▶️ Bybit is just the stage, the main character is the user – The Evolution of TradFi Official

Yesterday, I conveyed the content of Ben Zhou's past interview, introducing that Bybit's recent expansion into TradFi is not just an experiment but a clear vision and a designed strategy. In particular, looking at the interview with CEO Ben Zhou, it was evident that Bybit, which started simply with derivatives, is executing a user-centric expansion roadmap across all areas, including Spot, TradFi, and xStocks.

To implement this, Ben Zhou mentioned the importance of building a user-centric fast system, which I also emphasized in my post.

(For the full text, please refer to the attached post below)

▶️ Strategic Three-Stage Plan for Liquidity and Expansion

1. Removing Barriers to Entry through Spot and TradFi

Ben Zhou mentioned in the interview that "only 5% of Bybit's early users used derivatives." This was a realistic judgment that more user inflow necessitated strengthening the ❗️ Spot and TradFi asset classes, and subsequently, hiring talents from Huobi to quickly establish the Spot system was likely part of that strategy.

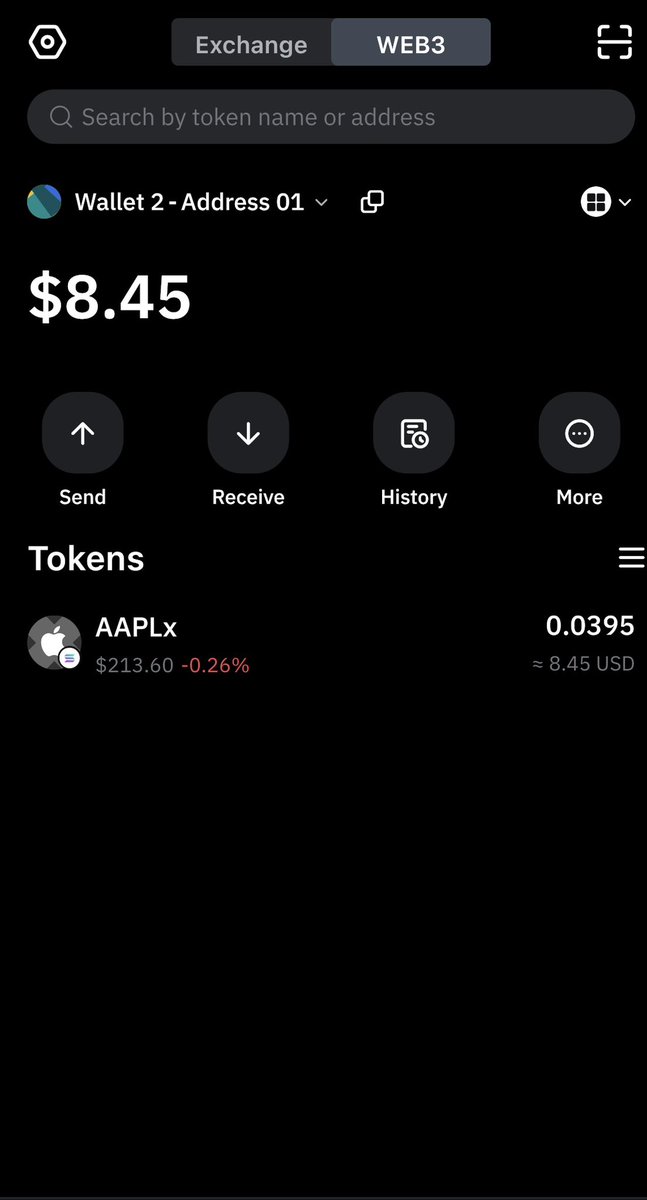

→ And now, we are witnessing the actual use of tokenized assets like AAPLx and TSLAx on Bybit @Bybit_Official.

2. "Road Builder" Strategy

Ben Zhou @benbybit stated that Bybit provides the stage, but the main character is not the exchange but the users, and thus aims for a community-centered ecosystem platform. In fact, his philosophy became clearer in collaborations with xStocksFi @xStocksFi and KaitoAI @KaitoAI.

As a real user, live feedback is extremely valuable for Bybit to further expand into areas like TradFi, which are still unfamiliar to crypto users.

