The ZK Endgame: Boundless vs. Succinct

ZK season is upon us, and the ZK infra market is projected to grow to >$10B by 2030. Meanwhile, Boundless and Succinct are shaping up to be the proving dominators.

What many fail to understand tho, is that while similar, they are different.

Let me unpack this ↓

Boundless: The "Uber for ZK Compute"

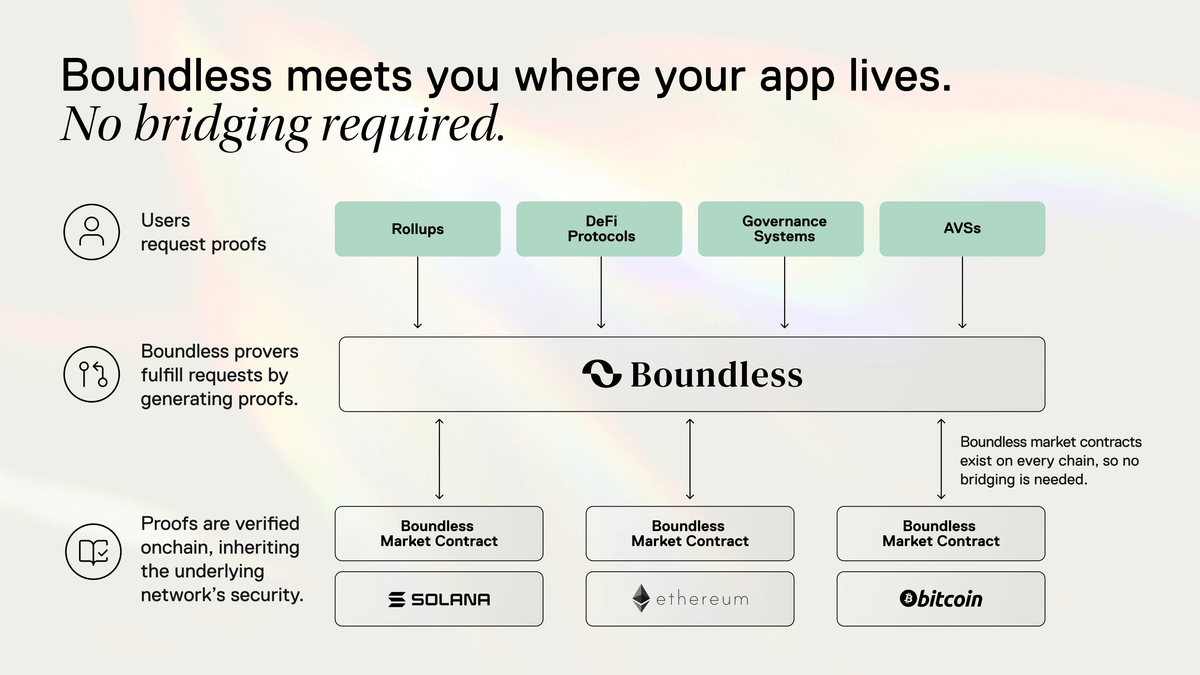

- Execution Model: Provides a universal marketplace where jobs are posted onchain (possible on any chain without bridging, which is a key differentiator), reverse Dutch auctions, and Proof of Verifiable Work (PoVW) to create a competitive marketplace connecting proof requestors and provers, while rewarding the latter based on the actual compute cycles they perform. Boundless uses a three-layer architecture: Bento (local proving), Broker (market interface), and on-chain settlement.

