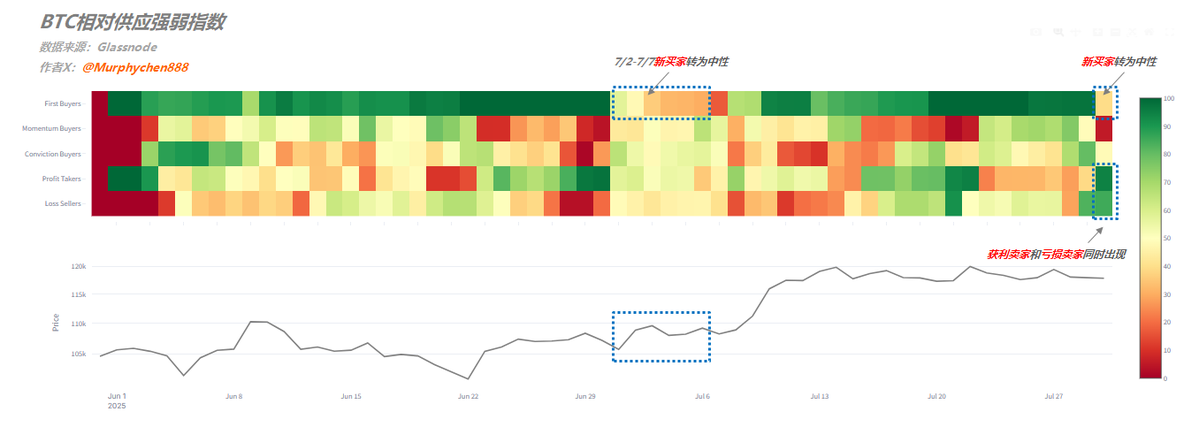

Market sentiment is cooling down, and data shows that current "new buyers" are shifting from positive to neutral (Figure 1). Looking at the historical data from this cycle, a decrease in the activity of new buyers does not necessarily mean a significant drop, but it usually does not lead to a strong bullish trend either; the probability of sideways consolidation is much higher. After all, the active buying behavior that has persisted from July 10 to July 28 for nearly half a month is bound to take a break.

Relevant data from the options market also corroborates this emotional observation. Since July 23, the 1-week and 1-month 25-delta skew has been continuously rising (Figure 2), indicating that the price of put options is becoming increasingly expensive compared to equivalent call options, as traders are betting on a potential short-term pullback.

However, I personally believe this is a necessary adjustment period for the market. The current chip structure is very healthy, and large holders are generally more inclined to accumulate rather than distribute. Therefore, the weakness is not a bear market; it is just that BTC's pace has slowed down a bit.

👇

👇

‼️ My sharing is for learning and communication purposes only and should not be considered as investment advice ‼️

-------------------------------------------------

This article is sponsored by #Bitget | @Bitget_zh

Show original

131.59K

110

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.