Market Outlook

Press like or else

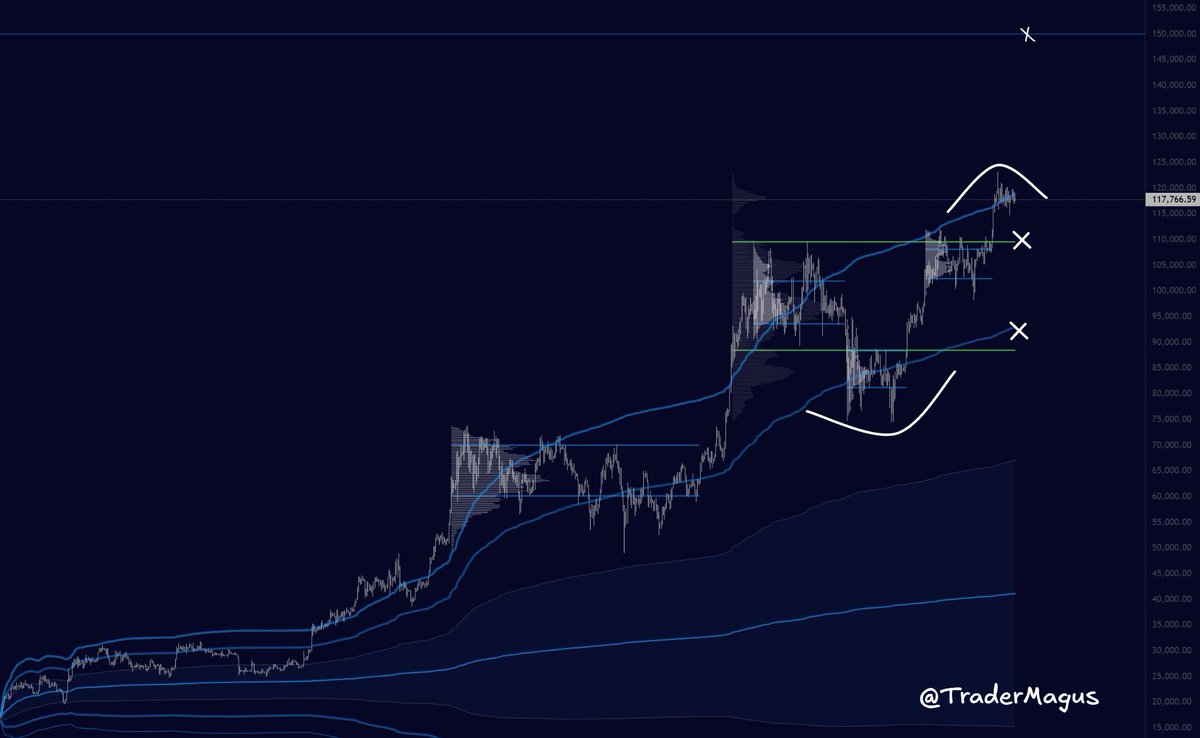

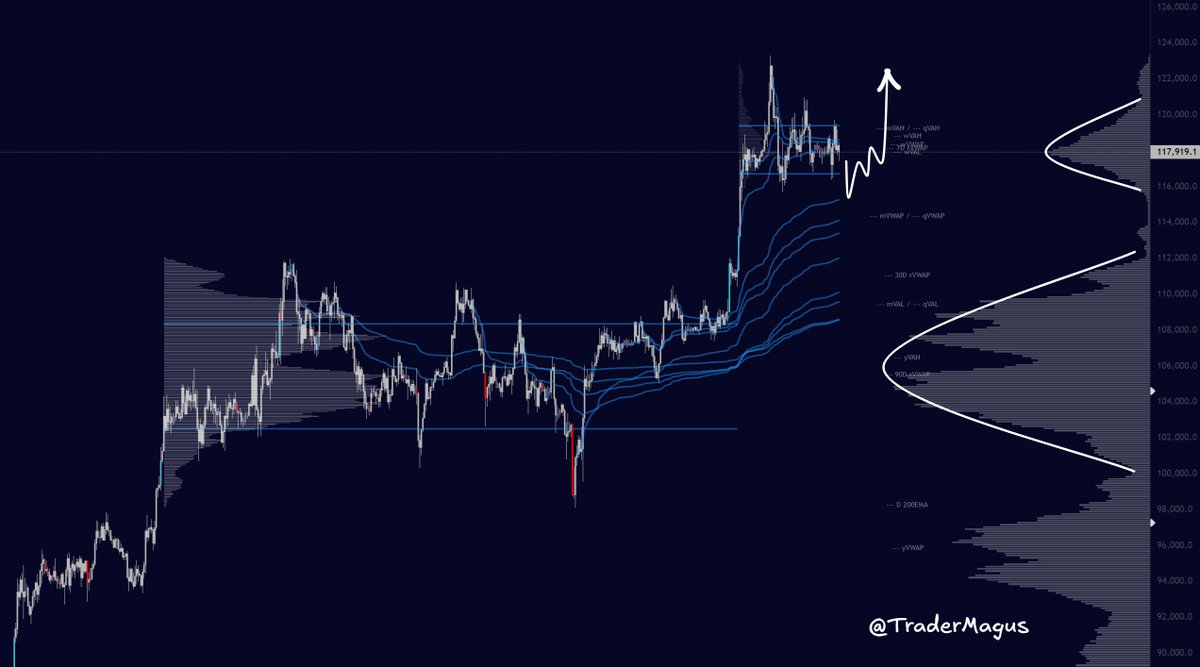

Macro: Strong up trend; Fuck you higher

Medium Term: Strong impulse outside of eight month range. Building value between 119.3k & 117k. hunting for next impulse higher

Short Term: Monitoring the new range under 120k closely. 115k single prints must hold for continuation

Macro Levels: 115k is support with 110k macro support; 120k is final boss resistance now to see the trend spark towards 150k

New meta buying pressure: The boomer arms race I mentioned last year is well underway with ETFs & Treasury Companies

Macro:

Fuck you higher

If we lose 115k go short term risk off with eyes on 110k & 90k as buy the dip zones

I don't expect BTC to trade down much before higher in Q4

Buying 90s in Q3 would be the ultimate gift but I don't think you'll get the chance

If we see a larger sell off, 110k is the most obvious zone(so expect some frontrunning)

Levels:

