Yield bearing stablecoins is one of the absolutely hottest narratives this cycle. The GENIUS Act solidified stablecoins position even more, and TradFi has gotten the taste of the 5-15% APYs that DeFi can offer, dwarfing the normal TradFi yields

Two of the absolute beasts in the space have been @ethena_labs and @pendle_fi, both currently over $6B TVL. Yield bearing stablecoins TVL have grown over 500% in the last year

The latest trend is that we're seeing 'stablechains', blockchains tailored for the use of stablecoins, and protocols building purely for stablecoins

One of the problems with stablecoins is that there is not deep enough liquidity on secondary marketplaces (DEXes). A large swap of 7-8 digits could depeg most yield bearing stablecoins significantly

This is where Converge and Terminal aims to take a hold

✅ @convergeonchain is a new blockchain that aims to be the settlement layer for TradFi and digital dollars

Backed by @ethena_labs and @Securitize (Blackrock BUIDL)

They have already partnered with many of the largest players in the stablecoin and RWA space such as

• Maple

• Ondo

• Securitize

• Centrifuge

• Ethena

• Pendle

There will be no new token for the Converge chain (value flows to ENA)

✅ @Terminal_fi is the liquidity layer (DEX) of Converge

Terminal Finance is an institutional-grade DeFi protocol that serves as a liquidity hub and interface for regulated institutions to access DeFi yield. It is design to be a DEX for reward bearing stablecoins.

Terminal is creating a marketplace where yield bearing assets can be traded at scale.

sUSDe will be the base currency of the DEX

Ethena is also launching an institutional wrapper of sUSDe, iUSDe (KYC required) which will be exclusively tradeable on Terminal

Pre-Deposits on Terminal went live in end of June for USDe, WETH and WBTC

✅ @pendle_fi

As you already know, pendle offers tokenization of yield by splitting a yield bearing token into a Principal Token and Yield Token.

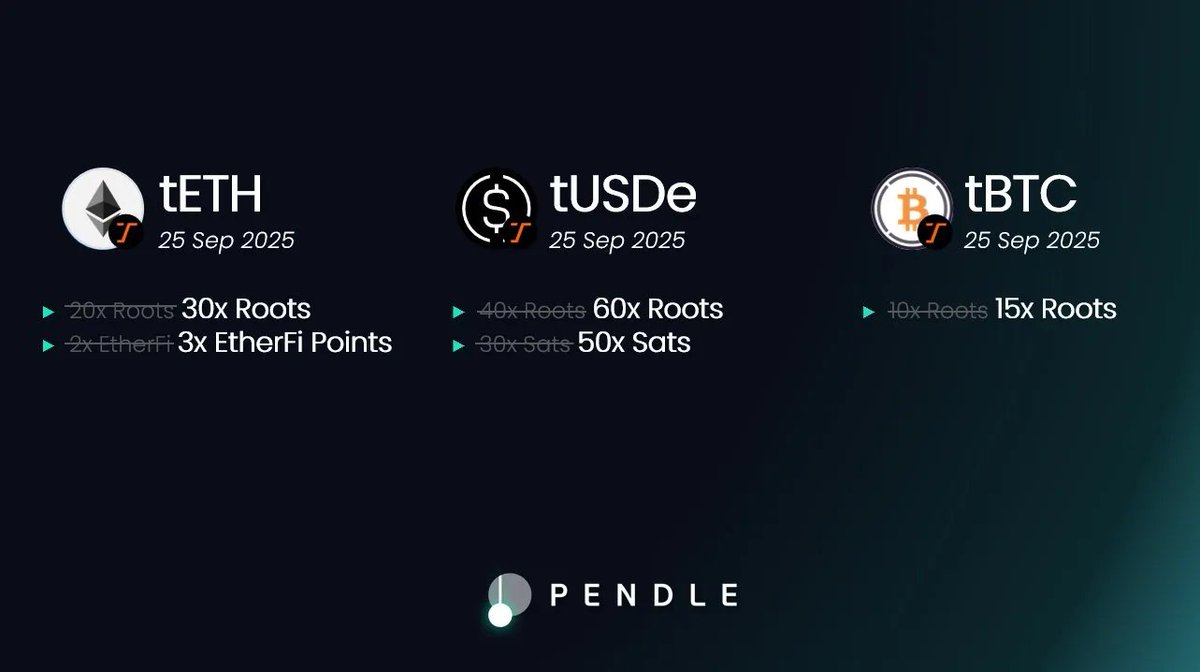

Pendle has already launched pools for the Terminal Pre-Deposits with 50% extra points compared to vanilla deposits

tUSDe

tETH

tBTC

As always, the highest point farming opportunities are found on Pendle

The Penthena symbiosis between Pendle and Ethena keeps on growing and Converge + Terminal will open access for institutional KYC gated Pendle pools

✅ How can you take advantage of this?

