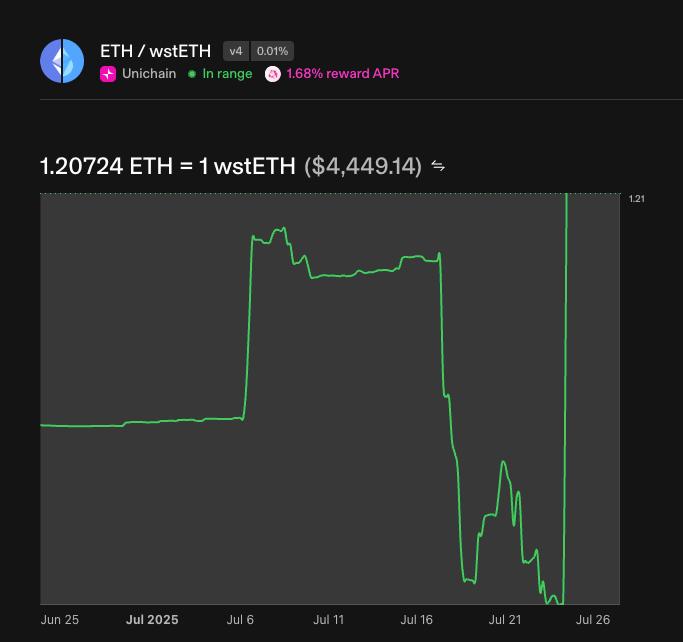

Woke up earlier this week to my wstETH/ETH LP being completely wrecked. My first thought: 'what did I screw up now?'

Turns out the whole market is spasming, and the person who pulled the fire alarm is His Excellency @justinsuntron.

A thread on the great stETH depeg: 🧵

2/4 Here's the quick & dirty: For years, degens created leveraged yield by 'looping' stETH. This whole game works because stETH is supposed to be worth 1 ETH.

The hidden catch? Redeeming stETH for real ETH isn't instant; there's an "exit queue."

3/4 Justin Sun clogged that queue by cashing out his massive ~450k ETH position, blowing the wait time to 9+ days & causing the depeg.

Now, every other looper is royally screwed. Their money printer has become a cash furnace as ETH borrow rates have skyrocketed.

47.8K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.