$ETH is up 60% this month and this might just be the catch-up rally to $BTC

– On-chain activity is at 2021 levels

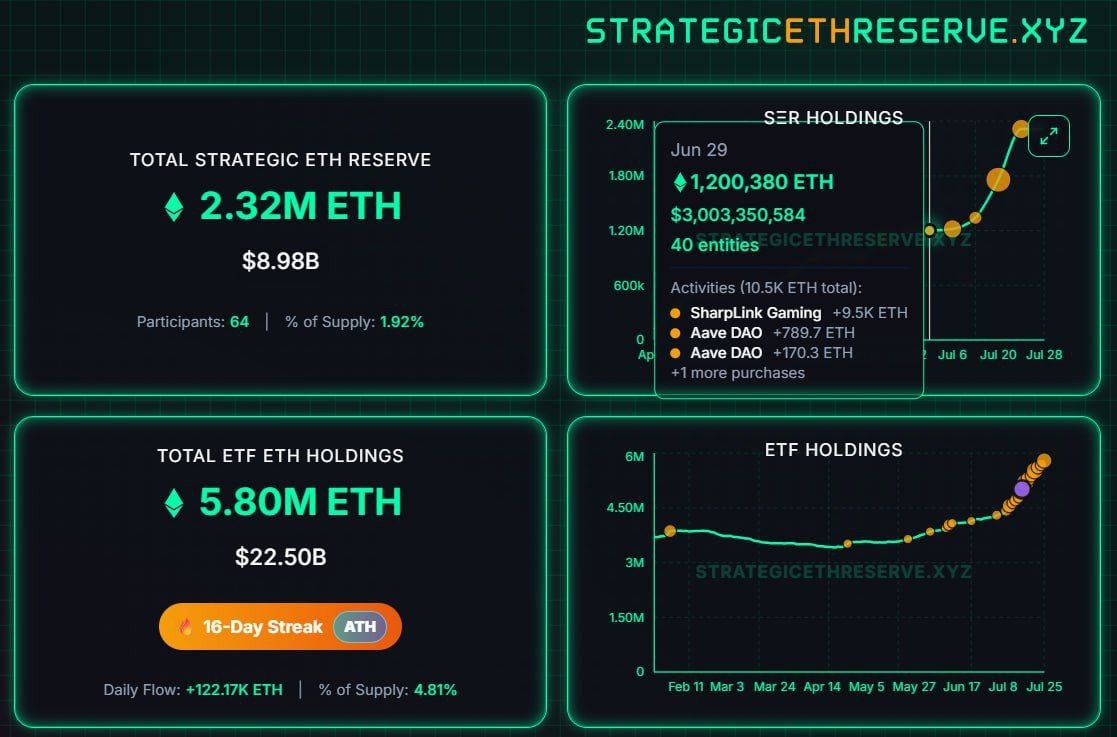

– ETFs & public companies buying millions

– ETH/BTC golden cross forming

– Shorts getting wiped

$BTC 3x'd off the same catalysts.. can ETH follow & hit $10K ? 🧵👇

2/

In the past few months, I have consistently said that ETH hated rally is coming.

This month, ETH is up 60% which means my thesis is playing out perfectly.

3/

But this could just be a start

$ETH has a lot of bullish catalysts aligning together which could send it above $10K this cycle.

If you just watched BTC going from $40K to $120K, ETH is your best chance.

Let me show you why ETH is primed for even bigger rally.

4/

➔ 1) Network Activity:

Ethereum's user base is fading away. No one will use Ethereum in the future.

When ETH was at its bottom, we heard these statements about Ethereum.

5/

So, let's see how Ethereum network activity is going right now.

