I'm going to drop a little Sunday nugget that I guarantee you no crypto research firm, no crypto podcaster, no crypto VC, no crypto social media bro, has ever pointed out:

TVL of assets on a chain is not proportionately correlative to the value accrual of that chain's gas token.

Example:

Take 10 billion stablecoins/tokenized RWAs/ETH/whatever, dump it into Aave for a year, book $50 million in yield income, and withdraw it for $3 in ETH gas fees.

TVL: $10 billion

Yield income: $50 million

Value accrual to ETH: $3

But, in contrast, the TVS of Chainlink on lending protocols *IS* value accretive to Chainlink and that lending protocol in proportion to that TVS:

The more TVS in Aave (secured by Chainlink) -> Larger sized loans -> Larger sized liquidations -> Larger sized profit margins for searchers to liquidate those loans -> Larger sized bids that searchers will pay Chainlink to the buy the rights to the liquidation.

The money paid by the searchers is then split by Chainlink and Aave.

Hence, Chainlink's Smart Value Recapture (SVR, OEV solution) is how you directly monetize the TVS secured by Chainlink's price feeds.

The larger the TVS -> The more value accrual to both Chainlink and the lending protocols consuming its feeds.

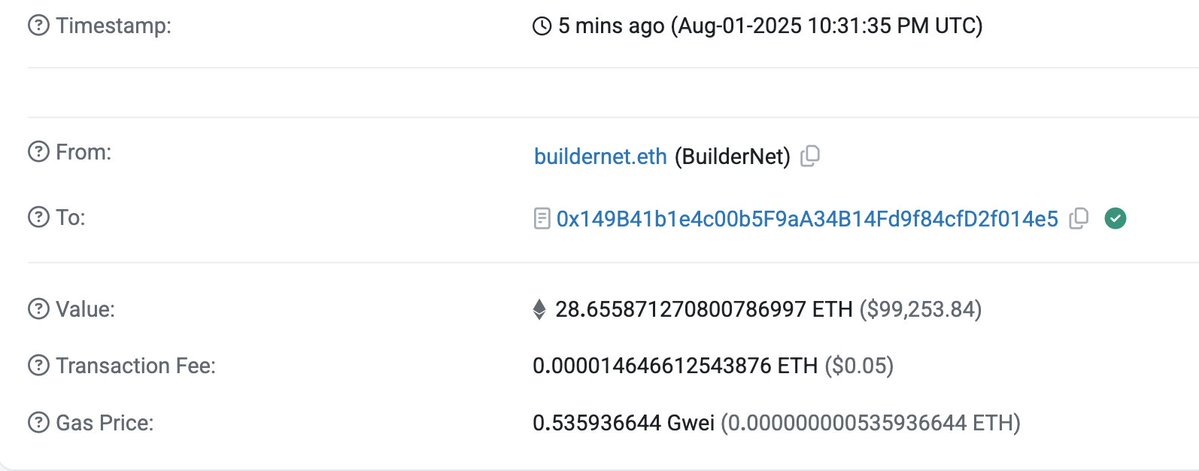

In this attached example ( a $2.8 million dollar loan was liquidated and the searcher paid $100K to Chainlink for the rights to the liquidation, which is then split between Aave and Chainlink.

Food for thought.

>Ethereum is a public good

That's funny because Ethereum would be the first public good in history that has an ETF where you're directly buying the asset of the "public good" itself rather than a company benefiting from the provision of it.

I've also never seen any other public goods have treasury company and shills on CNBC selling an investing narrative around them, either.

>Chainlink is a good business

Chainlink is a decentralized, immutable, permissionless protocol. Chainlink Labs is one contributor building services on it. Very soon 3rd party devs can build their own workflows on it independent of Chainlink Labs.

@IrfanMussa1 Another hilarious point is that until Chainlink built this, this value used to go to Ethereum validators and was ETH staking yield. So, was Ethereum a "good business" then and now it's not?