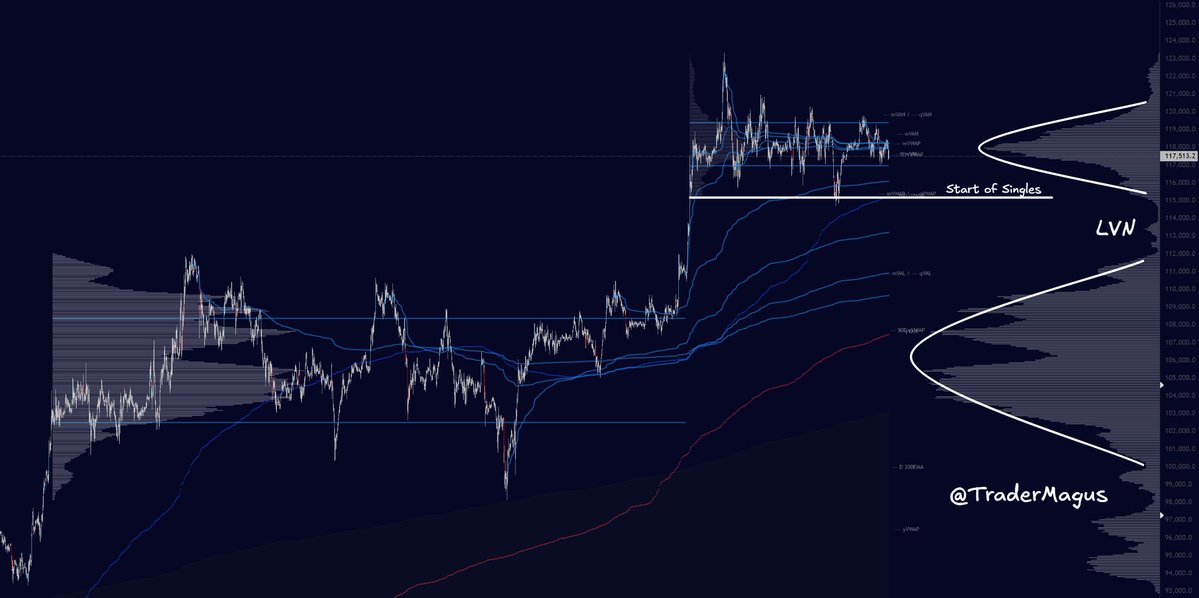

Medium Term:

Building fresh value just under macro resistance

Singles + LVN region must hold as support

Per last outlook 115k was the bid zone

Local momentum is weak so we need a spark to ignite impulse now

Closing Thoughts:

Slow & steady wins the race

Don't get baited into going all in on shitcoins until after BTC had had a strong impulse over 120k(I might cook altcoin outlook this week)

Until then I will sit mostly in BTC

Alt season will come but only after the king has paved the way

Let the boomers do the hard work and lift price

Pessimists sound smart

Optimists make money

Choose optimism

See you at 150k in Nov.

Thanks everyone for reading & big shoutout to @coinbasetraders for sponsoring my content