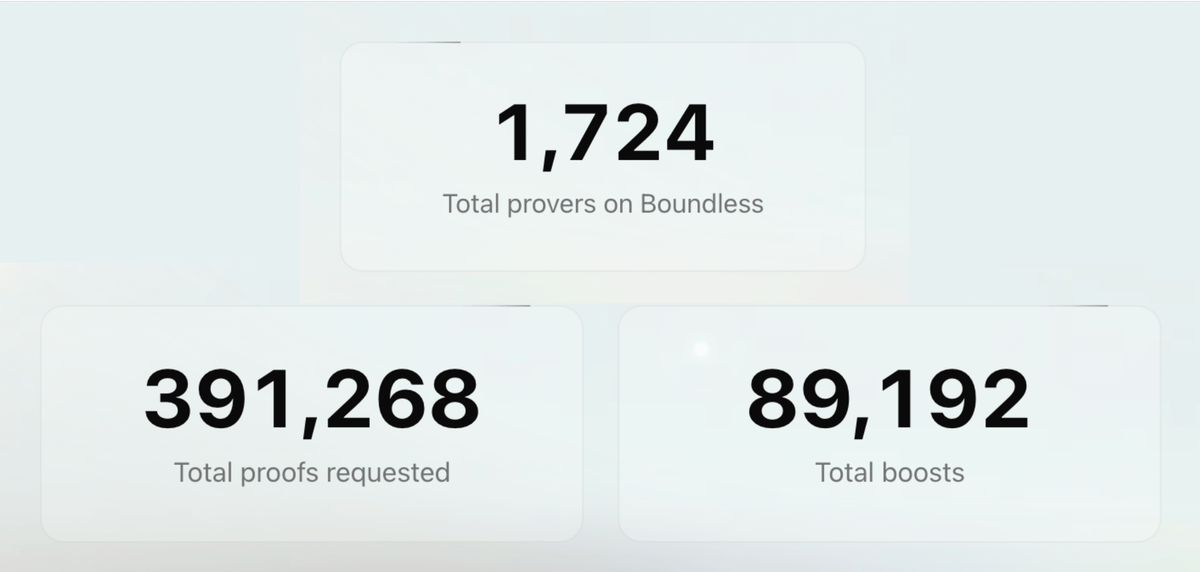

- Performance & Adoption: Open proving marketplace that powers the R0 zkVM (based on RISC-V) by RiscZero, which reduces proving costs from thousands to just a few dollars, and produces proofs 7x smaller than SP1 (Succinct's zkVM), making ideal for onchain verification and smaller workloads. Boundless already has >1,700 provers live on mainnet beta and >391k proofs requested from "The Signal" (ZK state proofs for interop public good) alone.

Succinct: The High-Performance Developer Platform

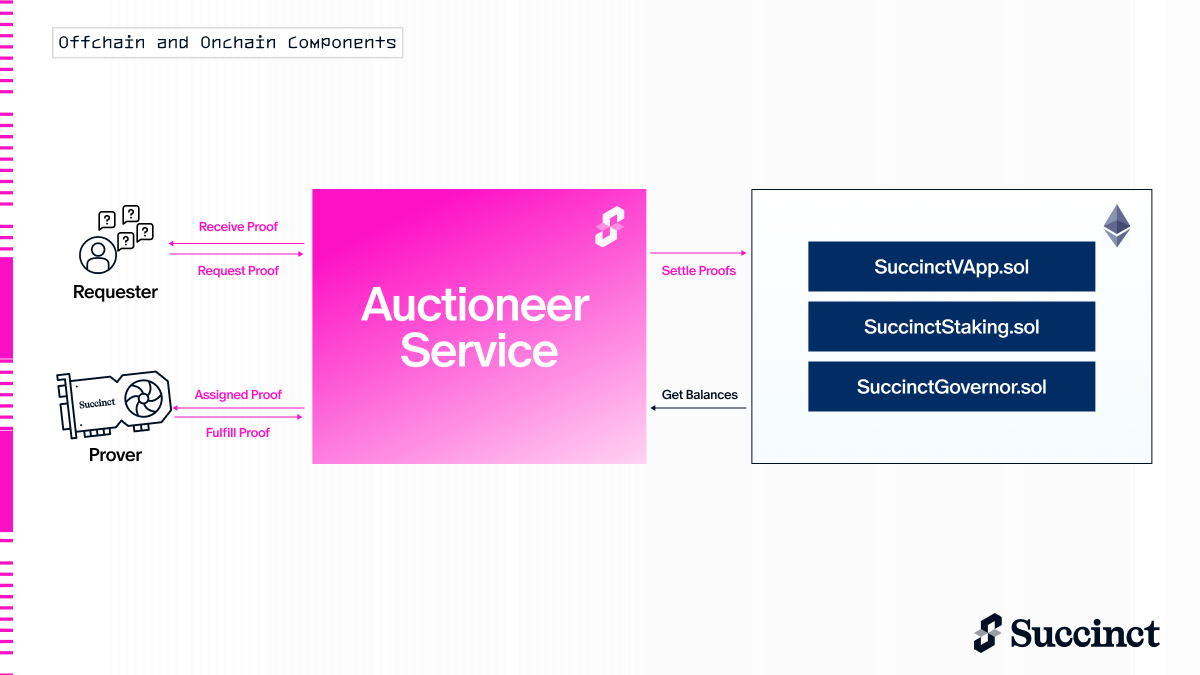

- Execution Model: Lean, high-performance network acting as an "API for ZK proofs", powered by its SP1 zkVM (also based on RISC-V) and a fast offchain auctioneer to match/assign one prover per job, optimizing for low latency, and allowing devs to generate proofs from standard Rust code that are subsequently verified onchain (on Ethereum). Succinct runs SP1 through either local proving or their hosted prover network API.

