"The news of microstrategy fundraising is out, how much can BNB rise? 》

After today's post, some people have been asking which shell of the BNB microstrategy may be, I don't know at the moment, maybe not many people on the market know about it, but it is true that I heard that fundraising is extremely hot and sought after.

However, for us and other small scatters, we don't need to know which shell company it is, because in the end they all want to buy $BNB which is also good for $BNB.

In fact, referring to the previous BMNR and SBET routes, micro-strategy coins seem to give institutions that cannot directly intervene in $BNB an opportunity to eat dividends, which is a bit similar to leveraged $BNB.

Everyone increases their positions in BNB, or increases their positions with low leverage, which is actually not much different.

This morning I calculated the amount of funds needed to rush 1,000 $BNB, and it happened that Miss Lin Wanwan sorted out the current WINT and the unnamed regular army fundraising scale, which has locked in nearly $1 billion, exceeding the $880 million demand I calculated in the morning.

Portal:

So theoretically, it's only a matter 😍😍😍 of time before $BNB exceeds 1000 (not financial advice, I have a stake, don't scold me if you lose)

~~~~~~~~~~

But don't forget, this is only the buying power of Micro Strategy, how big is the market buying volume driven by this buying process?

If all these funds come to buy $BNB, how high can the price go?

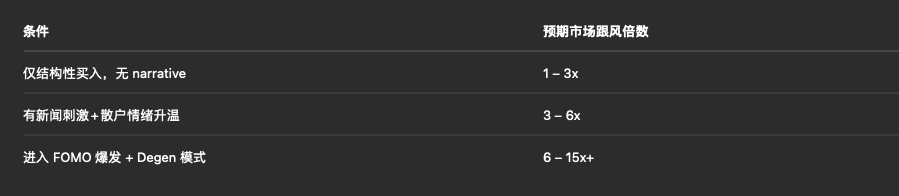

Let's not pat our heads, model and derive according to the previous data of the ETH microstrategy, I asked ChatGPT to do this for me:

Prompt : "As a senior US securities expert and cryptocurrency expert, if BNB Microstrategy companies start to buy BNB continuously, referring to the cases of SBET and BMNR, what is the approximate ratio of market buying to microstrategy buying?"

There is a lot of content, pick the key points:

If a buying scale of 100M/day begins to appear, it can account for about 5% of the market and enter the "superimposed FOMO" stage.

If the FOMO state begins, the market buying will reach 5.5-17X of the original microstrategy funds.

According to this logic, let's take the number and continue to deduce:

Assuming that BNB MicroStrategy invests $500 million to buy BNB in the next month, triggering 6 times the market to follow the trend ($3.5 billion in total), how much can the price of BNB rise?

Conclusion:

BNB is poised for a +24% to +36% increase in a month, with price targets in the $1,050–$1,150 range. (The prerequisite is that the market does not collapse, there are no various black swan events, and BNB Micro Strategy can invest 500 million yuan to buy spot in the market)

BNB pension monsters like to run big 🥰🥰🥰

~~~~~~~~~~

Finally, this conclusion is only a superficial modelling deduction based on the current limited information and cannot be used as rigorous investment advice.

If the market is so simple and predictable, then AI will not let go of let me wait for mortals to spend a little money at will. In "Awe of the Market"

Under the premise of doing a good job in investment planning and risk control, and increasing your winning margin is the recuperation that you need to continuously improve.

I wish you all good money from $BNB

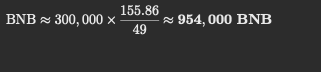

根据昨晚的数据刚才推算了一下如果 $BNB 涨到1000需要多少资金以及需要购买多少个BNB。

昨天约 30万 BNB → 拉升 49 美元(796→845)。

现在现价约 $844.14,到 $1,000 还差 $155.86。

用同样“量价弹性”线性估算:

若冲击沿途线性展开,平均成交价约为 844.14 + 0.5*155.86 = 922.07 美元,

则追加资金约:

结论是:

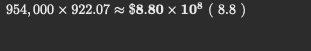

还需购入大约 95.4 万枚 BNB,约 8.8 亿美元 级别的净买盘。

对比 $ETH 的微策略,仅 SBET 就花费了13亿美金(周末他们刚刚花了2.96亿),BMNR通过换股和市场购买持有超过20美金的ETH。

在我看来,同样的微策略模式,可能 $BNB 的微策略给币价带来的提振效果会好于 $ETH 的。

Why?

🫰BNB的筹码集中度明显高于ETH,且历史抛压(化石手/钻石手)明显小于ETH。

🫰ETH是通胀的,但BNB其实是通缩的。

BNB总发行量最初为 2 亿枚,已经半数通过回购销毁释放(剩余上限为 1 亿枚)。

每季度 Binance 会将当期净利润的 20% 用于回购 BNB 并燃烧(销毁)最终将永久销毁 到剩余 1 亿枚 BNB,不再继续增发。

🫰币安的搞事能力和效率远高于正在高层重组,试图基本面突破的EF。币安的利润提升传导到BNB币价,币价传导到微策略账面盈利增加股价上涨,进而获得更强融资能力和更多资金青睐,飞轮起飞

🫰目前美国市场散户是不能购买并持有 $BNB 的。即便Kraken上有BNB/USD pair,但美国人无法购买。BNB微策略不但可以吸引那些散户,甚至可能吸引那些不能直接持有加密货币的传统基金参与。这是非常直接的新增购买力。

所以,拿住 $BNB ,等风来~!

51.54K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.