@Slizzzy13

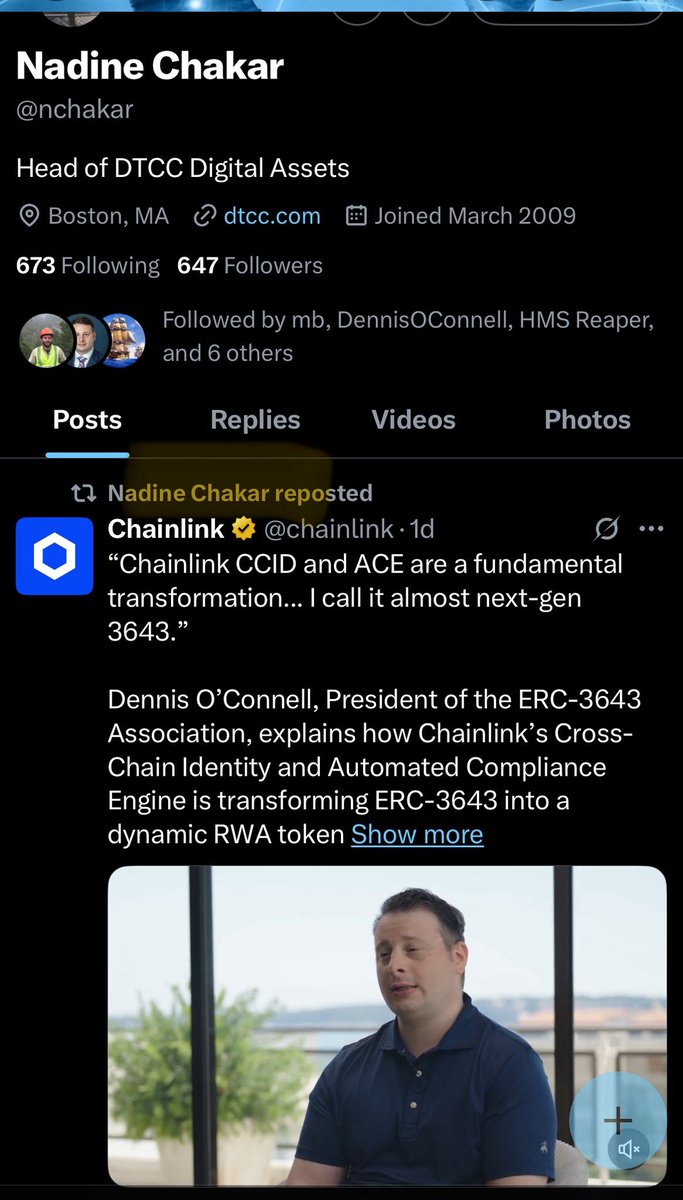

It's not an ETH format. It's an EVM format. It doesn't need to be used on Ethereum.

Example: DTCC's own permissioned chain will use ERC3643 (they're part of the org), but they don't need any ETH to do so.

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

>$ETH is money for the web3 economy

No, it's not.

A) It's a gas token to pay for write access to Ethereum blockspace.

B) When staked, it's a claim on Ethereum cash flows.

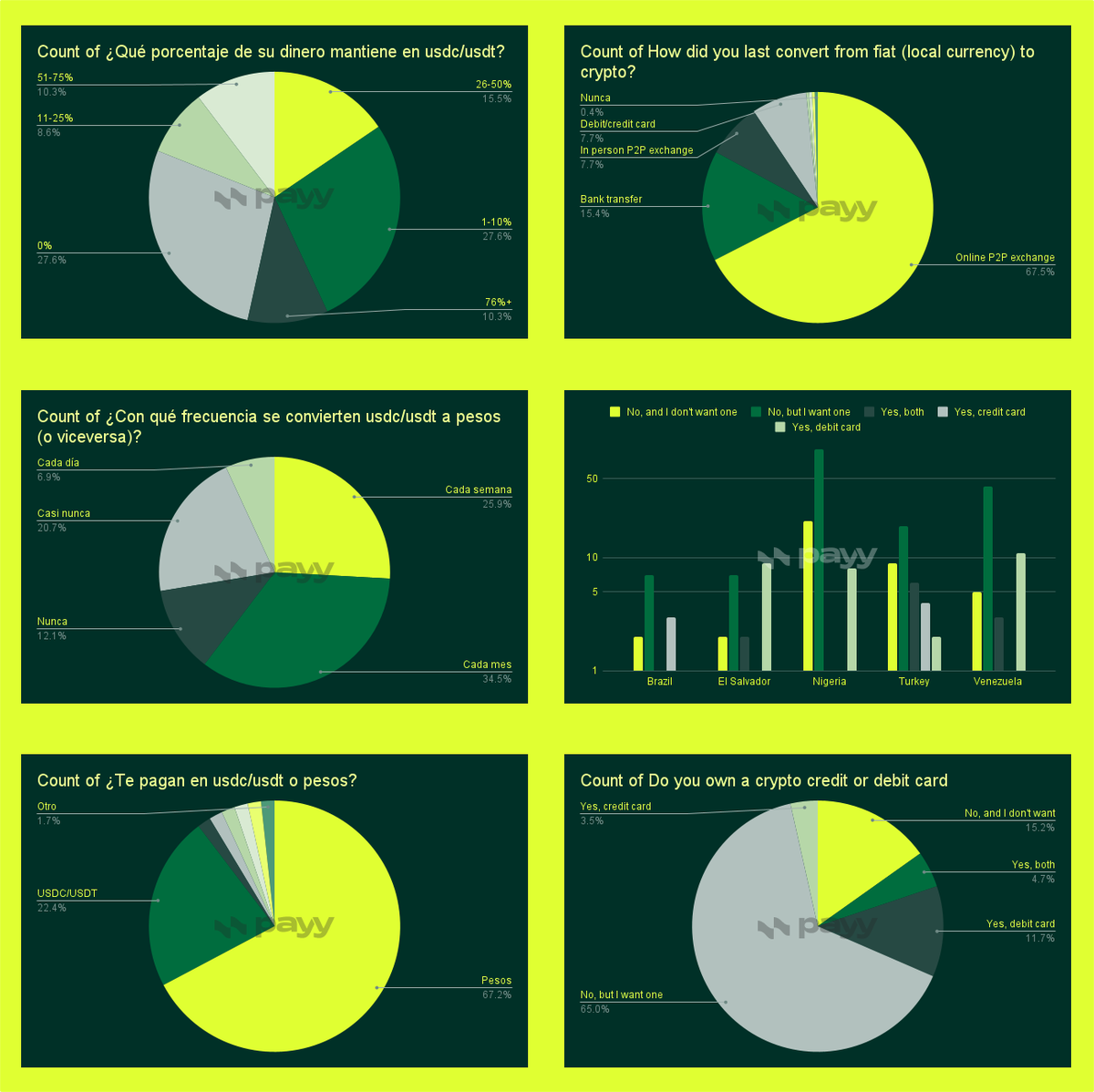

1. People actually prefer and use stablecoins as money; not volatile crypto tokens. If you look at my attached thread about people who are actually using tokens as money (surprise! They're stables), you'll see no one is mimicking them with any volatile crypto-native tokens.

