A ninja cat riding a mech dino in full @INJECTIVE armor, smashing through the stone wall of Monday Blues and tokenized stocks

Scroll in hand: Gasless Perps & Orderbooks

This is the gwei

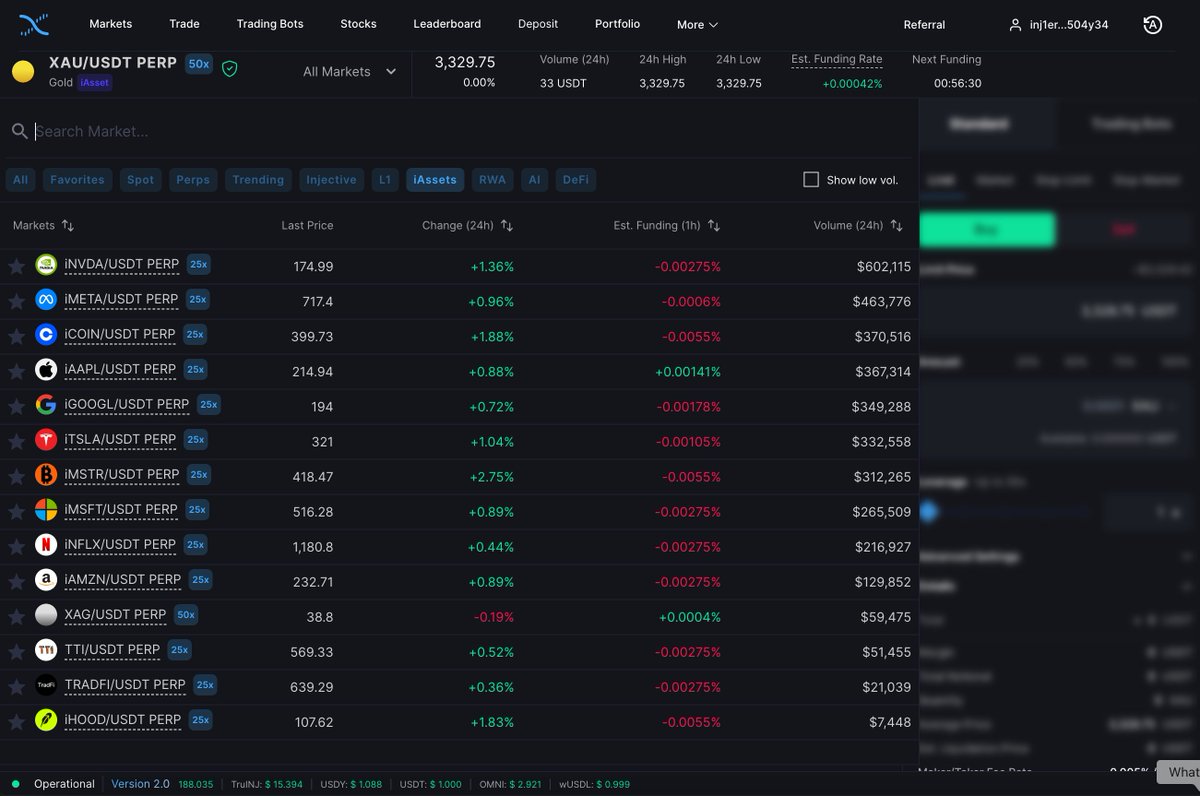

Onchain orderbooks

bEVM live

Real dApps, real usage

Built different

Built for traders

Play to Its Strength: Multi-Sector Dominance

Hyperliquid is all-in on perps, just started spot. @Injective, on the other hand, is quietly building across:

+ RWAs – e.g., tokenized equity via SharpLink on-chain.

+ AI – powering prediction markets and LLM-based agents.

+ Lending/DeFi – native money markets with custom asset support.

+ more tokenized stocks too!

What’s missing? Bundling it. Injective could build hybrid products (e.g., AI-predicted RWAs with perpetual hedging baked in).

That’s something Hyperliquid can’t match, yet. (3/6)

4.01K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.