By farming Roots (Terminal Points Program) and Sats (Ethena Points Program) at the same time by depositing in the tUSDe pool

(As usual) Pendle has the best multiplier for Points so if you plan to deposit you are better of depositing in the Pendle LP Pools rather than directly on @Terminal_fi

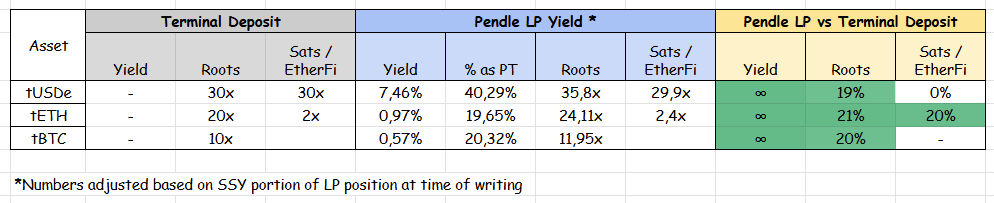

Based on these calculations (that i stole from @PendleIntern but updated the numbers) we can see that you earn about 20% more points by LPing in Pendle than depositing directly on Terminal (even though a part of the LP is converted to PTs) and in addition you earn Pendle Yield

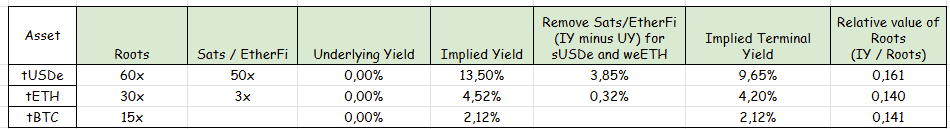

If you're looking into YTs for pure Root exposure they are valued at about the same level (relative value) if we subtract the Sats/EtherFi points value

Please note that as there is no Underlying Yield you are basically buying points without getting any yield in return. This would be a bet that Roots points are valuable

Will have to come back later with an estimate of YT values, but i did ape quite a bit of YT-tUSDe👀

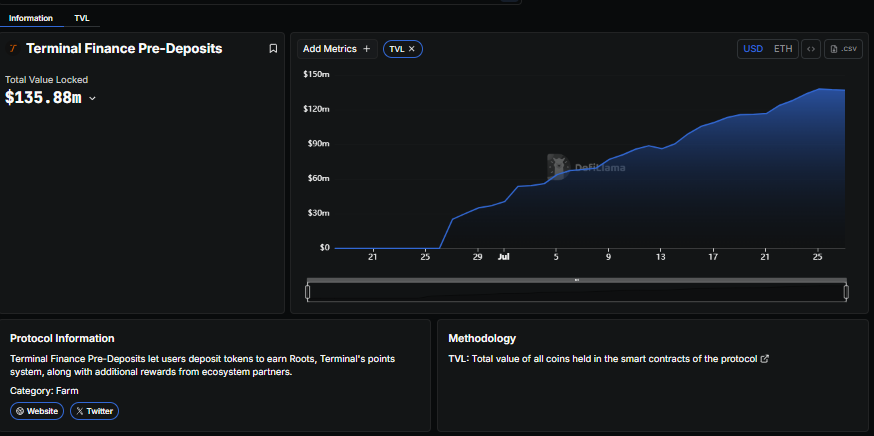

✅ Growth

Terminal has grown to $135M in only one month, and over 75% of the total TVL is already deposited via Pendle

✅ Concluding thoughts

Pendle continues to be the main arena for anything related to yield and points. Both for stablecoins, and majors like ETH and BTC

There's so many hidden opportunities if you bring out the spreadsheets

With powerful backers such as Ethena and Blackrock im sure institutional TVL will flow heavily into Terminal and Converge, and its a bet i'm willing to take.

Farming this one hard with tUSDe LP, and at the very least i'm expecting around 4% APY from the Ethena Sats airdrop

I've also got quite a bit of YTs as we all remember the 80% implied Yield YTs for Ethena which still paid of handsomely

Show original

14.13K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.