1/3 Thoughts on $PUMP

PUMP trade feels like a good setup, but token price action, driven by incessant selling from ICO participants, paired with retreating fundamentals, and value leakage to comps (bonk, jupiter, raydium) has created a down only chart. This down only chart has burned a lot of the believers, and hence, it is difficult to see who the next marginal buyer will be.

2/3

To make an investment case for PUMP, you have to believe three things:

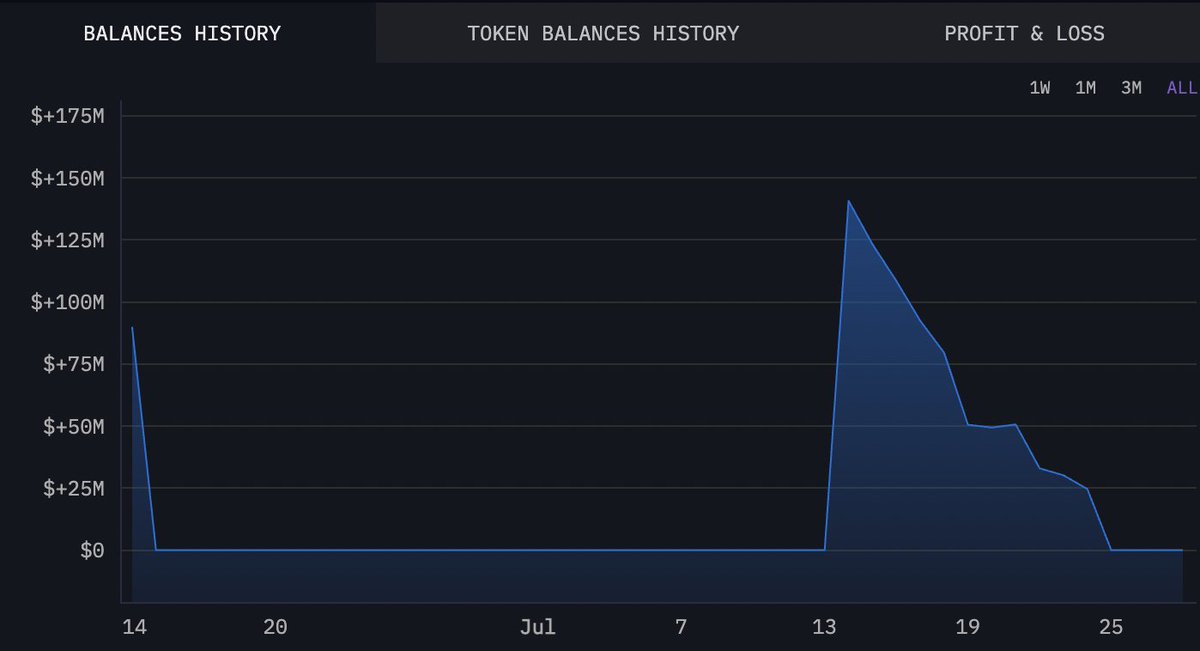

1. Price action is more a reflection of flows than it is of mkt share and value leakage to comps. The first 3 weeks was net selling pressure created by private sale participants.