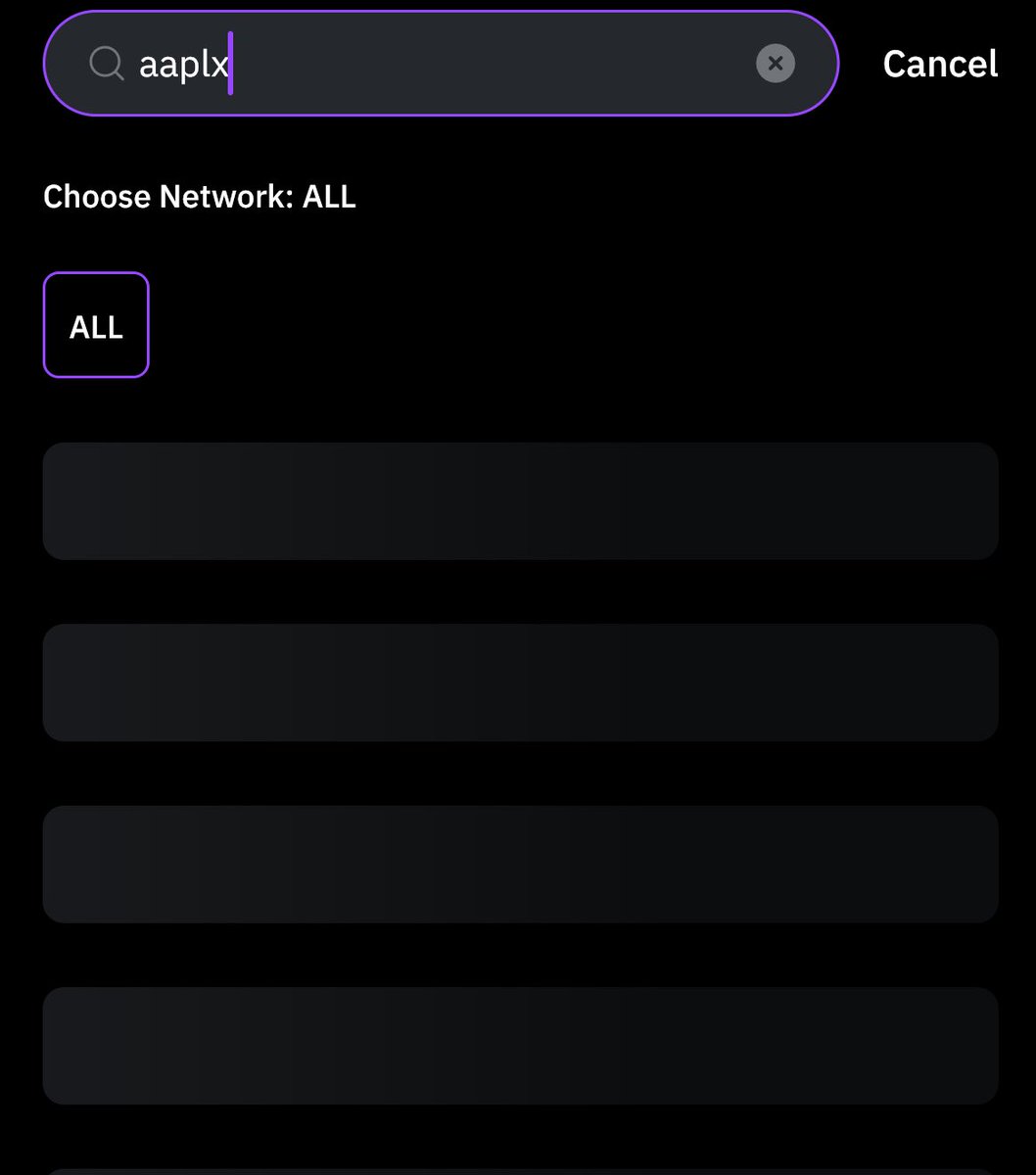

Recently, Bybit user @tm_uchal shared a case of utilizing AAPLx connected to DeFi based on real TradFi usage experience, and during this process, also provided direct improvement suggestions.

1⃣ Missing AAPLx search in Web3 wallet

2⃣ Absence of direct swap function from USDC to xStocks, etc.

Such specific user feedback is the key that enables the "Road Builder" strategy to be realized by users.

▶️ In Conclusion

I believe that Ben's interview did not merely sketch a plausible vision, but that it is actually in the process of being executed according to his roadmap. And now, the community is actively using, experimenting, proposing, and spreading that roadmap. I think this is the true value of Inforfi.

✅ User suggestions drive platform improvements,

✅ Technical infrastructure handles complex asset flows,

✅ A virtuous cycle is established where tokenized stocks and DeFi are actually connected.

If this happens, Bybit will evolve from being "just talk about TradFi" to executing TradFi.

▶️ What are the essential conditions for Bybit's success in TradFi?

1. To actually implement a variety of asset choices

2. To reflect user feedback in real-time product improvements

3. To focus on improving Web3-centric UX and removing barriers to entry

4. To further strengthen technical infrastructure to establish trust

TradFi is not just about placing financial products on the blockchain. It is about designing an experience that users "want to use" and reflecting their voices as "features." If this practice continues, Bybit will be the first to seize the true future of TradFi.

TradFi, CFD with xStocksFi looking great on Bybit

✅ xStocksFi looking great on Bybit

✅ Real equities, tokenized & composable

✅ 24/7 stocks on-chain, Web3-native

✅ TradFi collateral meets DeFi utility.

Hello Bybit Team,

I'm tm_uchal, currently the #1 Korean user on the 7-day Bybit TradFi Yapping leaderboard.

@Bybit_Official x @xStocksFi

I actively explore various Bybit TradFi features and share practical insights based on direct usage to help the broader community better understand and utilize the platform.

Recently, I conducted an experiment by purchasing AAPLx via xStocks and utilizing it within DeFi protocols. I was particularly impressed that the Bybit Web3 Wallet supports the Solana chain, enabling seamless interaction with platforms like Kamino and Raydium — all without requiring an external wallet. It's a well-designed and highly promising structure.

However, I would like to suggest a few improvements that could further enhance the user experience:

1️⃣AAPLx token not appearing in the Web3 Wallet search

→ Although the asset is successfully received and usable, it does not show up in the wallet search results. This could cause confusion, especially for first-time users.

2️⃣The need for a direct USDC → xStocks swap feature within the Web3 Wallet

→ Currently, users must go through several steps: manually purchasing AAPLx on the exchange, transferring it to the Web3 wallet, and then deploying it on DeFi protocols like Kamino.

→ If a direct swap feature from USDC to xStocks tokens within the Web3 wallet were implemented, it would significantly streamline the process and allow users to enter DeFi strategies more intuitively and efficiently.

→ This would further solidify Bybit TradFi’s position as a complete infrastructure bridging tokenized traditional assets with DeFi.

Bybit TradFi is already innovative, but with these improvements, I believe it can become the most seamless and powerful investment route between traditional finance and DeFi.

If these features are currently in development or being considered, I would be excited to see them launched soon.

The future of TradFi starts with Bybit.

Thank you!

5.86K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.