2. Abstraction tools/layers allow any on-chain denomination of cost to be paid for with any form of value. Thus no token is "money" more than any other.

Every token in your on-chain wallet is "money for the web3 economy."

3. Trillions of dollars' worth of RWAs will be tokenized and not a single one of them will be denominated in anything other than the dominant fiat currencies. Not one will be denominated in ETH or any other crypto token.

@DaoChemist

@DaoChemist Even Circle agrees.

Circle Paymaster now supports EOAs and is expanding to 7 blockchains!

Paymaster is the official solution for paying gas fees in @USDC, eliminating the need to manage native tokens.

Now EOA wallets can enjoy streamlined onchain transactions.

What's New:

✅ EOA Support: Now compatible with EIP-7702, allowing externally owned accounts to pay gas in USDC

✅ Chain Expansion: Expanding to @avax, @ethereum, @Optimism, @0xPolygon, and @unichain in addition to @arbitrum and @base

Learn more:

Not at all. The Bitcoin network has more liquidity than any other chain, yet the mempool sits empty.

BTC that doesn't move for a year = $0 fees for BTC miners

Billion dollar capital deposited into Aave once a year, with occasional yield claims = $10 for ETH validators

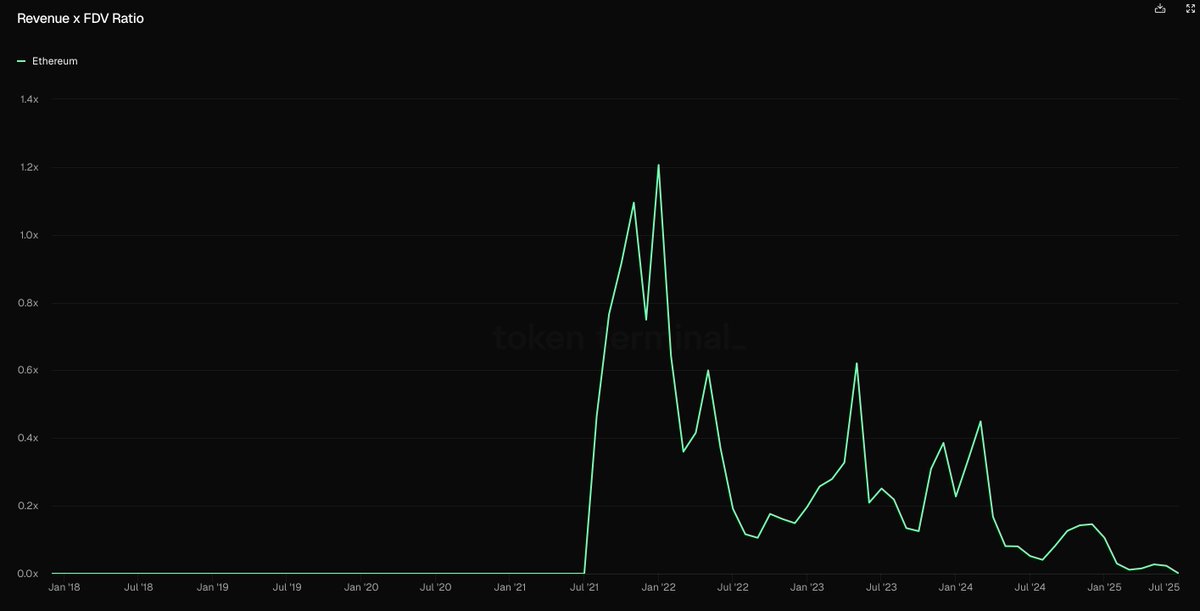

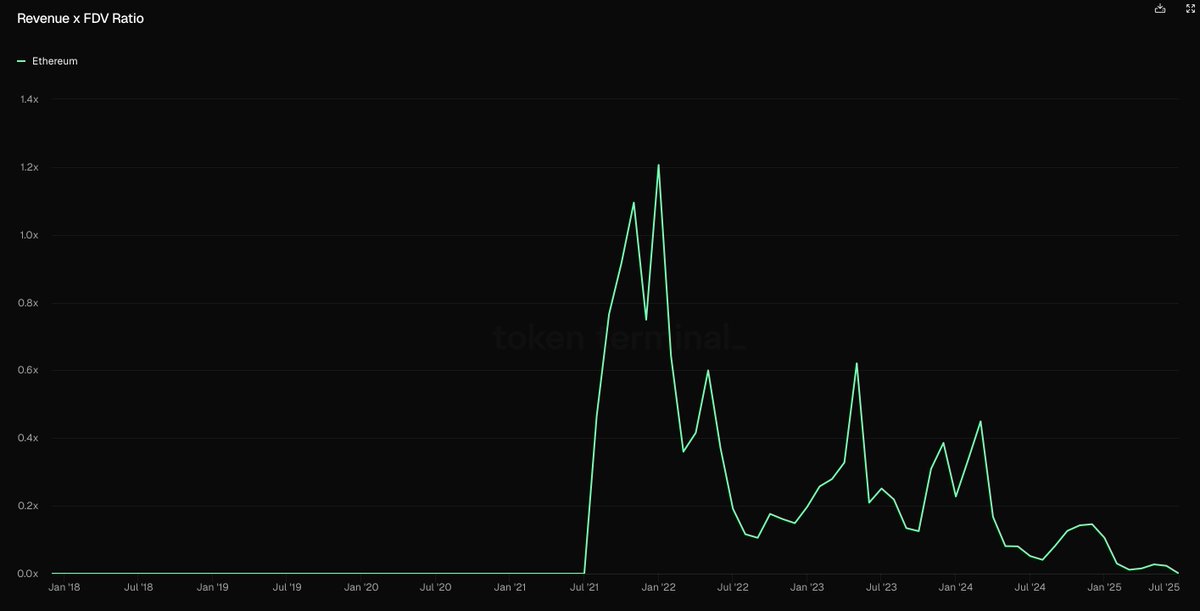

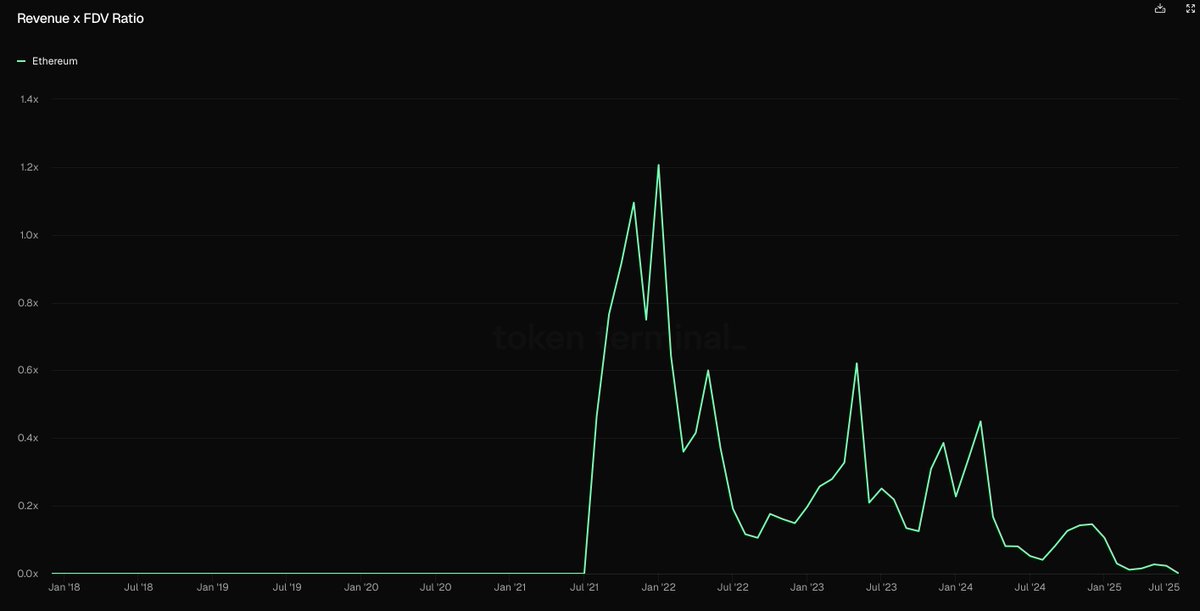

See the chart, despite TVL going up on Ethereum:

