➿ In The Loop #004

A biweekly digest covering Loopscale strategies, integrations, product updates, and the best yields.

Thread below↓

Loopscale launched a first-of-its-kind feature that enables one-click leverage on CLMM LPs.

This opens the door to levered LP yield — like @orca_so's cbBTC-zBTC with a Max Loop APY of 14.39%.

Get the full breakdown in this thread:

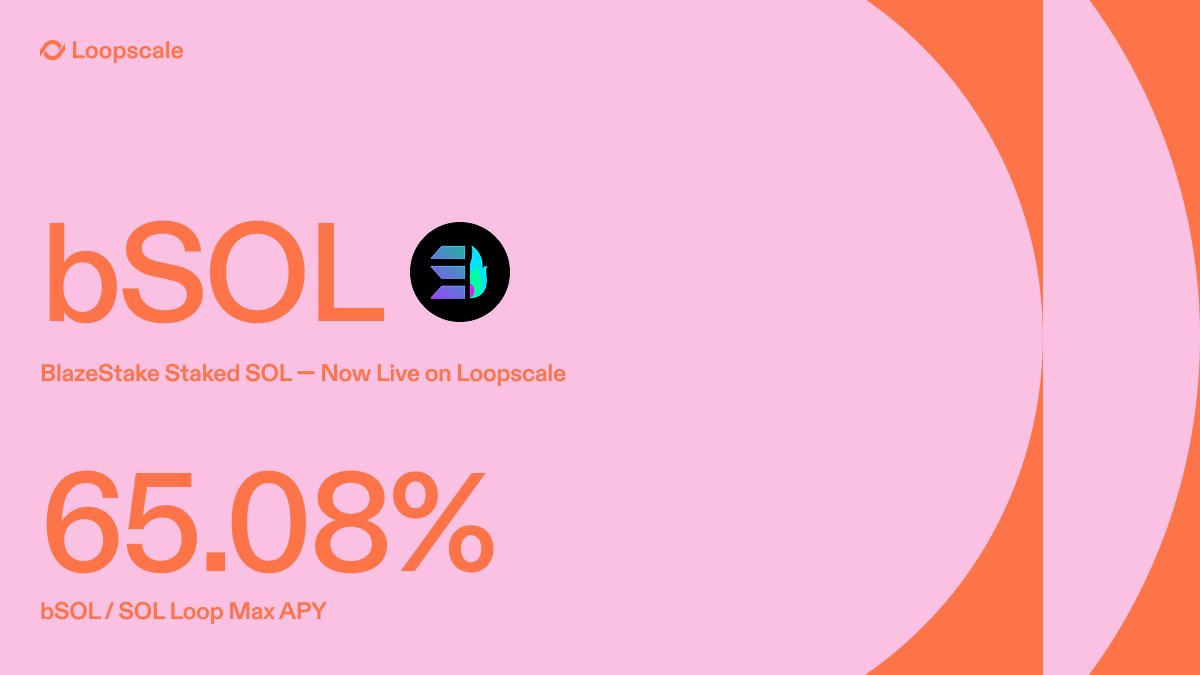

SOL is accelerating on Loopscale with new LSTs and rewards for SOL Vault depositors.

@solblaze_org's bSOL / SOL reached over 3M in under 48 hours and currently has a Max Loop APY of 32.99%.

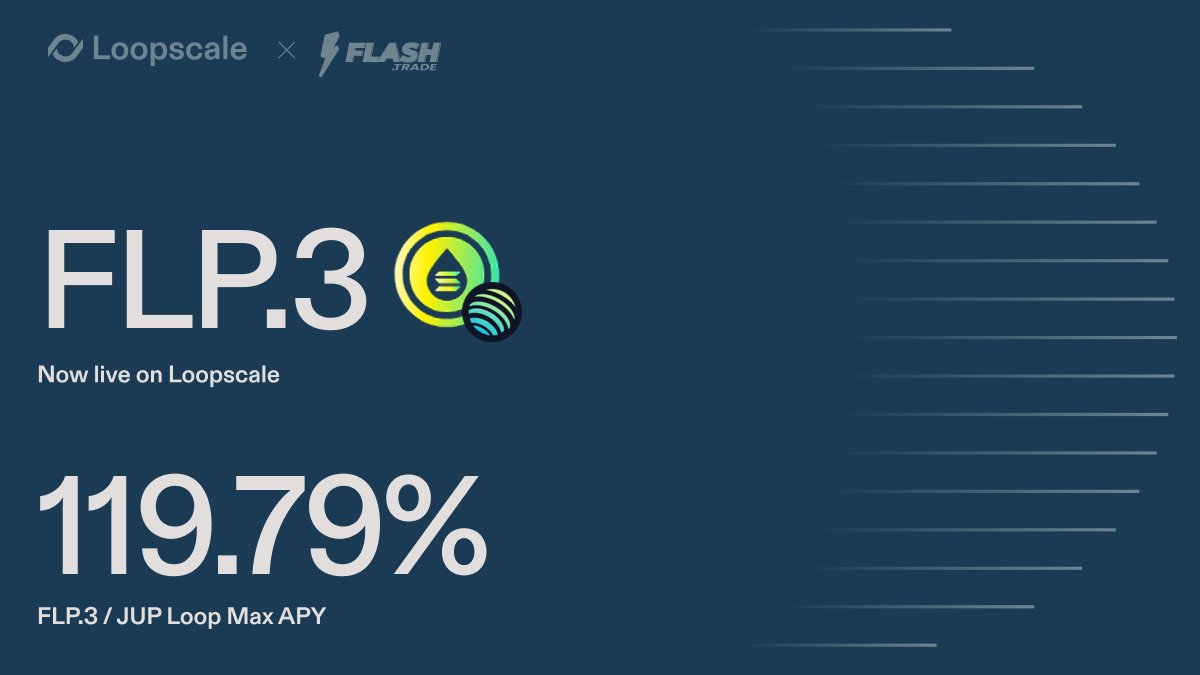

FLP.3 joined the ranks of @FlashTrade_ FLP Loops on Loopscale with

a Max Loop APY of 115.91% and 65.84K Deposits.

Meanwhile, FLP.1 continues to grow with a Max Loop APY of 166.35% and 1.22M Deposits.

Loopscale continues to ship new features, enabling new primitives for lending on Solana. ↓

Last week, we launched the first DeFi product offering one-click leverage on CLMM LPs. Users retain complete control over their strategies, with positions manageable through our interface.

Following Rollovers earlier this month, we've now shipped yet another onchain lending product previously considered unviable.

The architectural choices that once seemed like overhead are now proving to be the catalyst for rapid 0-to-1 innovation.

The future of lending is modular and it's nonstop from here.

8.04K

45

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.