Altseason is next in the bull cycle: BTC→ETH→Alts

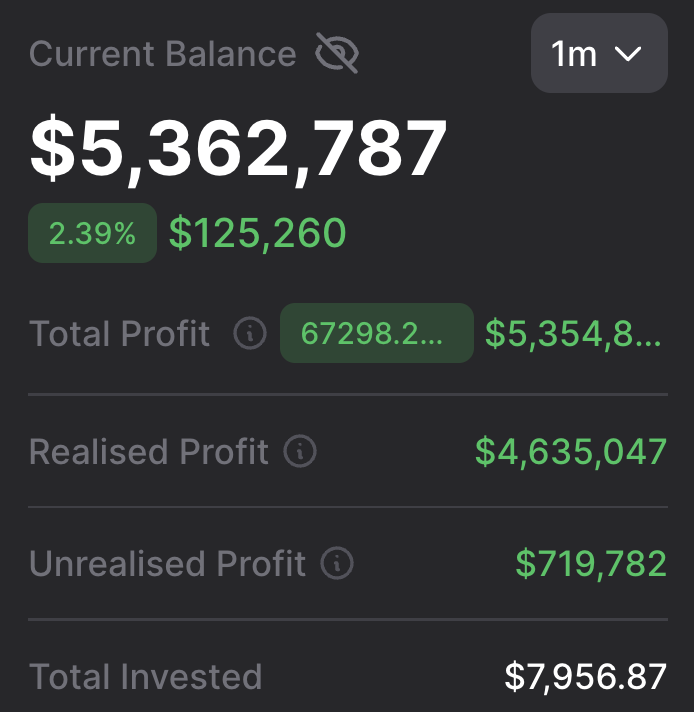

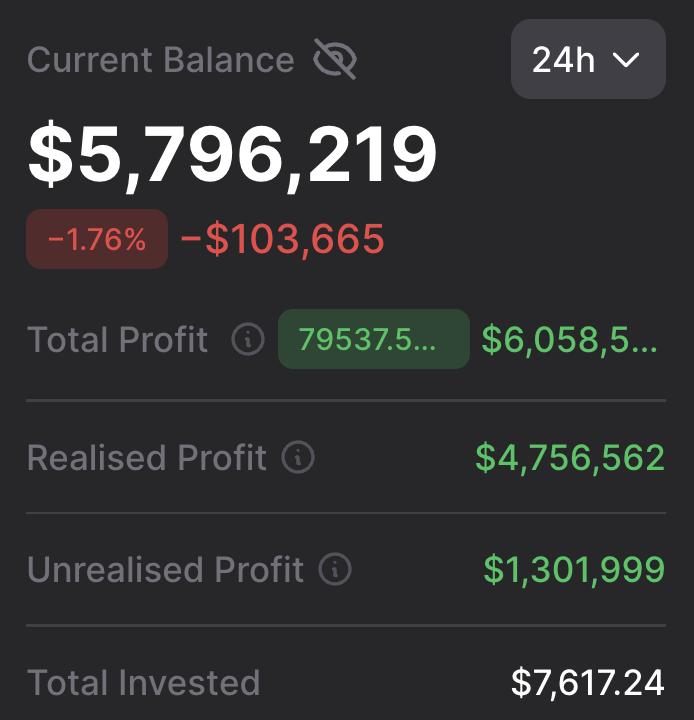

Last altszn, I turned $1k into $130k in just 3 months.

Next 6 months may be a once-in-a-lifetime chance: $5k now = $1M+ - if you build your portfolio right.

My mega-🧵 on how to do it (+ examples & best coins)👇

➮ Before we start...

I'd really appreciate a like, RT, or comment on the first tweet – I put a lot of effort into this thread.

1/➮ Most people suck at building a crypto portfolio - and even worse, they don’t build one at all

✧ They’re either way too aggressive or too safe, and end up losing money throughout the entire cycle

✧ In other words - they're basically gambling blind

Let’s change that👇🏻

2/➮ First, let’s break down why you even need a portfolio in the first place

✧ The core goal of any portfolio is simple:

"Lower the risk, increase the reward"

✧ And remember, there’s no such thing as a perfect portfolio - there’s only your portfolio

Let me explain:

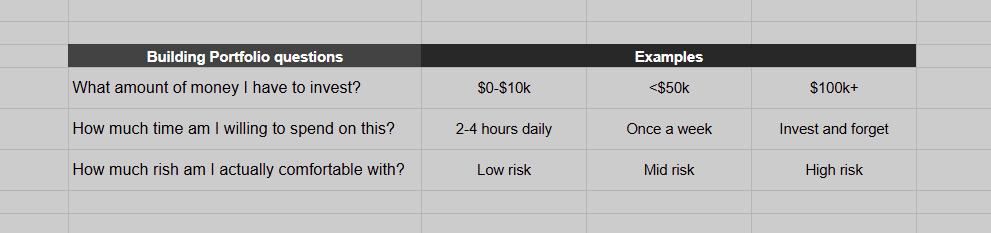

3/➮ Your portfolio should match your lifestyle, your job, money you have to invest