That’s the tragedy of ETH: @ethereum's revenue relative to its fully diluted valuation (FDV) has been on a steady decline since early 2022, and it just fell back to 2021 levels.

At its peak, ETH’s revenue/FDV ratio was 1.21 -meaning it was generating $1.21 in annualized revenue for every $1 of fully diluted market cap. Pretty good. Last month, that ratio dropped to just 0.02. In other words, for every $1 of potential market cap today, Ethereum produces only 2 cents in annualized revenue.

Yes, L2 scaling has pushed activity off mainnet and reduced direct fee revenue. But even so, that alone can’t justify such a drastic drop in this ratio.

Data via @tokenterminal

@DeFi2099 @wmougayar @0xPeruzzi @dnrcsii @ChainLinkGod

Let's just look at this chart, while Ethereum's TVL has gone up.

That’s the tragedy of ETH: @ethereum's revenue relative to its fully diluted valuation (FDV) has been on a steady decline since early 2022, and it just fell back to 2021 levels.

At its peak, ETH’s revenue/FDV ratio was 1.21 -meaning it was generating $1.21 in annualized revenue for every $1 of fully diluted market cap. Pretty good. Last month, that ratio dropped to just 0.02. In other words, for every $1 of potential market cap today, Ethereum produces only 2 cents in annualized revenue.

Yes, L2 scaling has pushed activity off mainnet and reduced direct fee revenue. But even so, that alone can’t justify such a drastic drop in this ratio.

Data via @tokenterminal

That transaction is 100% based in reality.