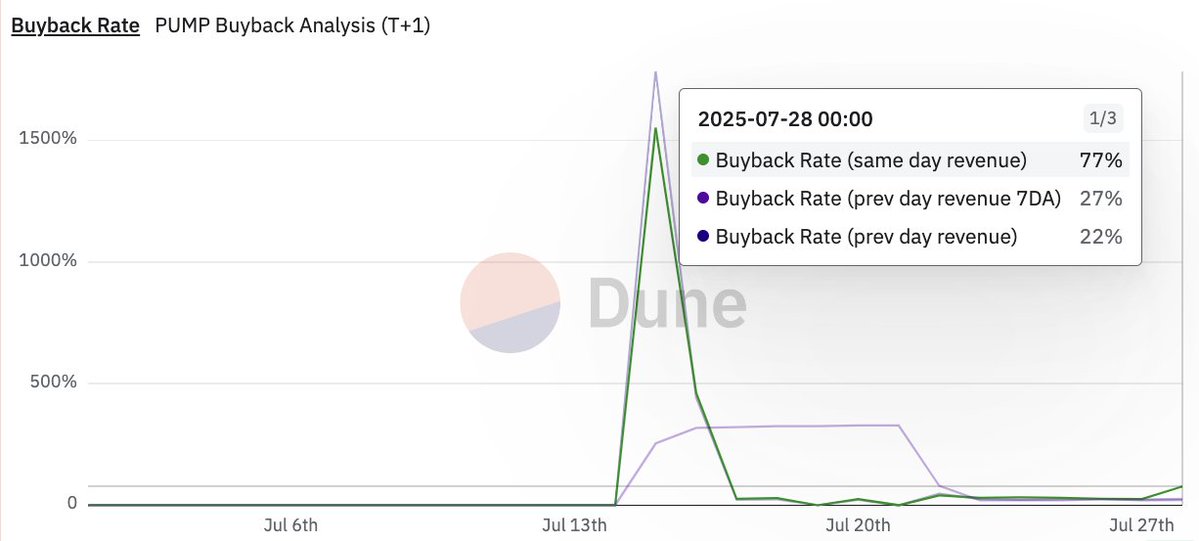

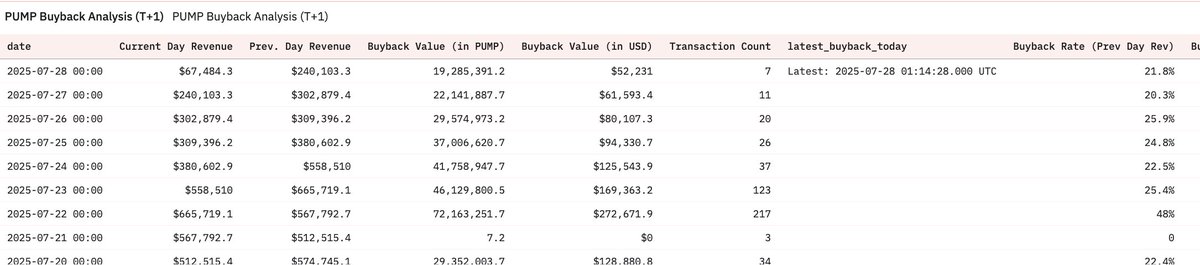

2. The marginal buyer of the token will be buybacks. If you believe these buybacks can scale effectively in the wake of dwindling market share, then there's likely an opportunity here.

3. Market share volatility is only a temporary concern.

3/3

Things we know:

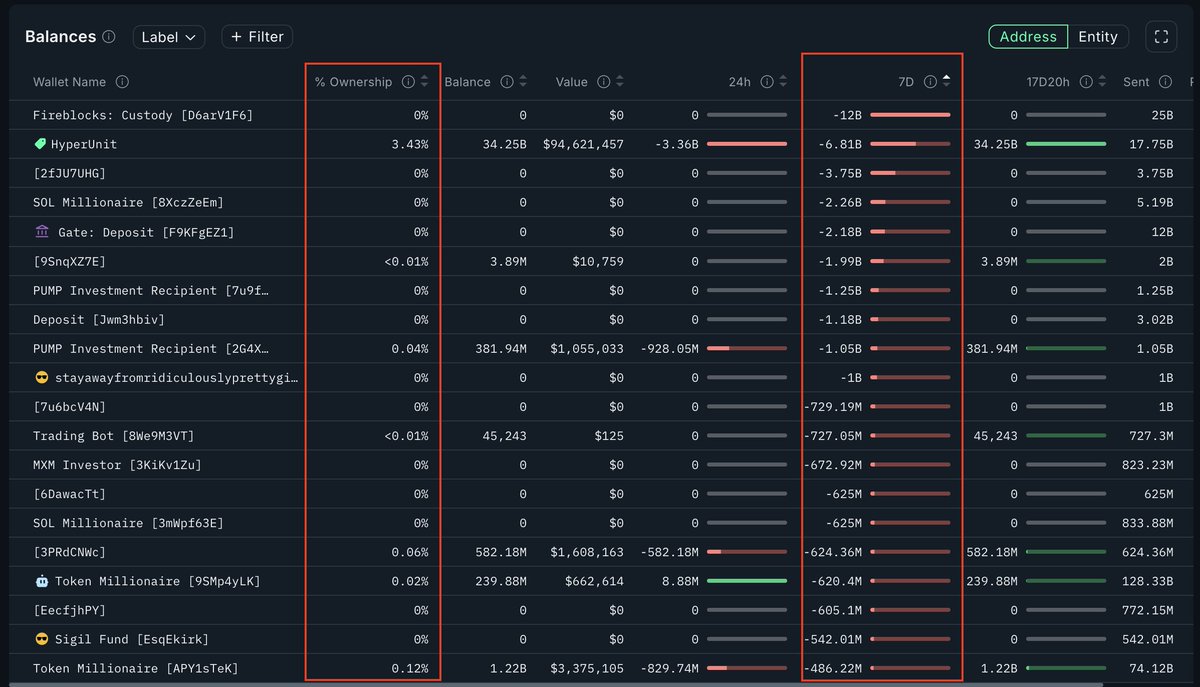

- Onchain data tells us that those that had to sell, have likely sold almost all of their tokens. (Largest pvt. sale participant's PUMP holdings chart below)

- There's rumours of a volume incentive program - if true, this could boost volumes, fees and buybacks. This could easily boost volumes 2-3x, which boosts buybacks 2-3x. If they start to win back mkt. share, sentiment starts to improve, demand starts to arise.

- If they earn ~$4 in fees for every $1 in PUMP spent, this program will be *extremely* successful.

- Buybacks operating at ~22% to 25% of total fees, absolute fees still ~$500k/day

- 12 month run-rate revenues still over $270M (trading at ~10x P/E to this)

- Balance sheet with close to $2B in cash

12.13K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.