the most dominant decentralized lending protocol @aave $aave sits at 5.4 times annual fees, sits at 29 times annual revenue. In the past 30 days, they've generated $12.4 million in revenue. Revenue consistently increasing, market share completely dominant, trust unmatched. New revenue lines including stablecoins and RWA lining up. An @ethereum $eth behemoth.

@StaniKulechov @lemiscate

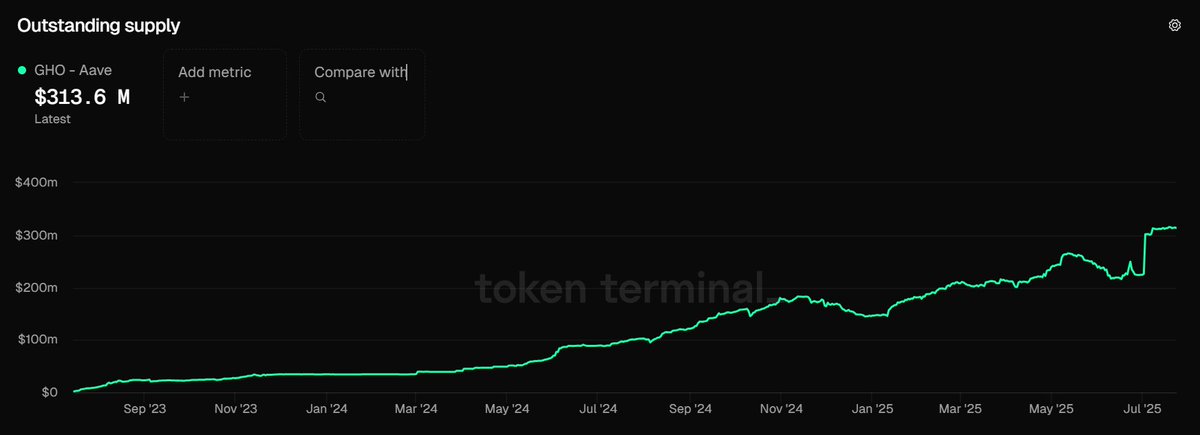

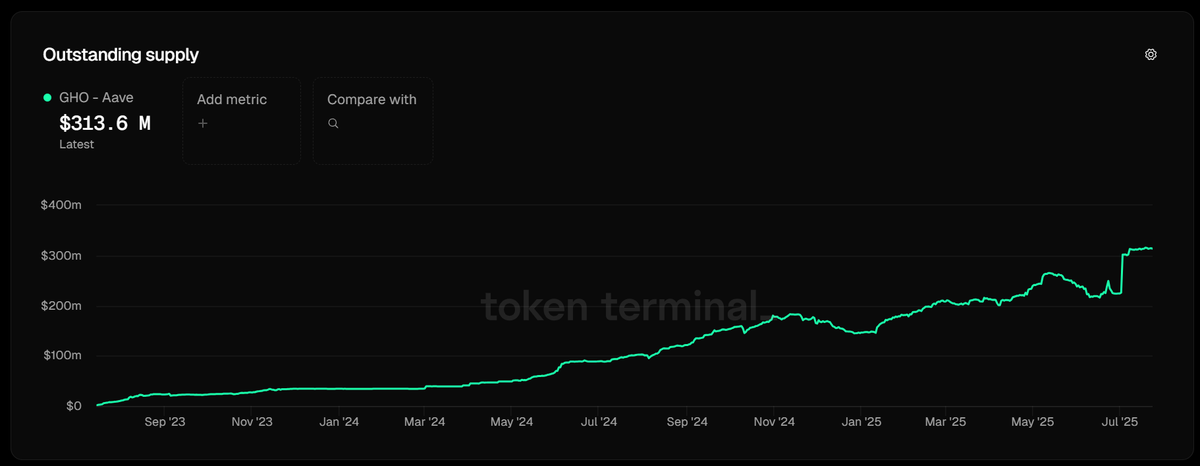

$gho continues to grow in terms of usage. aave is uniquely positioned here to leverage their industry dominance and encourage the adoption of their stablecoin across defi. this is an important part of their growth strategy. lending their own stablecoin is highly profitable and works well with their next unlock: anti-gho

anti-gho will be rewarded to $aave stakers, and it eliminates $gho debt 1:1. so $aave stakers will be able to initiate and maintain debt positions and then use their accumulated anti-gho rewards to pay down their debt.

this is the future of banking.

$gho continues to grow in terms of usage.

Based on growth trajectory, I wouldn't be surprised to see $gho utilization reach close to $1 billion before the end of the year.

Aave is uniquely positioned in the DeFi arena to leverage their industry dominance and encourage the adoption of their stablecoin. This is an important part of their growth strategy. Lending their own stablecoin is highly profitable and works well with their next unlock: anti-gho.

Anti-gho will be rewarded to $aave stakers, and it eliminates GHO debt 1:1. So Aave stakers will be able to initiate and maintain debt positions and then use their accumulated anti-gho rewards to pay down their debt.

This is the future of banking.

@SinCertidumbre @aave Revenue is what Aave keeps

3.21K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.