I literally described how much it does actually accrue from that magnitude of TVL being used in that fashion.

I didn't say it represents all forms of activity on the chain.

Ethereum's TVL chart has been nothing but up. Look at its value accrual vs marketcap chart.

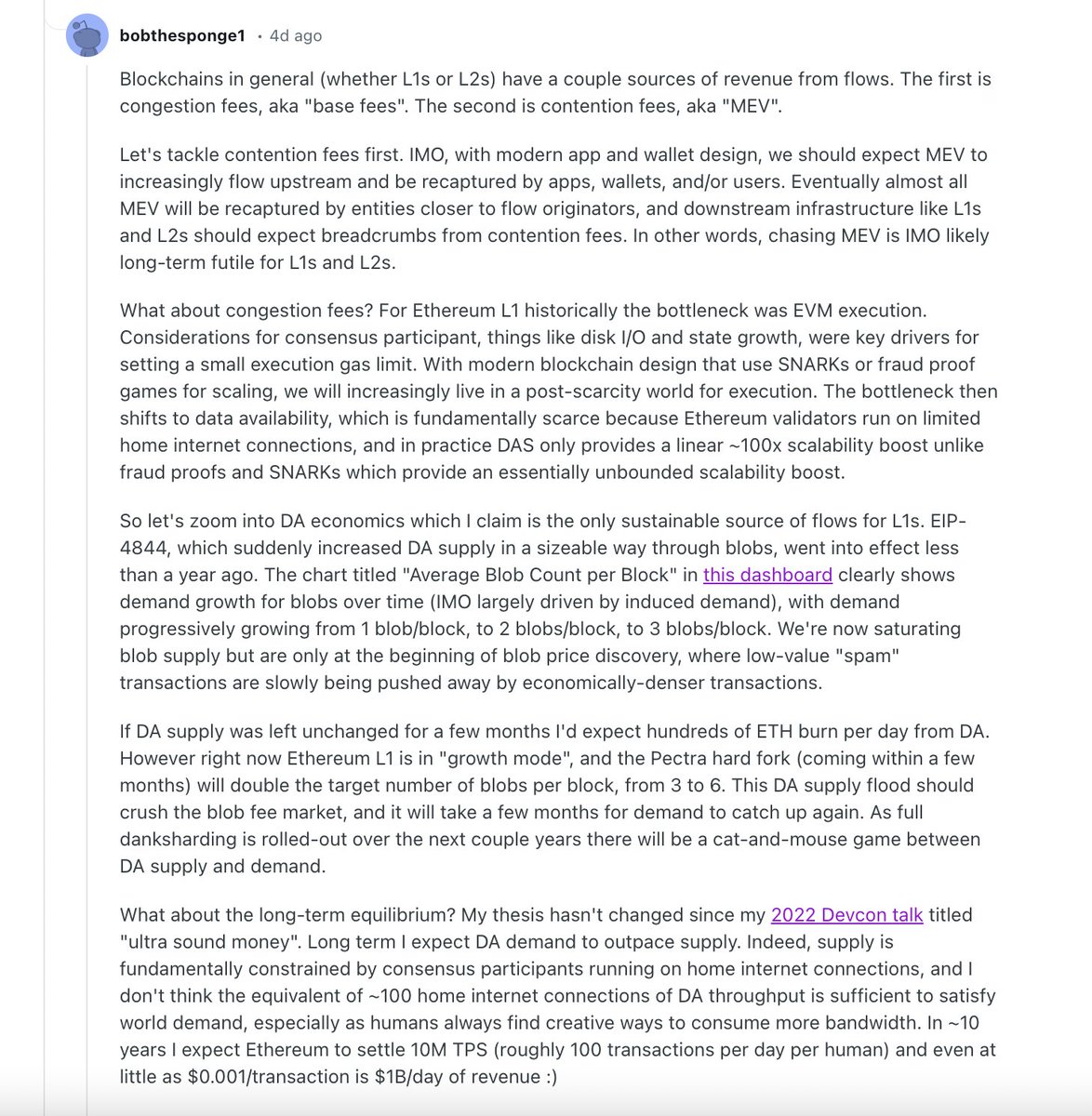

L1 value accrual is going towards dust due to applications, wallets, and Chainlink recapturing the value of their order flow. This is a new shift.

That’s the tragedy of ETH: @ethereum's revenue relative to its fully diluted valuation (FDV) has been on a steady decline since early 2022, and it just fell back to 2021 levels.

At its peak, ETH’s revenue/FDV ratio was 1.21 -meaning it was generating $1.21 in annualized revenue for every $1 of fully diluted market cap. Pretty good. Last month, that ratio dropped to just 0.02. In other words, for every $1 of potential market cap today, Ethereum produces only 2 cents in annualized revenue.

Yes, L2 scaling has pushed activity off mainnet and reduced direct fee revenue. But even so, that alone can’t justify such a drastic drop in this ratio.

Data via @tokenterminal

@Danism2376 See Justin Drake's post about the former sources of value accrual that Ethereum no longer has.

This isn't a "bash Ethereum" thread.

I am simply making the argument that if you want to have exposure to a fundamentals based bet on tokenization and institutions using chains, LINK is way better than ETH.