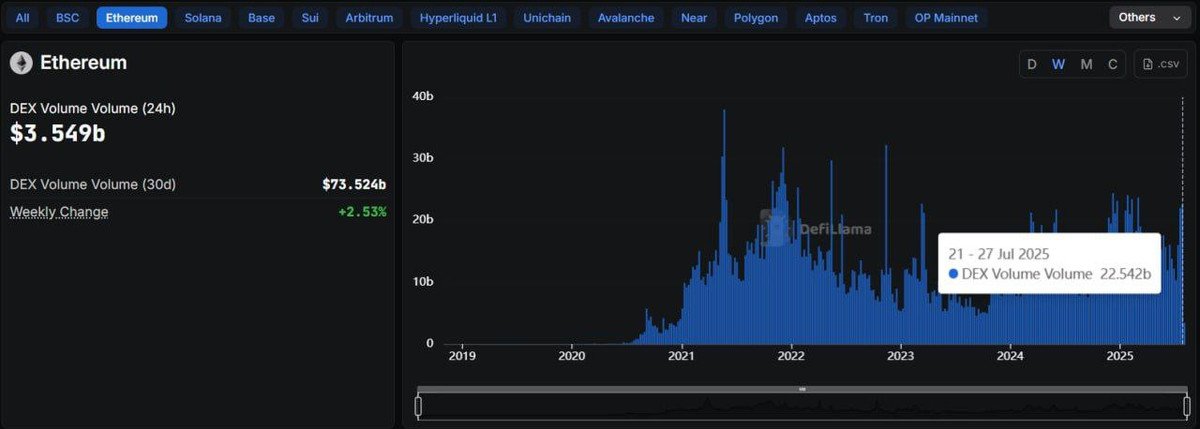

DEX+Perps Volume:

Last week, Ethereum weekly DEX volume hit 22.45B, its highest level since Feb 2025.

Also, Ethereum daily DEX volume surpassed Solana for the first time in months.

6/

Talking about perps volume, weekly perps volume reached a 14-months high of $13.28 billion.

Ethereum also overtakes Solana and BNB Chain to become the #2 chain by perps volume.

Stablecoin Growth:

This month, stablecoin supply on Ethereum grew by $6.34 billion.

7/

In July, total stablecoin MCap went up by $10B and 63.4% of that were minted on Ethereum only.

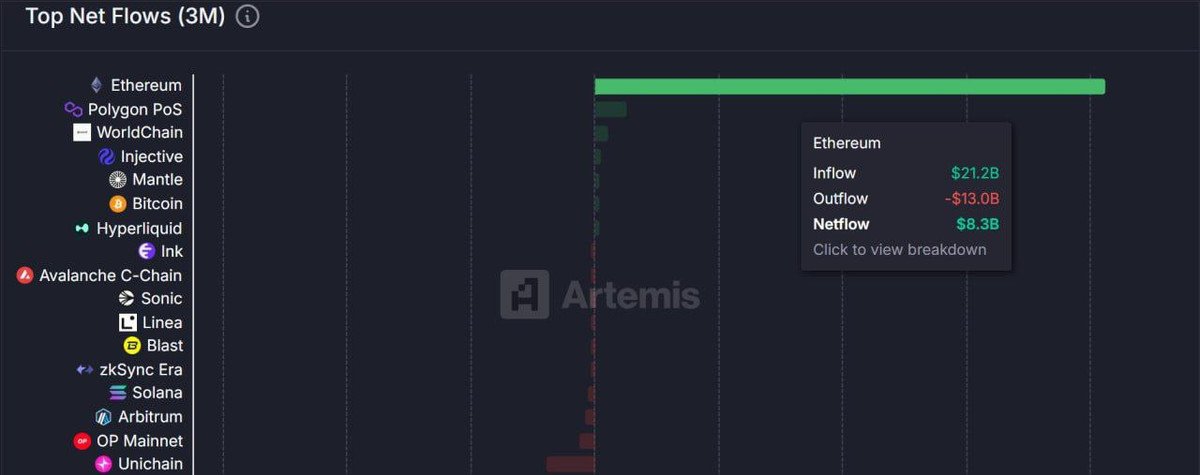

Total Inflows:

This month, Ethereum had a netflow of $2.9 billion.

