🏘️⛓️ RWA Weekly News: Real Estate, Credit & Policy Heat Up

@ChristiesInc goes crypto-native for tokenized real estate, @centrifuge expands cross-chain, @grovedotfinance commits $250M to RWA credit, and Hong Kong signals full support for tokenization.

Weekly RWA roundup👇🧵

@plumenetwork @binance @NuklaiData @Polytrade_fin @CoinstoreExc @Bybit_Official 🔎 DIA xReal: Powering the RWA Revolution

From tokenised treasuries to real estate and FX, DIA delivers transparent, verifiable RWA data across 60+ blockchains, underpinning the tokenization infrastructure of tomorrow.

Explore the oracle suite ↓

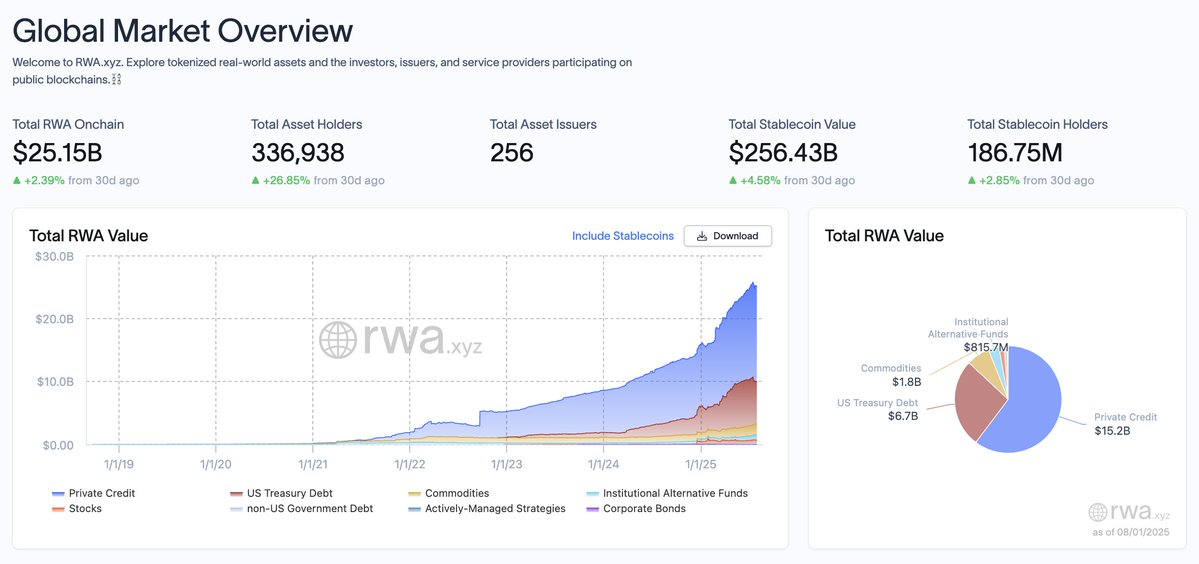

📊 RWAs in Numbers (August 1st)

• Total RWA On-chain: $25.15B

• Asset-backed stablecoin total market cap: $256.43B

• Total asset issuers: 256

• Leading RWA chains: Ethereum, ZKSync Era, Aptos, Solana, Stellar.

Learn more at

🌀 Centrifuge Migrates to Ethereum for Cross-Chain RWA Access

@centrifuge expands its RWA protocol by going multichain with a new EVM-native layer, boosting composability on Ethereum.

🏠 Christie’s Launches Crypto-Only Real Estate Division

Auction giant @ChristiesInc forms a crypto-native team to handle high-end tokenized real estate deals.

🇭🇰 Hong Kong Doubles Down on RWA Tokenization in New Policy

A new policy paper signals Hong Kong’s fast-track crypto licensing and prioritization of RWA innovation.

⛓️ KOZII IEO Targets Real-World Yield via Blockchain

KOZII launches its IEO on @CoinstoreExc, aiming to deliver real-world yield opportunities through tokenized infrastructure.

🔺 Grove Finance Commits $250M to RWA Credit on Avalanche

@grovedotfinance launches with a $250M push into real-world credit, accelerating RWA adoption on Avalanche.

⛓️ BNY & Goldman Sachs Bring Money Market Funds Onchain

The two giants partner to tokenize part of the $7.1T money market industry, signaling massive TradFi-RWA convergence.

🏦 Binance Launches RWUSD for Tokenized Treasuries

@binance introduces $RWUSD, a new asset backed by U.S. Treasuries and other RWAs, expanding its stablecoin suite.

📈 Polytrade Expands to BNB Chain for Cross-Chain RWA Scaling

@Polytrade_fin extends its RWA offerings to @BNBCHAIN, building toward seamless multichain infrastructure.

🧠 Smart Money Flows Into RWA-Linked Altcoins

@Bybit_Official report shows rising capital moving into altcoins tied to RWAs, even as stablecoin balances drop.

⚫ BlackRock’s ETH ETF Crosses $10B as RWA Thesis Gains Ground

@BlackRock’s Ethereum ETF hits $10B, with tokenized real assets seen as a key driver of institutional inflows.

🇧🇷 Brazil’s VERT Capital to Tokenize $1B in RWAs via XDC Network

Brazil’s VERT Capital will tokenize $1B in real estate and financial instruments using the @XDCFoundation blockchain.

🎤 Plume & Web3Labs Advance RWA Policy in China & HK

@plumenetwork and @web3labs co-host forums to push forward regulatory and infra development for tokenized real assets.

🌀 RWAs are entering prime time.

• Real estate giants & DeFi protocols launching tokenization platforms

• $250M+ in RWA credit deployed

• Policy tailwinds from Asia to the Americas

RWAs aren’t a side bet, they’re becoming the foundation of modern finance. More next week.

19.66K

237

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.