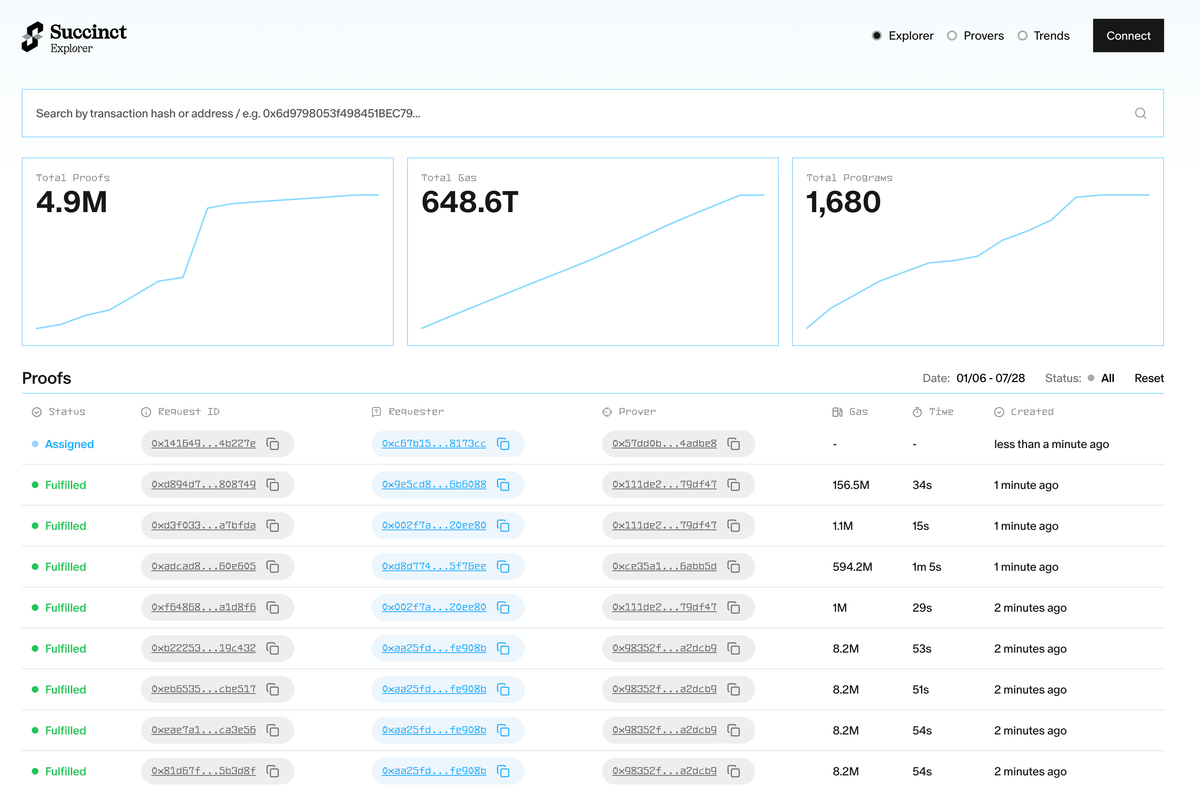

- Performance & Adoption: SP1's high-performance prover network excels at complex cryptographic operations due to its precompile architecture. It is fully production-ready and for example reduces a >2h Tendermint proof to only a matter of minutes. The prover networks has already generated close to 5M proofs with 99.9%+ uptime, and hosting >1,600 programs.

What's the key takeaways?

While both ultimately strive to make ZK proving more efficient and widely accessible to builders, they take a distinct approach to that mission on a technical level.

Boundless for example is more of an open network, where any prover can compute offchain while all proofs are submitted onchain, and with market contracts across all major ecosystems/chains. Meanwhile PoVW ensures metered prover rewards based on actual computation performed.

It is also proof system agnostic infra, and as a permissionless marketplace, aims to be the one-stop shop for all verifiable compute and proving needs (beyond powering the full RiscZero ZK product suite incl. the R0 zkVM, Kailua, its Steel co-processor, etc. or more recently "The Signal" by Boundless). In its entirety, the RiscZero ecosystem around Boundless provides a full-stack ZK dev solution.

On Succinct's prover network on the other hand, it's the network's auctioneer system that finds cheapest prover in real-time, with a single prover winning the job, and subsequent onchain verification of the delivered proof, with the onchain components living on Ethereum.

It is specifically focused on powering SP1, Succinct's high-performance zkVM, and the dev tooling around it. A lot of Succinct's current adoption stems from "ZKfiyng" rollups with its OP Succinct framework or powering ZK appchains (e.g. Hibachi) with a focus on the modular ecosystem.

Are they competitors?

To a large part yes, because the fact that both @boundless_xyz and @SuccinctLabs ultimately provide proving services, also means that there will inevitably be products built on top of that infra that ultimately rival each other in terms of adoption (and proving demand that accrues to the underlying infra).

Some examples here, are their zkVMs (R0 and SP1), and many use cases enabled thereby, incl. RiscZero's OP Kailua framework for hybrid ZK fraud proofs that competes with OP Succinct (Succinct's ZK framework for OP chains), the two ZK-powered versions of Blobstream (DA bridge for Celestia) that both teams built on top of their infra, or their in-house ZK co-processors (Steel vs SP1-CC), etc.

However, I believe that the ZK proving infra market is large enough for two (or more?) major players, and that especially in the case of high-stakes apps (e.g. institutional DeFi, some AI use cases, etc.), or chains that cater to these verticals, multi-prover systems will become increasingly prevalent (improving robustness and security), potentially leading to dual integrations with both networks.

We will imo also see aggregation layers built on top of multiple proving markets/networks, which will ultimately both lead to these infra layers working in tandem to some degree.

ZK is the endgame.

ZK season is upon us.

Study ZK.

Show original

3.69K

46

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.