Talking about the past 3 months, Ethereum netflow stands at $8.3 billion which is more than all the chains combined.

8/

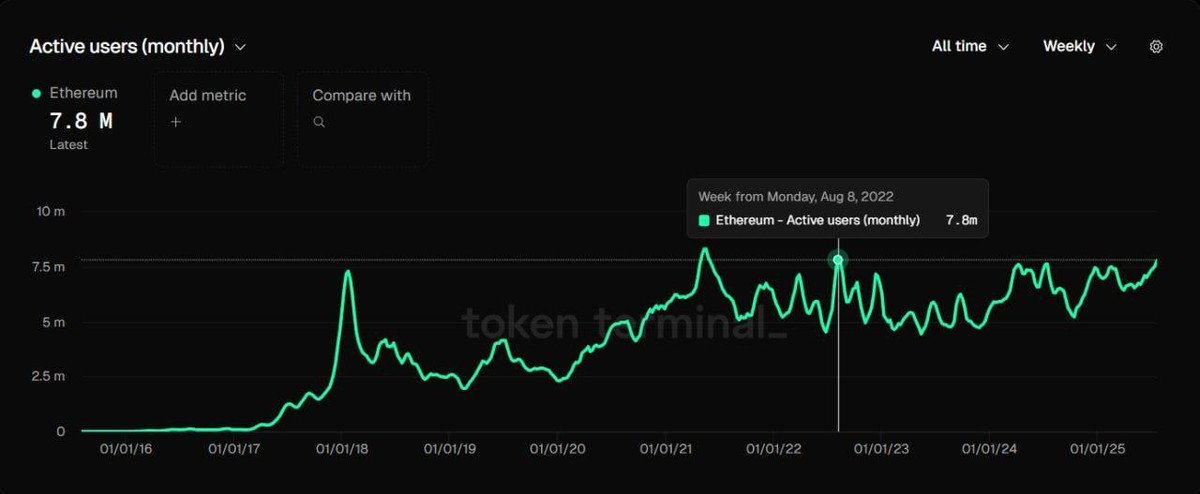

Transactions+Users:

In July, Ethereum monthly active users reached a 3-yr high of 7.8M

Weekly transaction count reached its highest level ever with 11.1 million

Meanwhile, average transaction fee dropped below 50 cents.

9/

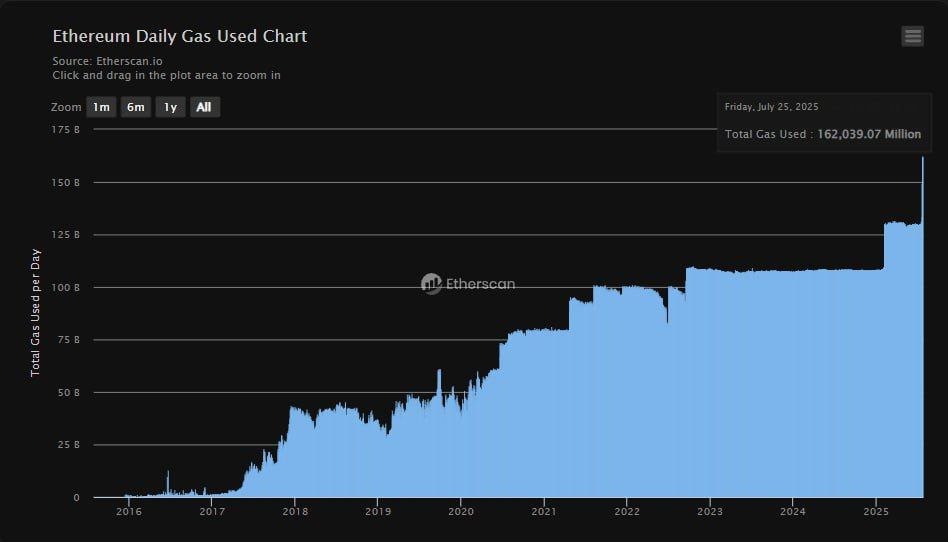

If that's not enough, here's something else too.