✧ So I made a quick cheat sheet for you - with core questions and example answers you’ll need to figure out

Now let’s jump into some examples of how you can build a portfolio based on that 👇

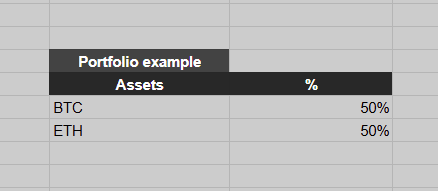

5/➮ BTC/ETH Split

✧ This strategy is more for the invest-and-forget type - works best if you’ve got at least $50k+ to put in

✧ It’s simple, low-risk, and perfect for people who want exposure to crypto

but don’t want to dive deep into it

Portfolio example:

- 50% BTC

- 50% ETH

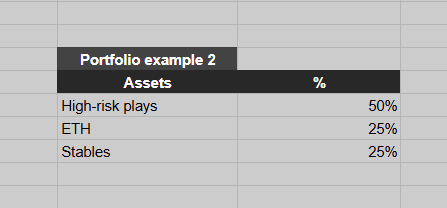

6/➮ Half Gambler

Strategy for those who have time to monitor crypto daily.

It mixes short-term high-risk plays with long-term holds (BTC, blue chips, stables) and works well for $5k–$10k+ portfolios.

Example:

• 50% high-risk

• 50% safer assets (e.g., 25% ETH, 25% stables)

Sometimes you might hold even 70% in stables - but when a hot opportunity shows up (like the recent $Pump/$plasma sales), where you need to lock stables, you go all in.

You've got nothing to lose 😁 - and even if you do, it's easy to earn it back doing work where you're paid for your time.

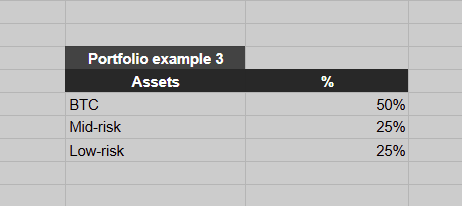

7/➮ 50/25/25

✧ Popular portfolio setup across CT with everything inside: BTC, mid-low risk plays

This one takes min risk since it skips the high-risk stuff entirely and works for each size

Portfolio example:

- 50% BTC

- 25% low risk (blue-chip alts: hype/sol/eth/ltc, etc)

- 25% mid risk (mid-cap alts, some big memes: fartcoin/pengu/bonk/wormhole, etc)

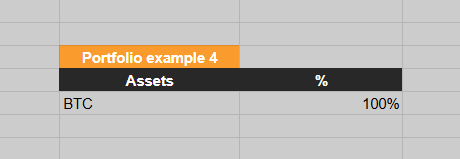

8/➮ BTC Maxi

✧ Strategy built on buying BTC consistently over time, no matter what

✧ For the Michael Saylor fans who get hyped every time he makes a new purchase

✧ It's a classic invest-and-forget play with low risk and for good size

Portfolio example:

- 100% BTC

Perfect for people who are just setting aside money from work, inheritance, or whatever else - and funny enough, in this cycle so far, these players have outperformed 99% of investors.

BTC alone is outperforming almost the entire market.

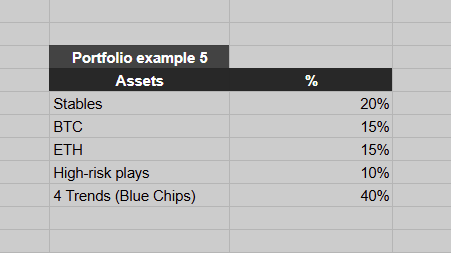

9/➮ Diversifier

✧ People that are trying to catch every narrative (or at least attempting to)

✧ Ideally, you don’t go into more than 4 trends

Strategy takes at least 1-2 hours daily for crypto

Portfolio example:

- 20% stables

- 15% BTC

- 15% ETH

- 10% high-risk plays

- 10% each into 4 different trend-based blue chips (RWA, AI, memes, etc)

10/➮ Choose your strategy based on the level of risk you're willing to take and the size of your portfolio

Because BTC/ETH can't crash 90% overnight

But alts crash, and even solid alts like HYPE/FARTCOIN might pump fast, but they also dump just as fast

Same with memes/shitcoins, etc.

