We’re entering a retro-future currency race. Not gold in vaults, but BTC and ETH in multisigs.

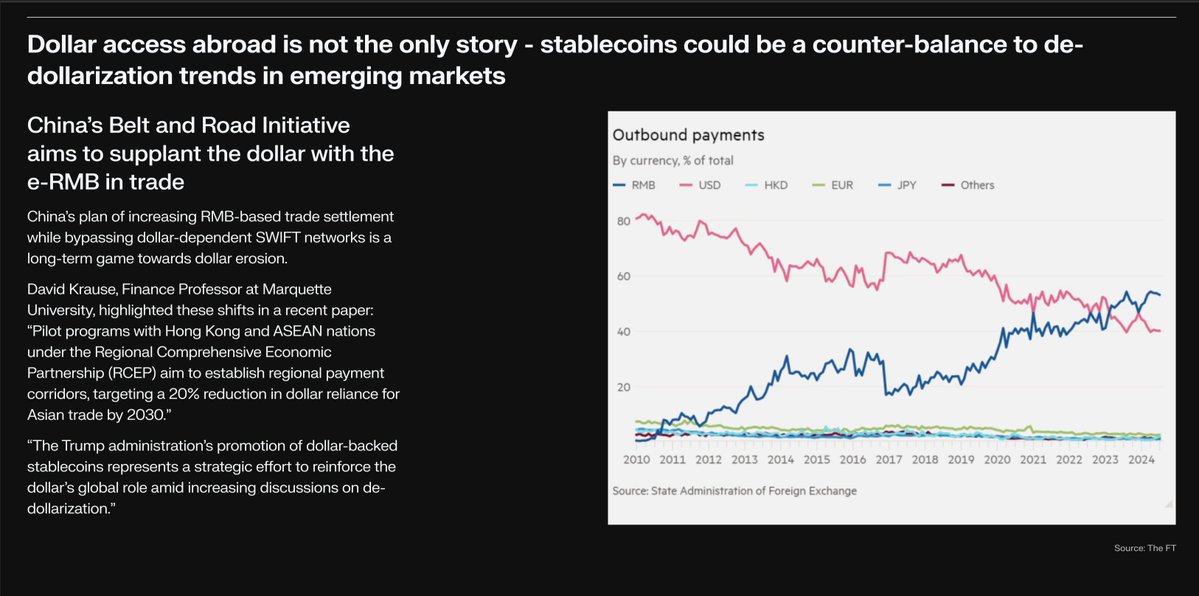

China’s RMB is overtaking the dollar in outbound trade payments. The Belt and Road is becoming a payments network. SWIFT is optional. e-RMB rails are expanding through ASEAN. This is active dollar displacement.

Most stablecoins today are dollar-pegged and backed by cash and T-bills. But what happens in a world where de-dollarization accelerates? What happens when trust in U.S. assets erodes?

Stablecoins will adapt. Non-USD stables — RMB, RUB, INR — will emerge. And in the absence of dollar reserves, they’ll compete to hoard BTC and ETH instead.

Stablecoins won’t just track fiat. They’ll evolve into digital currencies that compete for trust, liquidity, and integration. The backing will shift from sovereign debt to crypto-native reserves.

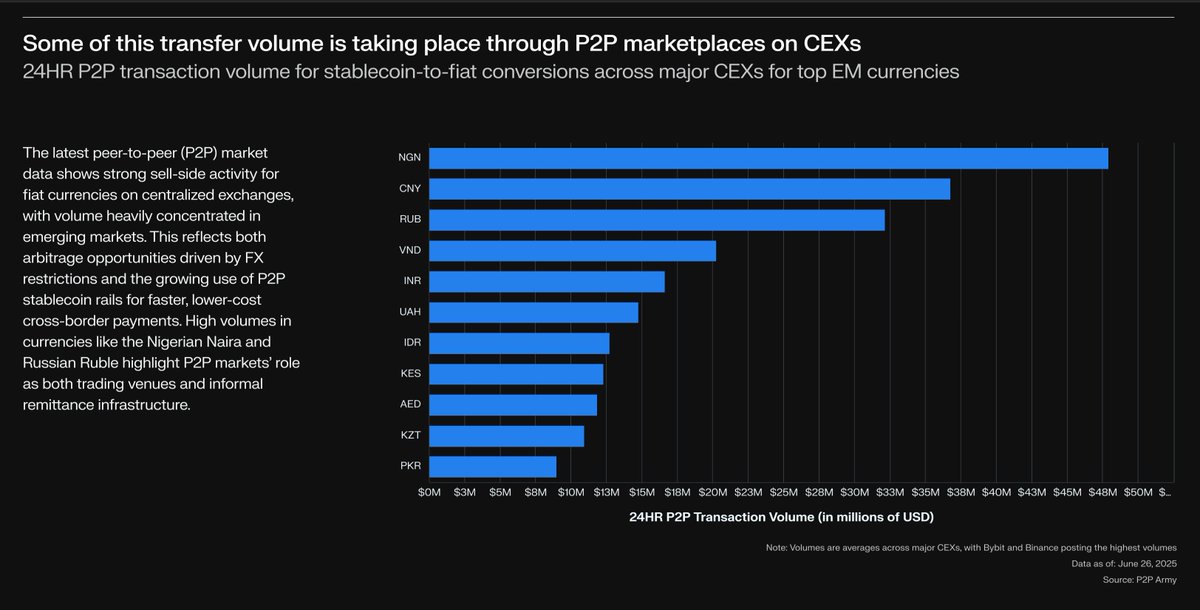

P2P volumes already show the shift. NGN, CNY, RUB dominate stablecoin sell-side flows. This is not just trading. This is FX and remittance infrastructure forming outside the banking system.

The next reserve currency might not come from a state. It might be collateralized by crypto, issued by code, and adopted P2P.

Not a dollar world. Not a yuan world. But a multipolar, permissionless one.

Stats from 👇 Read to learn more

Show original

15K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.