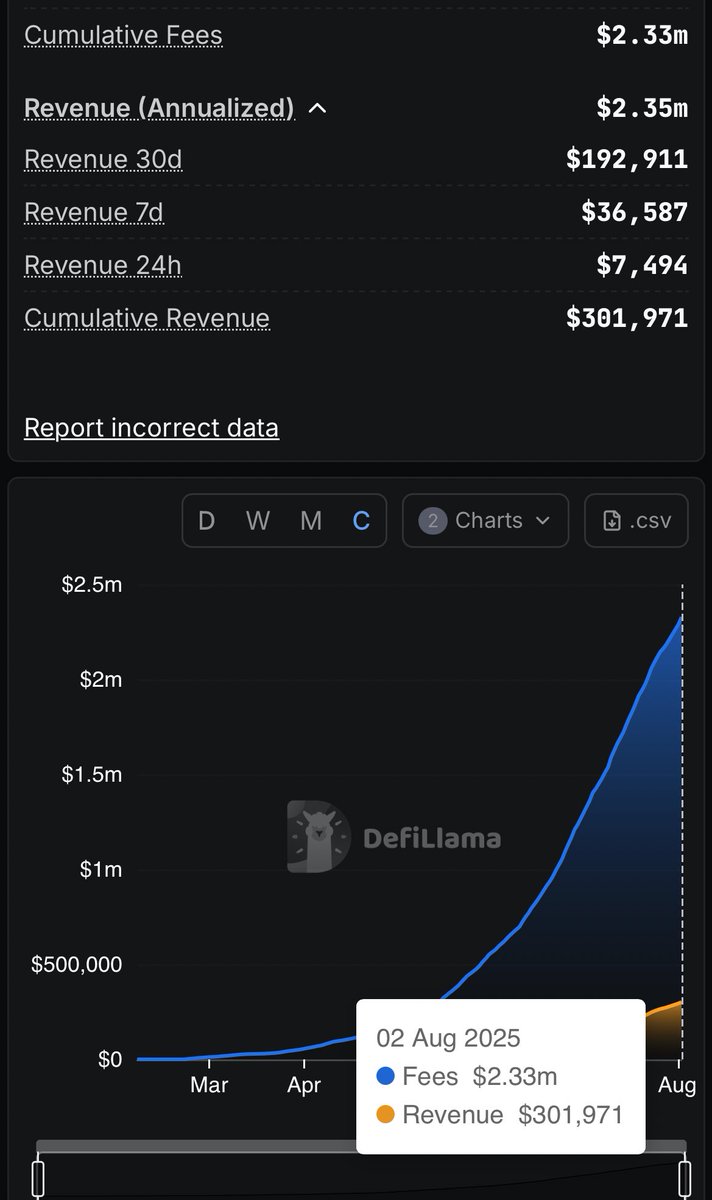

But if you look at the revenue distribution:

※ Cumulative Fees: $2.33m

※ Cumulative Revenue: $301,971

This means that while the transaction fees are substantial, the platform's retained revenue proportion is actually not that high.

This discrepancy is quite telling:

The trading volume is very large, the trading depth is sufficient, and the fee model tends to favor giving a large share to LPs. So you'll see that while the TVL and trading volume have increased, the revenue growth rate isn't explosive. This is actually Hyperion's consistent strategy:

First, build up liquidity and trading activity, then consider the platform's cut!

Another detail:

Annualized Revenue is $2.35M, which translates to a reasonable cut, and it's not a high-tax platform. This approach is similar to many new chain DEXs: first, make the trading volume and fees look good, pile up the metrics, then distribute the bulk of the earnings to early participants (liquidity providers/market makers/stakers), and gradually increase the profit-sharing portion.

So many people looking only at the trading volume might think Hyperion is raking in profits, but in reality, most of it is still being returned to ecosystem participants!

In other words, this is a window period suitable for early birds to reap rewards. When the platform starts to increase its fees (profit-sharing ratio), that's when the real monetization happens!

Lastly, just to add:

Currently, staking $RION has an APR of ~226.26%, with an annual interest rate of 200%, and it hasn't dropped since!

Show original

25.41K

232

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.