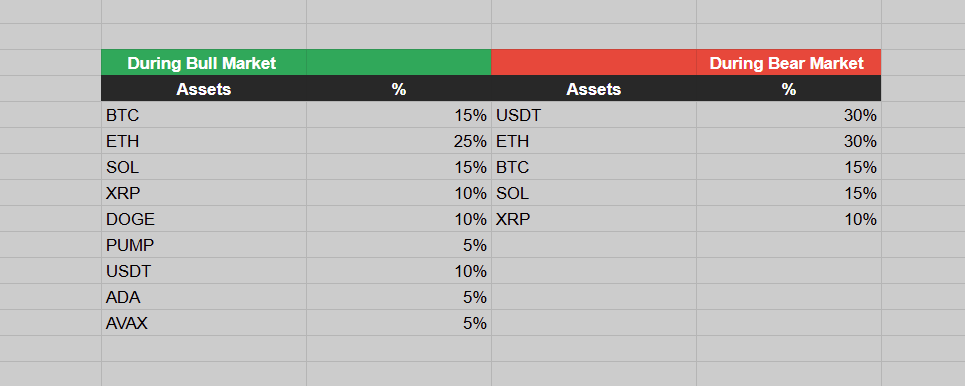

11/➮ Bull & Bear Portfolio Difference

✧ Your portfolio will also depend on where we are in the market (bull or bear)

✧ That’s what determines whether you go into risk-on or risk-off mode

✧ In a bear market, you’ll want more stables, for example, to buy the dip.

Overall, your stablecoin allocation should depend on your size.

For example, sitting on 7 figures now, I’m not looking to overexpose myself to risk.

My main goal is capital preservation and steady growth - not aggressive multiplication - so I always keep 70%+ in stables, no matter bull or bear.

But when I hadn't yet reached my target and could afford to take risks, I leaned more into leverage and high-risk plays.

Don’t forget that - first, get clear on your goals and your personal risk tolerance.

12/➮ Common Portfolio Mistakes

1) Too Aggressive/Lack of Patience

Most people want 100x; they throw money into a couple of memes and end up down -90%.

Of course, you’ve heard about some random dude who turned $1k into $1M and think you’ll do the same.

But the key is to focus on realistic profits and be more patient.

13/➮ Too Diversified

✧ Diversification is great - but there’s a limit

✧ You can’t catch the pump of every coin or trend

Plus, if one of your picks moons, you’ll make less profit because you’re too spread out

That’s why, as I mentioned - don’t go into more than 4–5 trends

14/➮ Not Rebalancing

✧ Rebalancing means selling or buying assets to maintain the % allocation of your portfolio

✧ For example - your random low-cap does a 50x and suddenly becomes 25% of your portfolio

But it was only supposed to be 3–5% max

Take profit → Rebalance

15/➮ Skip on Passive income

✧ 99% of people just buy an alt and let it sit in their portfolio

✧ But a lot of alts actually let you stake or earn yield with them

✧ Don’t miss out on those opportunities and just remember, there are risks there too

16/➮ Now that your portfolio’s set up, the real question is - do you know what to buy?

This altseason won’t be like 2021 where everything pumped

Back then we had ~2–3k tokens and now its ~35M (huge oversupply)

That’s why I’ve put together my 4 best bets for this altseason:

But before we move on, I've got something for those serious about leveling up in crypto:

I launched my private group @Degen_Uni just 1.5 months ago.

Since then we’ve already called:

$NPC 62x, $MEMECOIN 50x, $STUPID 30x and many more.

Here's how to join 👇

17/➮ @wormhole - $W

Narrative: DeFi

✧ Market cap: $380M

✧ Price: $0.081

About the project:

✧ Wormhole is a leading interoperability protocol enabling multichain apps, native token transfers, and secure cross-chain messaging across 30+ blockchains

19/➮ @cookiedotfun - $COOKIE

Narrative: InfoFi/AI

✧ Market cap: $100M

✧ Price: $0.17

About project:

✧ Cookie is a data layer for AI & builders, turning crypto data into insights

TL;DR: just a strong Kaito competitor with a decent team & 8x lower FDV, one of my biggest bets

20/➮ @PinLinkAi - $PIN

Narrative: RWA/DePin

✧ Market cap: $57M

✧ Price: $0.71

About the project:

✧ PinLink is the first RWA-tokenized DePIN marketplace that cuts AI development costs and enables anyone to earn passive income through fractional asset ownership.

Also, here are some other coins I’m holding (but too lazy to write separate tweets about):

$PENDLE

$CPOOL

$CULT

$IOTA

$BONK

$PUMP

➮ More free educational content calls in my TG:

✧ Real alpha, degen calls, and mentorship across all crypto fields: airdrops, memes, futures trading, arbitrage - all covered by 12 elite mentors in my private group for just $99/m:

➮ Liked this thread? I write educational threads daily, so don't forget to:

✧ Follow me @nobrainflip

✧ Join my ds:

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

73.29K

236

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.