ETH is a bet on the ability of asset managers to sell their ETF products and story-telling from people on TV; not value accrual of ETH, the asset.

@IrfanMussa1 @wmougayar @0xPeruzzi @dnrcsii @ChainLinkGod

He's selling slop to boomers.

@IrfanMussa1 @DrakeLinked @wmougayar @0xPeruzzi @dnrcsii @ChainLinkGod

Regardless, DTCC launched their own permissioned, Hyperledger Besu chain (EVM client with parallel tx processing.)

Uses EVM, uses ERC token standards, no ETH

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

@wmougayar @IrfanMussa1 @0xPeruzzi @dnrcsii @ChainLinkGod

Revenue is the value accrual of a token. You either have services to sell or stories, analogies, and memes to sell. There is zero moat to the Mother Goose story hour.

You better get the memo over to Tom because he's judging it on earnings on TV.

@IrfanMussa1 @wmougayar @0xPeruzzi @dnrcsii @ChainLinkGod

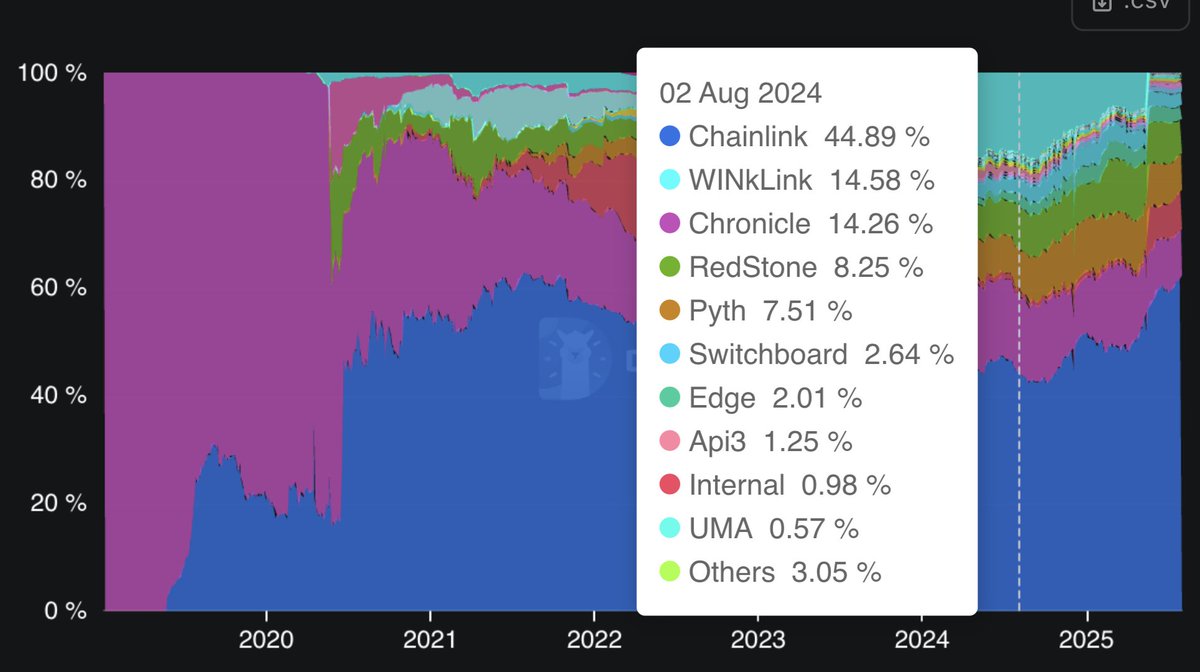

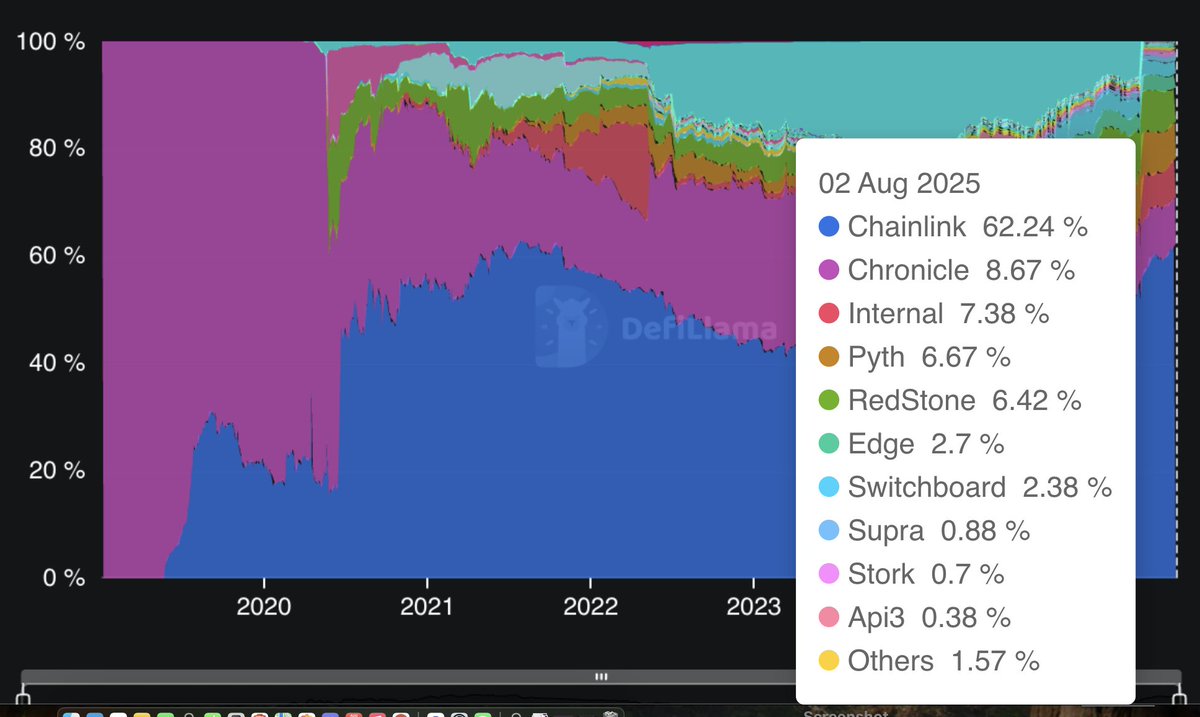

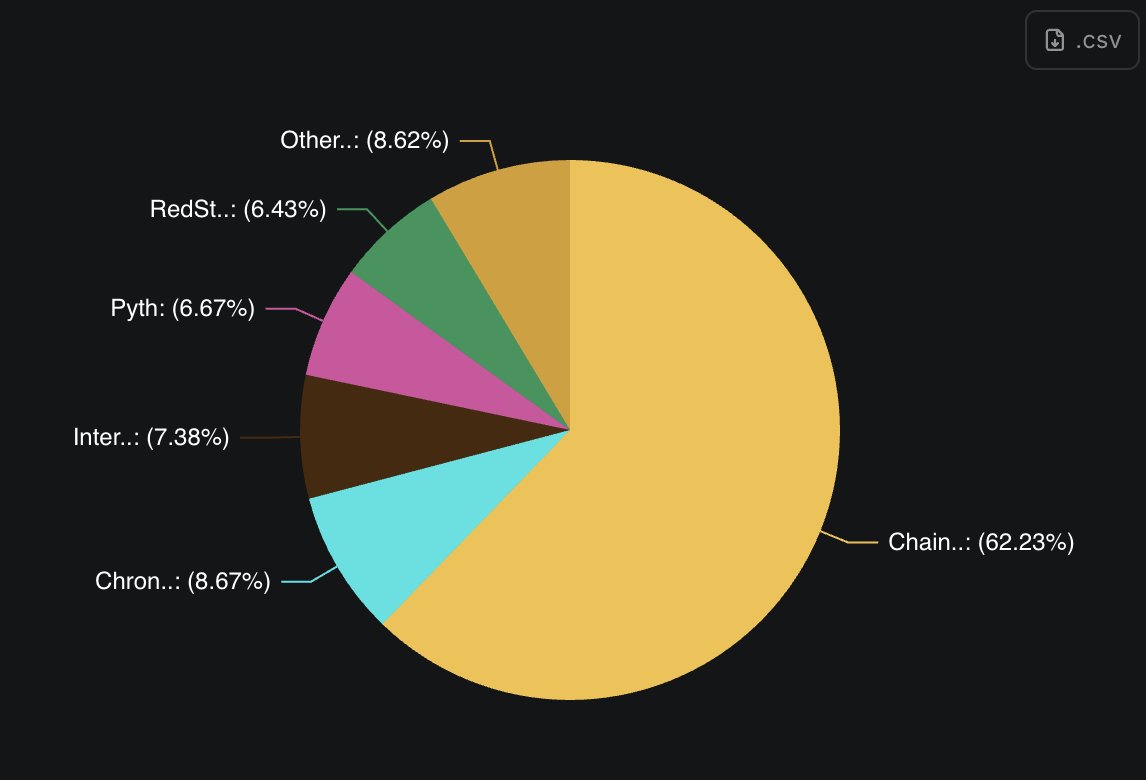

>Oracle competition is set to heat up.

Only in your mind.

You also don't understand that Chainlink isn't an "oracle" per how you're using the term.

There is no other protocol that is a complete platform of infrastructure.

If you keep strawmanning 70 IQ slop, I will block you.

No one said TVL isn't being issued. The claim is that mere issuance on a chain doesn't equate to value accrual of the token if the TVL is dormant, as I showed in my Aave example. I've explained to you 50 times already. Either you have the IQ to understand it or you don't.

Asset issuers and banks will deploy their use-cases on every single chain where it makes sense to do so. The marginal cost to have your application on all chains will continue to get lower and lower.

You keep saying "institutions keep building on Ethereum" as if some's that big investment and heavy lift on their part. It costs them nothing to deploy a token contract on a chain. They will deploy there and they will deploy anywhere. Why would they not? There's no downside.

You will have native cross-chain deployment of workflows across all the chains institutions want to be on.

