$MSTR $MTPLF

found this very interesting and had not thought to calculate it before

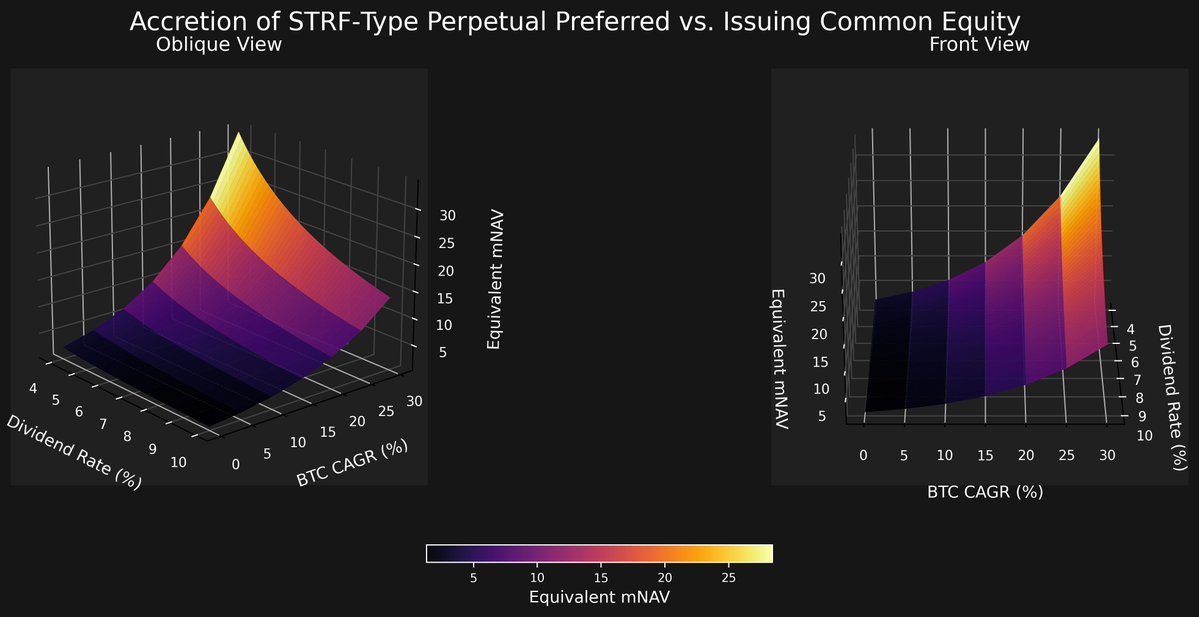

what this is doing is attempting to show you how lucrative for a DAT, like MSTR, selling preferred shares is relative to selling common shares

i decided to do the same a the capital(raised)-weighted aggregate of all four of Strategy's preferred equity instruments

here's the result I got for a 1.5 year time horizon:

Aggregate Preferred Equity mNAV = 10.2x

if the common stock mNAV was below that multiple, then the preferreds were the cheaper capital (and vice versa). MSTR's mNAV hasn't exceeded 4x in the past year, so their preferred equity raises are looking like very good plays.

doing this analysis requires several assumptions, but I tried to keep it conservative. more conservative than I know Strategy themselves would model it and probably most of their shareholder fanbase too.

primary assumptions:

i) i chose 1.5 years because i think that's a good approximation of the capital-weighted average investment time horizon of the market participants that actually determine the MSTR price

ii) BTC CAGR = 20% (Strategy assumes 30% over the next 10 years)

Strategy's latest earnings call showed that, below a common stock mNAV of 2.5, they find issuing more preferred equity likely to be much more lucrative (hopefully on a risk-adjusted basis!) than issuing more common stock

the above analysis provides insight into that idea

still not sure if committing to never issuing ATM above 2.5x was the optimal strategy though. i really don't lean one way or the other. but the market sure seems to think it was unwise.

btw Dylan is posting about it because Metaplanet just recently announced their plans to issue preferred shares akin to STRF

Metaplanet has both a higher mNAV and is going to pay a lower dividend on their preferred instruments

1.44K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.