There's TOO much fudding on @SonicLabs CT and not enough glazing.

As usual, your boy will be the first one gobbling, schlucking, GARGLING one of the BIGGEST success stories on the orange chain.

This is @stabilitydao's path to success and their 13% APY stablecoin.

👇

📚 History of Stability

Stability's success was founded on a simple principle: build things people want.

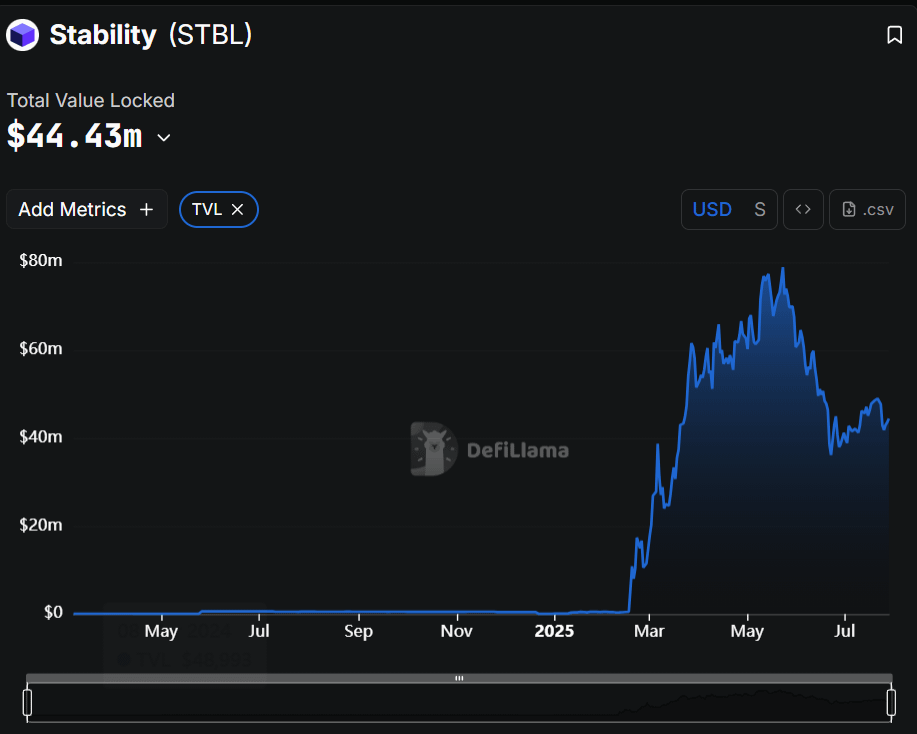

In Sonic S1, their auto-leverage vaults brought ~$80m TVL.

In Sonic S2, they outperformed most in liquidity retention.

Why? They kept building what people WANT.

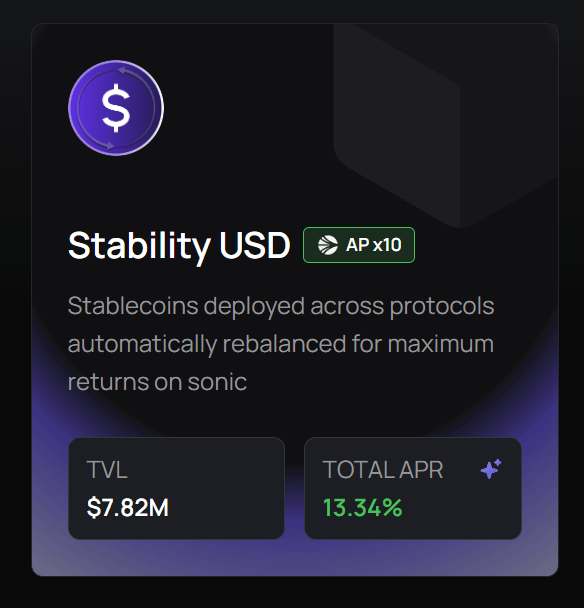

🪙 Native Yield-Bearing Stable

Your boy constantly harps about the importance of a HIGH YIELD-bearing stable native to Sonic.

It provides:

📌 USD-denominated SoV

📌 Driver for $USDC rates → capital attraction

This is EXACTLY what Stability's 13% APY wmetaUSD brings to Sonic.

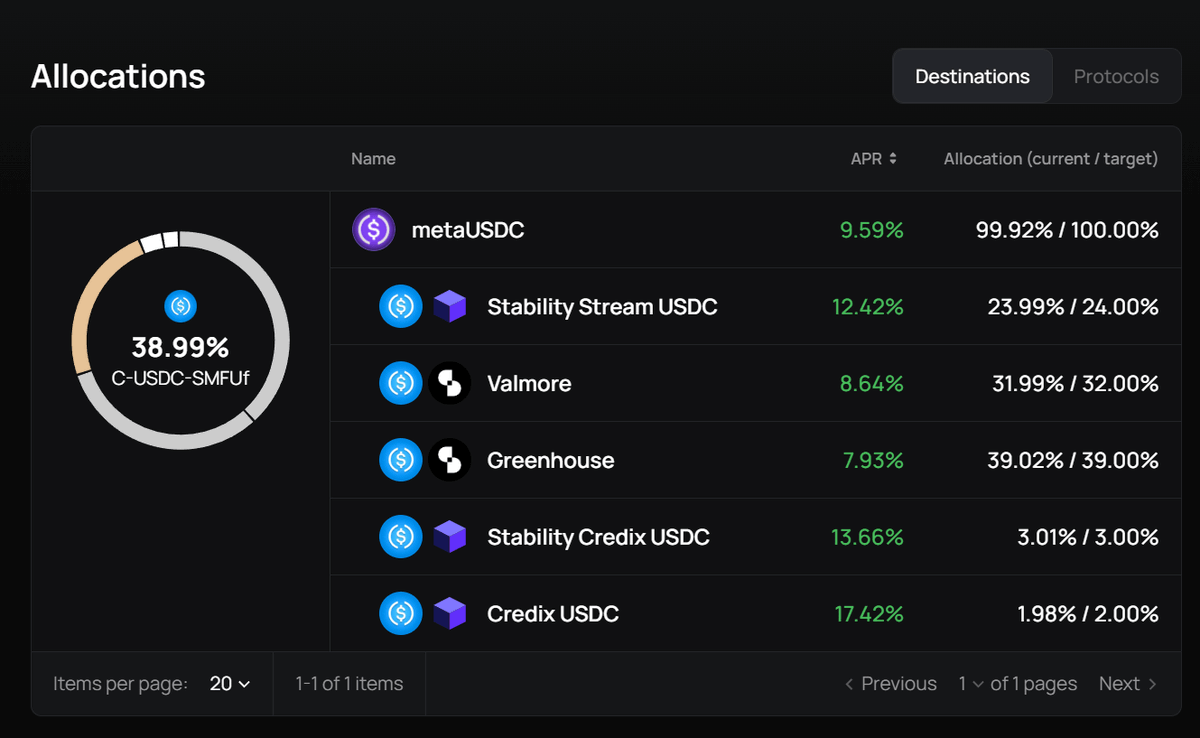

🫧 Liquidity Bootstrapping

wmetaUSD doesn't JUST bring yield.

It brings liquidity to the ENTIRE Sonic ecosystem.

Observe its allocations to:

📌 @aave (Stability Stream)

📌 @SiloFinance

📌 @CrediX_fi

Supporting Stability = Supporting Sonic

11.96K

141

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.