This week, Ethereum gas usage hit its highest level ever.

Ethereum is now doing network activity at the levels not seen since 2021, and it's still trading below $4K.

10/

➔ 2) Institutional flows:

July has been a record-breaking month for ETH in terms of institutional inflows.

This month, ETFs have bought 1.56M ETH which is almost 1.3% of total supply.

Public-listed companies have bought 1.1M ETH, accounting for 0.9% of total supply.

11/

And this is not the end.

This month, BlackRock filed for Ethereum staking and this could be approved in Q3.

Also, SharpLink Gaming, BitDigital etc. are raising more cash to buy ETH.

But, there's more to it.

13/

➔ 3) ETH/BTC Golden Cross:

ETH/BTC is approaching a weekly golden cross for the first time in 2025.

This month, ETH/BTC weekly RSI broke out of its 3-yr downtrend which is a major sign of strength.

Unlike death cross which is a lagging indicator, big pumps usually happen after golden cross.

14/

This means liquidity is about to flow from BTC into ETH.

You could also see this from last week ETF inflows as ETH inflows were substantially higher than BTC on several days.

Along with that, some old whales are also offloading their BTC, and maybe they're rotating into ETH.

15/

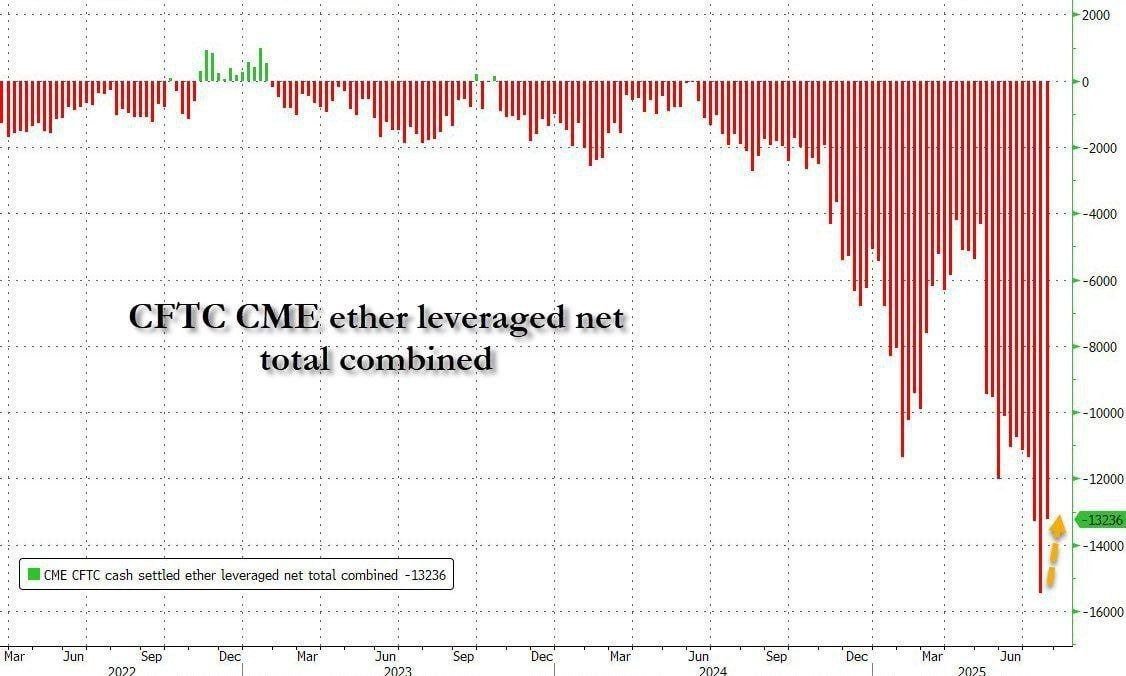

➔ 4) Shorts closing:

Last month, CME ETH shorts reached its highest level.