@0xPeruzzi @IrfanMussa1 @wmougayar @dnrcsii @ChainLinkGod

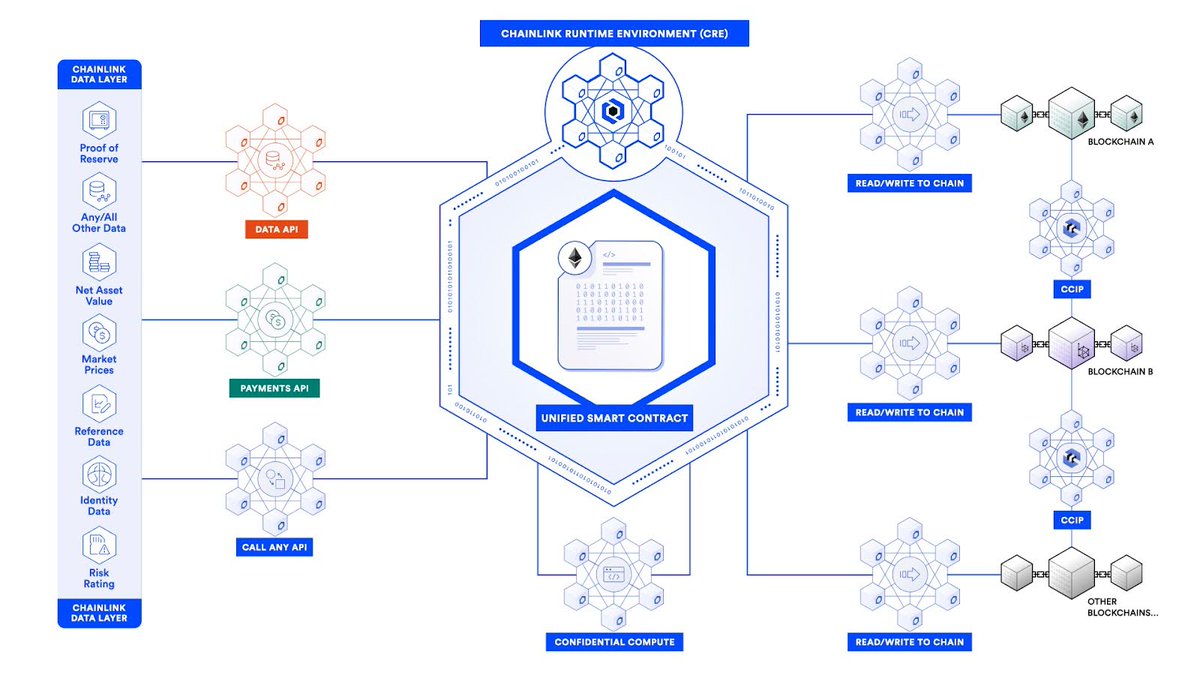

The entirety of how workflows function and how they're built and what they'll do will be different in the future than what they have been historically.

You can either figure that out now or you can figure it out later. At least try reading the post.

The thesis of Chainlink is completely different today than its early years.

How it started: A single data oracle service

How it's going: The Web3 cloud powering entire apps

Chainlink started out simple, providing existing data on to blockchains. Onchain apps used that data to make decisions like whether to liquidate a loan or how to settle a perp.

Chainlink then expanded into different types of computation (e.g., random number generation, keeper automation) before launching its cross-chain protocol. However, those were only building blocks to a much, much bigger value proposition emerging.

With the introduction of the Chainlink Runtime Environment (CRE), Chainlink is primed to be the main way developers and institutions both build onchain apps and power them through their lifecycle.

Chainlink is no longer just a service or even set of services, but the foundation underpinning onchain apps and use cases. It’s akin to the cloud but decentralized and for onchain apps, providing them the development framework for building apps, the key services they require, and the computation that powers them on the backend.

But why is this important? And why is Chainlink doing this?

The blockchain landscape is changing. You used to use a single blockchain as your cloud-like environment. But now there are hundreds of chains and you want to be able to interact across them all. Transactions are also more complex with the introduction of tokenized real-world assets (RWAs). This is the phenomenon of all the world’s existing value becoming tokenized, which is 100x the value that currently exists onchain. Thus, you must adopt RWAs if you want to succeed in this industry long term at any scale.

However, the introduction of RWAs requires new services. They require data like DeFi, but even more types of data, such as proof of reserves, net asset value, and much more. They also require compliance policies built into the asset itself and the services transacting them, which naturally needs identity data to work. Furthermore, they need privacy features, connectivity across chains, and integrations with legacy systems.

The best way to build an app like this is through a single platform that is chain-agnostic and has all the key services already built-in. This is Chainlink.

Chainlink is the only all in one platform where institutions can solve all their data, cross-chain, compliance/identity, privacy, and legacy system integration requirements. And importantly, they can combine these service into one sequential workflow (i.e., one piece of code) that Chainlink runs securely end-to-end in a decentralized manner.

This workflow is essentially an app that interacts seamlessly across chains and legacy systems while leveraging key services along its lifecycle. Once you build this workflow, you can easily reuse it and modify it to support new customers, new chains, new legacy systems, new oracle data, new use cases, etc without rewriting it all. It’s by far the most efficient and future-proof way to not only build DeFi apps, but apps for tokenized RWAs, which are the future of our industry.

This value prop puts Chainlink at the heart of onchain applications; far beyond just being a side service. The market doesn’t quite understand yet how well Chainlink is positioned, but it will because its product offering, vision, and historical track record of delivering solutions meshes perfectly with where the industry is heading and what TradFi & DeFi require to succeed in this new RWA paradigm.

41.08K

338

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.