Some unusual things are happening in this Bitcoin cycle.

Logically, this should be the last year of the four-year cycle. The buying power of major companies is stronger than ever.

But the price? It fails to spark any interest.

Perhaps we are experiencing the last rotation in Bitcoin's history. After this, everything will change: 🧵👇

In every previous cycle, the third year of Bitcoin's rise has been marked by a shocking parabolic surge.

But what about 2025 so far? Not yet.

We've experienced some significant volatility, but it has also been accompanied by shallower pullbacks and longer periods of sideways movement.

This doesn't necessarily mean the cycle has been broken. Perhaps it's just a slower pace, a bit more stable.

Beneath the surface, a massive transformation is quietly taking place.

Certain investors (like long-term holders) are cashing out at prices exceeding $100,000.

And who are the new buyers?

BlackRock, Fidelity, Bitcoin corporate treasuries, and large companies establishing strategic long-term positions.

They are not here to speculate on cryptocurrencies.

Michael Saylor said it well:

"Those who do not plan to hold long-term are leaving... and a whole new type of investor is coming in."

This is part of the rotation: shifting from trustees, lawyers, and governments to corporations, ETFs, and sovereign-level balance sheets.

This wave of new buyers is not speculating. They are allocating assets.

Swan's Chief Investment Officer Ben Walkman put it accurately:

"These companies are long-term buyers. They are not Bitcoin traders."

When long-term capital meets rigid supply, the market liquidity will gradually disappear.

And this is often a precursor to a market explosion.

As Bitcoin flows into more steadfast diamond hands, the macro backdrop has lit up warning signals.

A rare and dangerous divergence is emerging:

While the dollar weakens, U.S. Treasury yields are soaring.

These two should not happen simultaneously — for global capital, this is a significant warning signal.

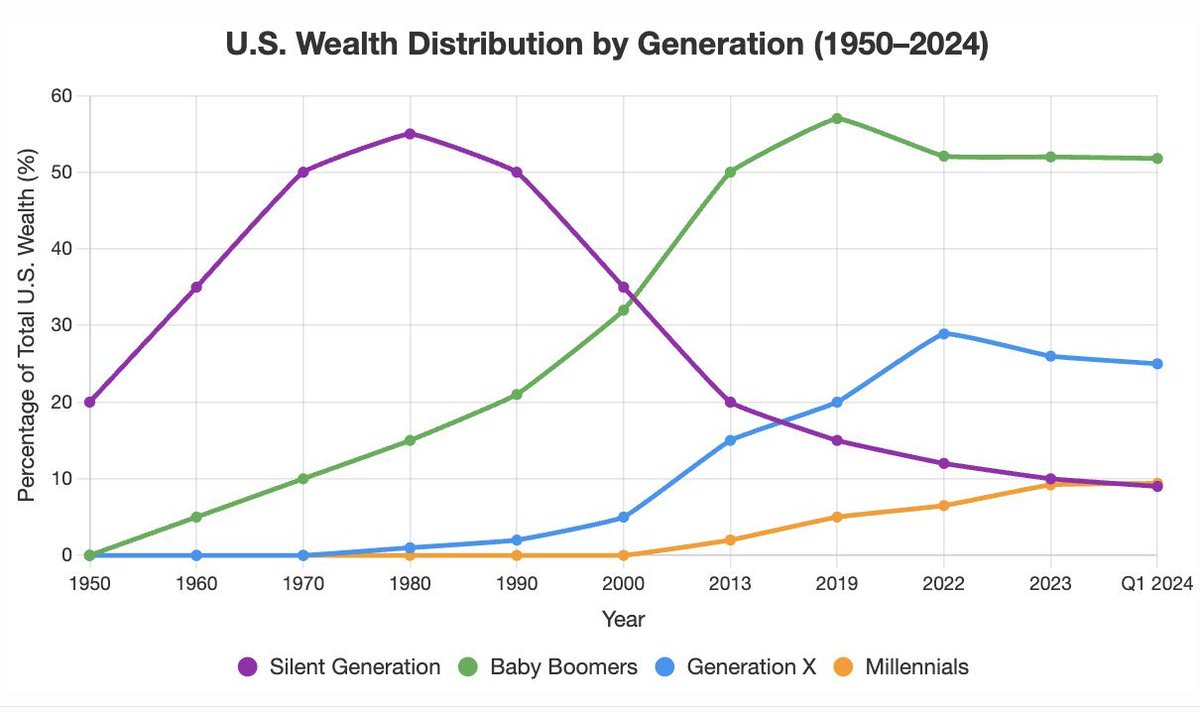

Bitcoin is not only rotating among different institutions but also among different generations.

The Silent Generation believes in gold;

The Baby Boomers accumulated wealth through stocks;

Generation X rode the wave of technology.

And now, the Millennials, who have just entered their peak asset accumulation phase, are inheriting trillions of dollars in wealth.

They have chosen Bitcoin.

So if you are planning to sell now, please understand one thing:

You are most likely giving your Bitcoin to an institution or legal entity that intends to hold it forever.

Once you leave, you will most likely never buy it back.

Look before you leap.

This is not just the next cycle. This is the end of an era.

The circulating chips are running out. The buyer structure is changing. The macro logic is failing.

This is the last rotation of Bitcoin.

If you understand what is happening, you will definitely want to experience it at this historical turning point.

16.3K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.