Why ICM - Internet Capital Markets?

- The trend of fundraising in web2 has been declining in recent years. It sounds hard to believe because people have been investing in startups there for a long time. However, this year has witnessed a record drop in the U.S. fundraising market over the past 9 years.

- Everything the U.S. does is driving Crypto, it's very clear. The same goes for fundraising.

=> The trend of fundraising is shifting to web3.

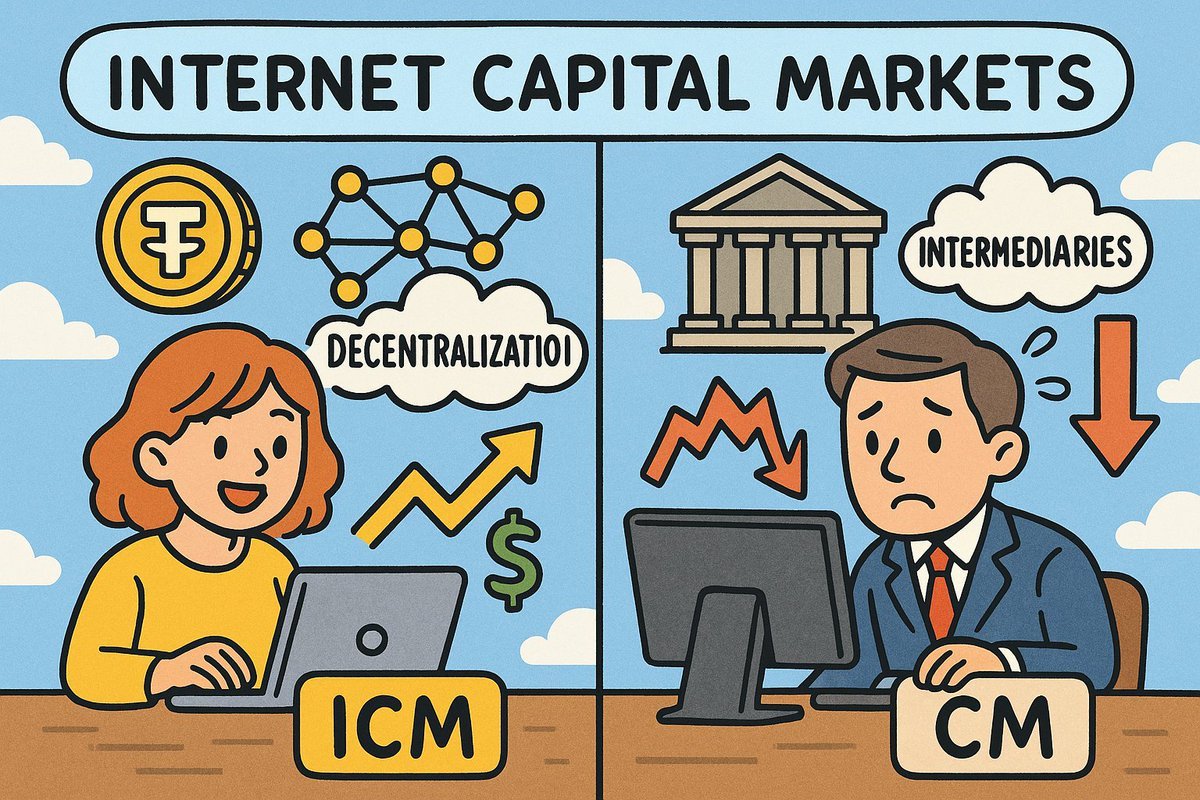

- ICM represents a model change in fundraising, allowing anyone to tokenize ideas, applications, or communities on-chain, overcoming traditional barriers like venture capital or IPOs.

- ICM leverages the scalability of Solana to democratize fundraising activities. Projects related to ICM align with the trend of tokenizing real-world assets (RWA) and innovation in DeFi.

Potential projects:

- Leader narrative: $LAUNCHCOIN. Represents the keyword ICM, backed by Solana with a $1M investment.

- Representative memecoin: $GOONC

- $PCULE: A project supported by Polymarket. The product has demand, generates volume, and collects fees. Invested $500k by top 1 Solana ventures.

- $AIXBC: A decentralized venture focusing on the ICM project group. Strongly supported by the Launchcoin team.

- $DUPE: Among the top leaders, has a strong web2 business model. Not prioritized much due to a fairly average cap and the web2 business model not being attractive enough to drive tokens in web3. However, it is also a safe choice if entering the ICM ecosystem.

- $VIRUS: A platform built for socialfi games. It is the second project announced to be supported by Launchcoin.

- $ORGO: A project developing Computer, a type of DePIN but focusing on computer resources for developing AI Agents. It is the first project officially announced to be supported by LAUNCHCOIN.

On the Base side, there are 2 projects: $RIZZY and $YUUKI, which I shared information about in the livestream, just noting here for those who missed the information.

Internet Capital Markets is the next trend. 🚀

This is a project that received $1M from the Solana Foundation, leading the keyword ICM.

When updating about the fundraising, I realized a clearer overall context; clearly, large organizations are one step ahead and are being led by major institutions. It’s not coincidental during this period:

+ The United States is approving the stablecoin bill, promoting asset tokenization on-chain.

+ Ondo Fi and Solana are continuously discussing the keyword Internet Capital Markets. They are developing products related to tokenization, especially fundraising through on-chain. Upcoming is the promotion of DeFi projects to expand utility for RWA.

The global fundraising trend is shifting, which few people see, from web2 to web3. Internet Capital Markets is the trend that is coming.

The keywords will be:

- Which launchpad will help ordinary users access the fundraising market in the United States?

- Which financial applications will promote utility for tokenization?

#Launchcoin is a launchpad platform that helps issue tokens with just a tweet on X. It is accessible and easy to use for audiences outside of web2. It is the first project to receive $1M in funding through the recent hackathon from the Sol Foundation.

Launchcoin does not compete with Pumpfun or Bonkfun but targets the KoL segment, web2 businesses wanting to enter web3.

The project will soon have updates on the launch mechanism, allowing owners to buy a portion of tokens right from creation, similar to pumpfun. It allows for vesting to reduce sell pressure like Jupiter Studio.

And more importantly, if we mention the keyword ICM - Internet Capital Markets, currently at Sol, LAUNCHCOIN is the representative with a token. Solana has been continuously shilling the keyword Internet Capital Market over the past month. And tweets directly about the project show the role and position of Launchcoin in the current Solana ecosystem.

Tomorrow I will have a livestream on YouTube, everyone remember to join to hear me share more about the ICM ecosystem.

11.91K

30

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.