Since then, ETH is up nearly 60% and short positions are being closed.

But this is just the start.

16/

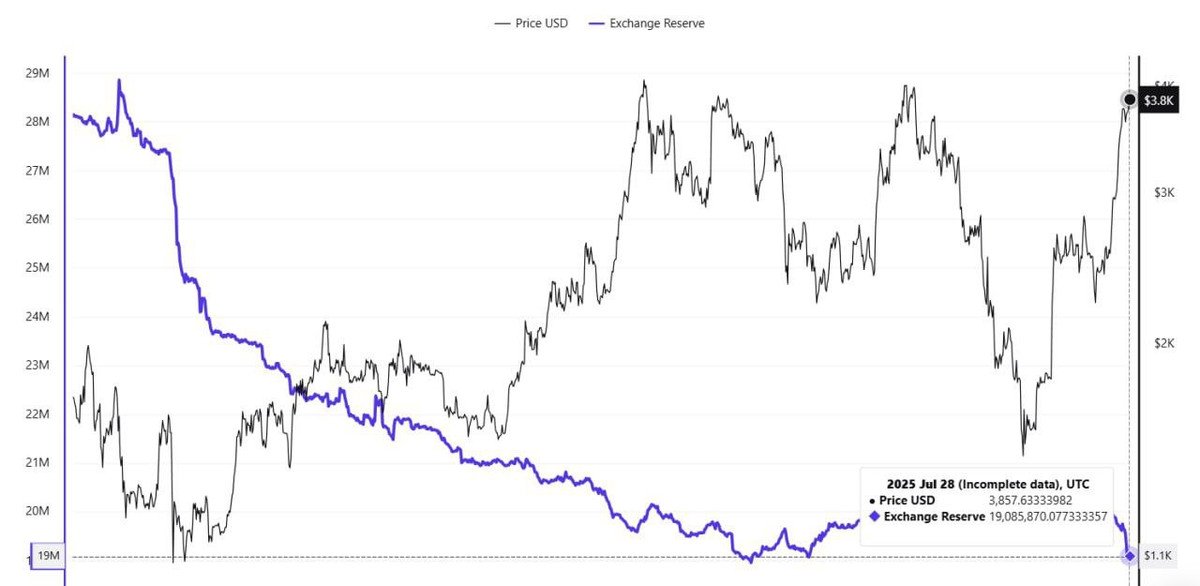

ETH supply crunch is about to hit, and this'll make ETH price go parabolic.

Nearly 16% of ETH supply is on exchanges, while the OTC desks are running out of ETH.

30% ETH has been locked for staking, 25% are in the hands of long-term holders, 7% are held by ETFs and companies, 5% has been lost forever.

With ETFs and companies buying 2%-3% of total ETH supply each month, supply crunch is just a matter of time.

17/

And what'll happen when ETH goes up?

Short-squeeze and even higher prices as short-sellers will be forced to buy back ETH to cover their positions.

If the pump is fast enough, we could even see GME 2021 repeat.

And with all these factors, $10K ETH will become a reality.

18/

➔ My Final Thoughts:

Everyone knows that I'm an ETH bull, and I was even bullish when it went below $1,400.

And now for the first time in 1-1.5 years, everything is aligning together to send ETH higher.

I wouldn't comment on 1-2 weeks of price action, but in 4-6 months; ETH will be trading way higher.

Just don't take high leverage trades and you'll be fine.

That's a wrap!

Got any questions about this thread? Drop them in the comments, and I'll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I'd really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉

I hope this thread brought you some value!

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

38.85K

147

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.