The old public chains that refuse to lie flat rely on three strategies for revival.

I like using Kaito to observe social sentiment, Defillama to track capital flows, and DappRadar to monitor user activity.

From my observations, @SonicLabs, @Aptos, and @NEARProtocol, these established public chains are all working hard, but many people are still unaware.

Let’s dive in!

⬇️

Blood transfusion, repositioning, and reducing inflation—these are the three strategies I’ve summarized for the revival of old public chains. I’ve already introduced Sonic and Aptos, and now Near is also starting.

As a first-generation high-performance public chain, sharding technology has always been Near's pride. Fast speed and low costs are great, but they also bury a hidden danger: high inflation.

In simple terms, because the gas fees are low, the actual tokens destroyed are much smaller than those issued, leading to an oversupply, inflation occurs, and large holders lie flat to earn interest while the ecosystem collectively retires and does nothing.

Data shows that Near has a fixed inflation rate of 5% per year, far exceeding the expected 2-3%. Due to the extremely low transaction fee burn rate of only 0.1%, the actual net inflation rate reaches as high as 4.9%. Approximately 60 million $NEAR tokens are added each year, with staking yields as high as 9%.

So, what’s the result? Prices keep falling, token value is diluted, holders prefer to stake rather than engage in DeFi, and ecosystem projects are abandoning ship, starting a vicious cycle.

Fortunately, they haven’t given up and are still working hard. They’ve now proposed a voting proposal to reduce emissions, and I’ll summarize the key points:

▰ Maximum inflation rate reduced from 5% to 2.5%

▰ Combined with a 0.1% fee burn rate, the actual inflation rate will drop to about 2.4%

▰ Maintain a fixed maximum inflation rate for easier community understanding and regular adjustments through voting

If the proposal passes, NEAR will achieve a lower inflation rate, reduce token dilution, enhance token value potential, incentivize DeFi participation, and align with the inflation models of leading blockchains, strengthening long-term competitiveness and community confidence.

However, there’s also a huge challenge; it will disrupt the existing benefits. What to do? Reducing emissions will inevitably lead to lower staking interest. If large-scale unstaking and selling occur, price volatility will be severe, and security will also be affected. I saw in the discussions that they mentioned increasing time weight, controlling the yield between 4% - 11%, meaning the longer you stake, the higher the rewards.

This should be a great idea, but we’ll have to see how it’s executed. If you hold $NEAR, you can vote and discuss here:

Voting address:

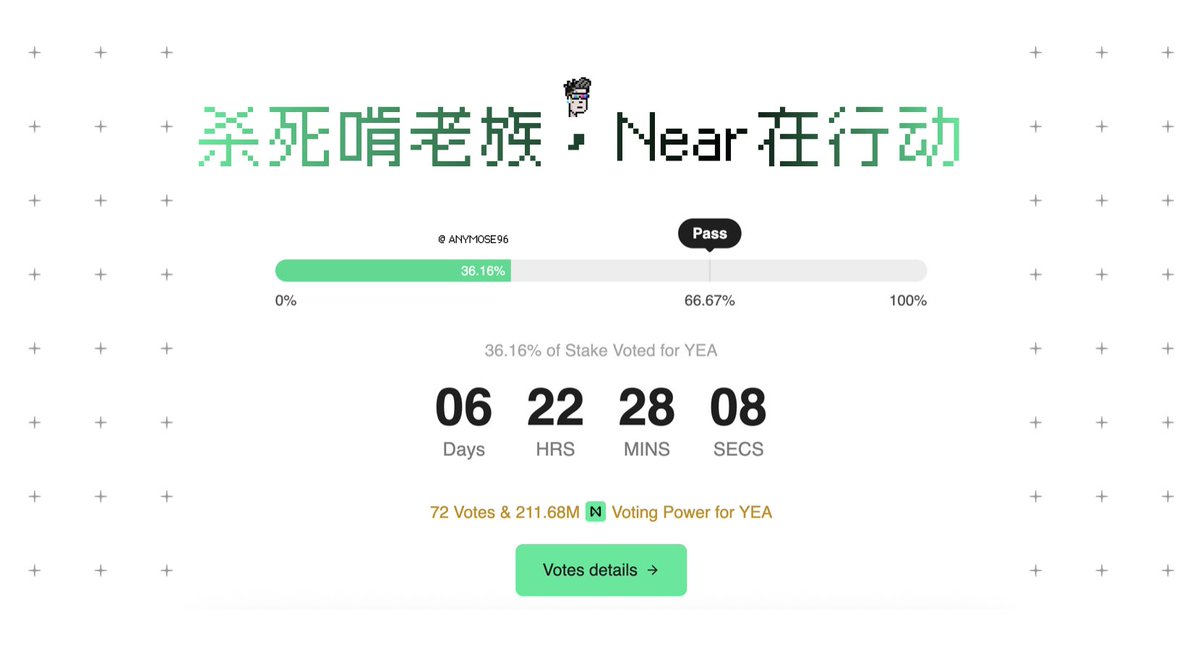

Voting ends in 7 days, and currently, 36.16% agree. To pass, it needs to reach 66.67%, so we can observe the results.

/

The Near Foundation is very determined and knows how to create buzz. I felt that shifting the chain's focus towards AI was quite reliable, but when discussing whether to invest in $NEAR with the experts, there were many concerns, mainly about the inflation we talked about today.

I will keep an eye on it. If it passes, it should be a big deal, similar to the new protocol we discussed earlier, @rhea_finance, which is definitely worth watching as recent data is surging.

This is a soft-core popular science article. Through this article, you can gain a basic understanding of the following knowledge:

▰ Three strategies for the revival of old public chains

▰ Near's strategy to solve high inflation

▰ Betting on the Near ecosystem (not

Author: anymose | A soft-core popular science writer <End of full text>

* This article is for informational purposes only and does not constitute any investment advice. Always remember to DYOR!

Show original

48.18K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.