Your idle USDC is getting destroyed every single day.

Most people think stablecoins are "safe" because the price stays at $1.

But there’s a wealth killer that’s hiding in plain sight:

1/

Over the past 50 years, $100 has lost ~85% of its purchasing power.

And it’s not because of market volatility.

But because of inflation - the silent tax on all cash.

The Bureau of Labor Statistics tracks this via CPI. It measures price changes across 80,000+ items monthly.

2/

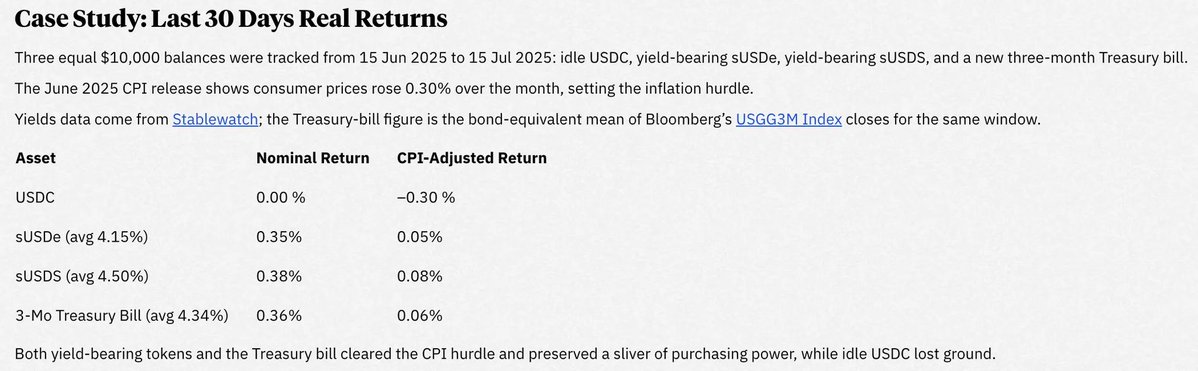

Here's what happened in June 2025:

CPI rose 0.30% in one month.

Idle USDC earned 0.00%.

Real return: -0.30%.

Your "stable" coin just became 0.3% less valuable in 30 days.

Multiply that by 12 months and you're looking at a serious loss.

3/

And it gets even worse when you understand how CPI is built.

Housing makes up 1/3 of the weight. Food, energy, medical care, transport - are all tracked monthly.

And, they update weights annually now.

Categories that spike in price get their weight reduced next year.

4/

Yield-bearing stablecoins have been fighting back:

sUSDe: +0.05% real return

sUSDS: +0.08% real return

3-month Treasury: +0.06% real return

Small numbers, but they're positive. Idle cash is guaranteed negative every single month CPI prints positive.

5/

"But what about deflation? Falling prices sound good"

Japan tried that experiment: 1995-2012.

Consumers stopped spending (why buy today if it's cheaper tomorrow?)

Economy stagnated for 20 years.

So now, central banks target 2% inflation to encourage spending.

6/

Three forces drive inflation:

Demand-pull: too much money chasing too few goods

Cost-push: supply shocks (oil embargos, shipping bottlenecks)

Monetary expansion: central banks printing money faster than economic growth.

7/

The Bretton Woods system (1944-1971) pegged dollars to gold at $35/ounce.

That constraint limited money printing and kept prices stable.

Nixon ended convertibility in 1971. Since then, no anchor. No limit on money supply growth.

Inflation became structural.

8/

So, with yield-bearing stables:

Real yield = nominal yield - inflation rate.

If Treasury bills pay 5% and CPI is 3%, real yield is 2%.

Negative real yield means your money is shrinking in purchasing power terms.

9/

To me, the choice is simple:

Money sitting at 0% = guaranteed real loss every month

Money earning yield = fighting chance to beat inflation

Even modest yields stayed ahead of CPI in our 30-day test.

Your idle USDC isn't "safe money". It's slowly melting money...

10/

Anyways, full breakdown and more details at

Will be sharing more on stables, so follow along if this is useful.

4.67K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.