Press like & rt if you want me to keep making these

previous outlook post

Market Outlook

Stop and press like you criminal

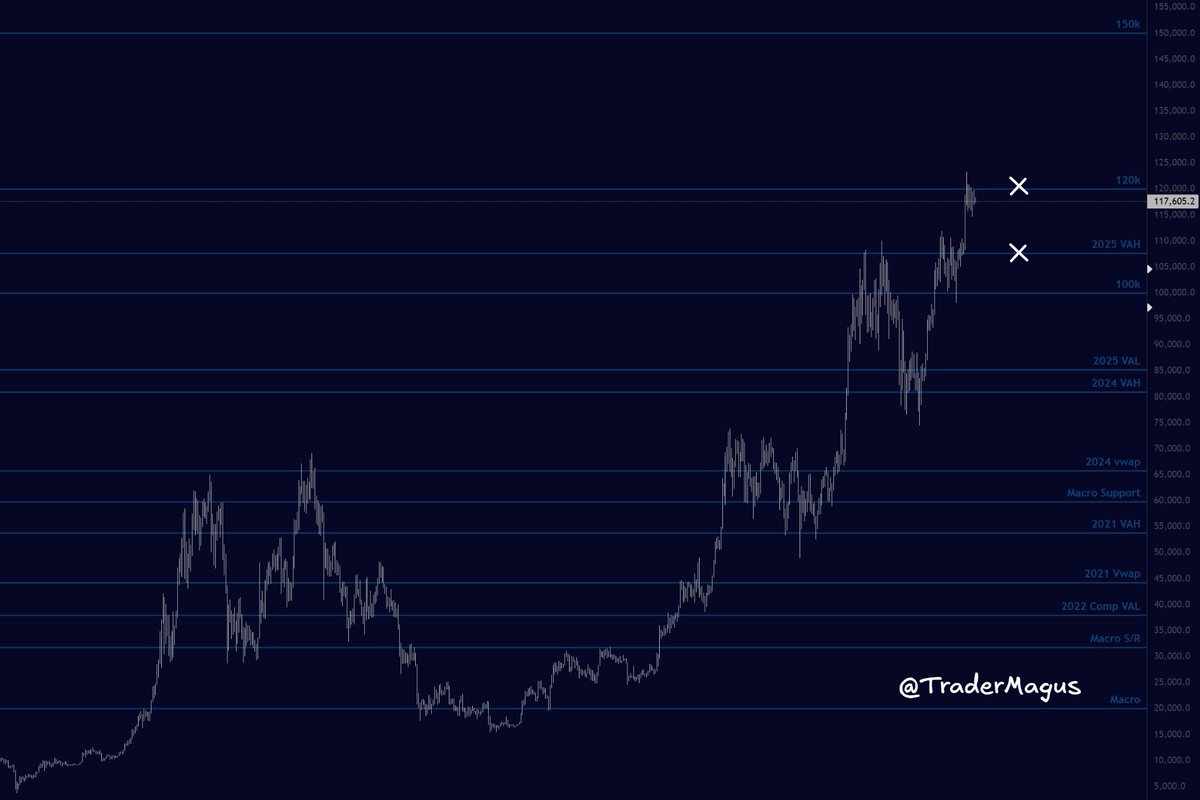

Macro: Strong up trend; Fuck you higher

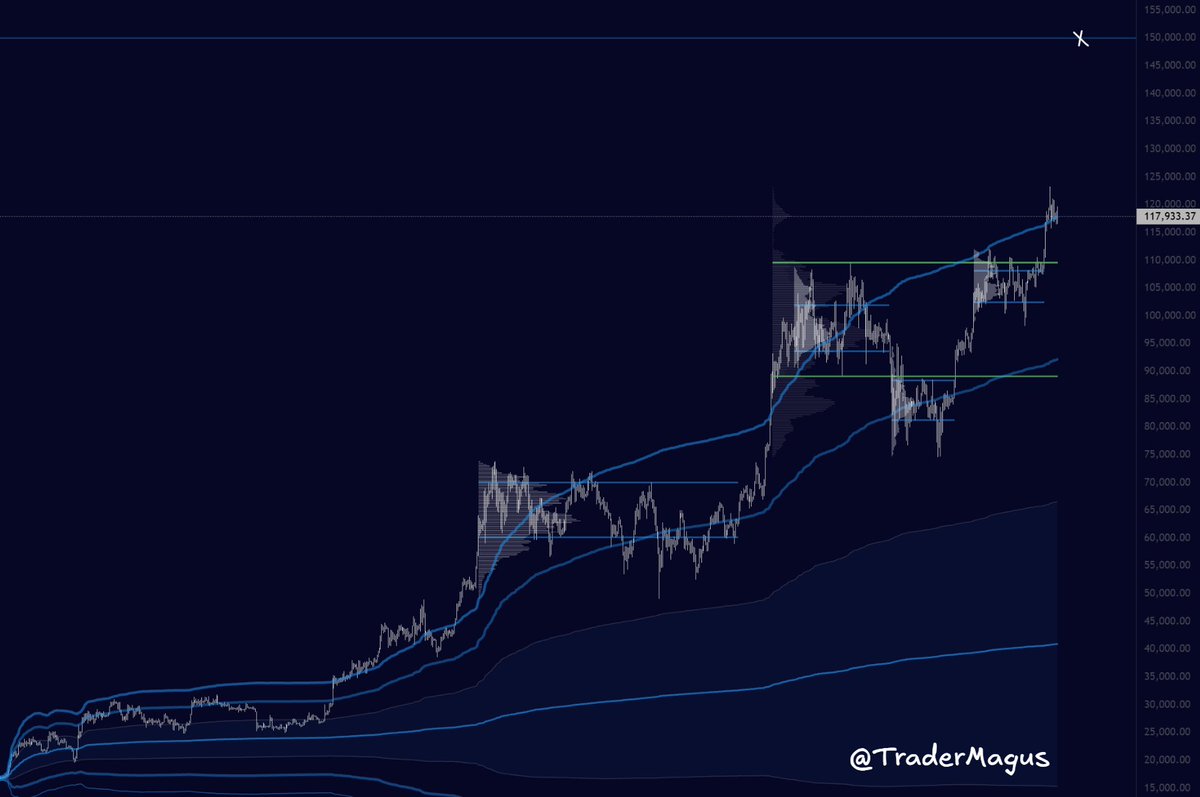

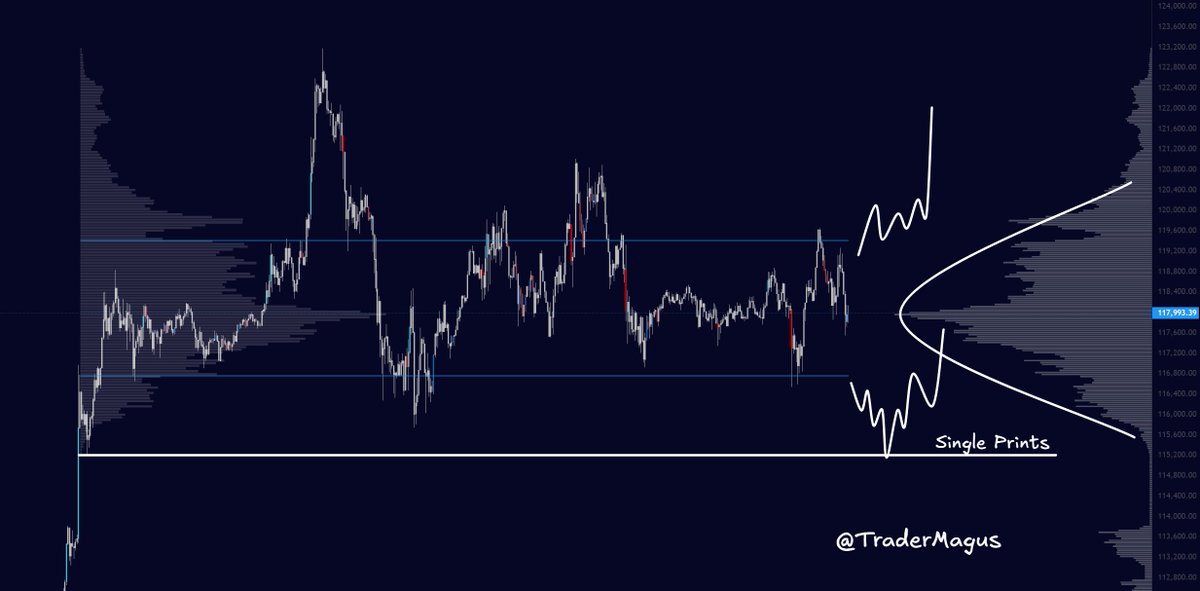

Medium Term: Strong impulse outside of eight month range. Looking for breakout candle to hold as support to trade up again

Short Term: Building new range between 116.7 & 119.4k, longing range low sweeps until we breakout above 120k

Macro Levels: 115k is support; 120k is resistance, above this we have 150k

Buying pressure: The boomer arms race I mentioned last year is well underway from ETFS & Treasury Companies

Positioning: BTC core, L1s & Memes(Doge, Fart, Bonk & Pepe)

Macro:

Strong macro trend

Broke out of eight month range, looking for price to hold above 115k for continuation to 150k

Medium:

Medium timeframe momentum is strong, shallow dips are for buying

All vwaps say bet on higher

Should see next drive upwards soon

Lose 115k and I go back to defense

Local Range:

Many are praying for 115k sweep

If we are truly strong we will likely leave this behind untested

One day a flush will come and Ill just buy more

Closing Thoughts:

Macro plans are slowly unfolding

For years we waited for the institutionalization of the space and now its here

We now have the buying force of all these ETFS + Treasury companies. The only thing left is the SBR

I think this is the last large growth wave for crypto, after this will be just another asset class

I'm forever grateful to the space

I'll share altcoin outlook next if you run up the likes on this post

Thanks friends

45.06K

451

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.