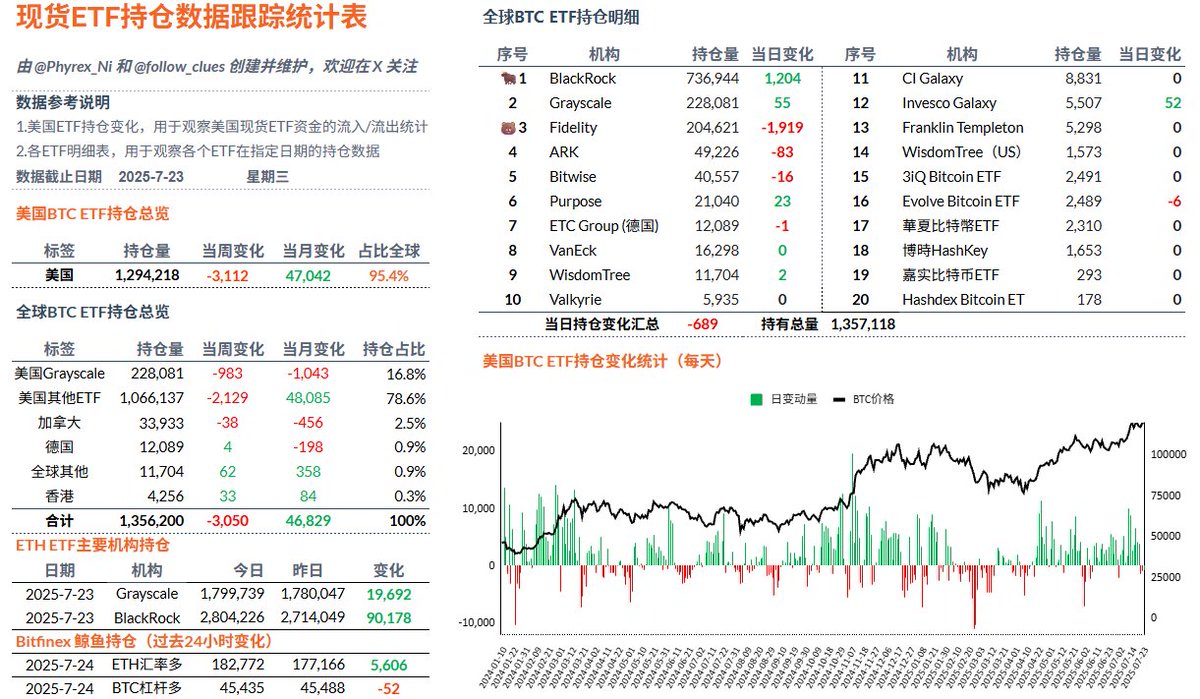

Wednesday's $BTC spot ETF was not very good, with net outflows for the third day in a row, even though BlackRock's investors had more than 1,200 Bitcoin inflows, which were beaten by Fidelity's outflows of nearly 2,000 BTC.

Although it has been an outflow in the past two days, the outflow is not much, it should be at a relatively normal level, and some investors have lifted the FOMO state, but there has been no large sell-off, mainly maintaining a wait-and-see situation.

Data Address:

This article is sponsored by #Bitget | @Bitget_zh

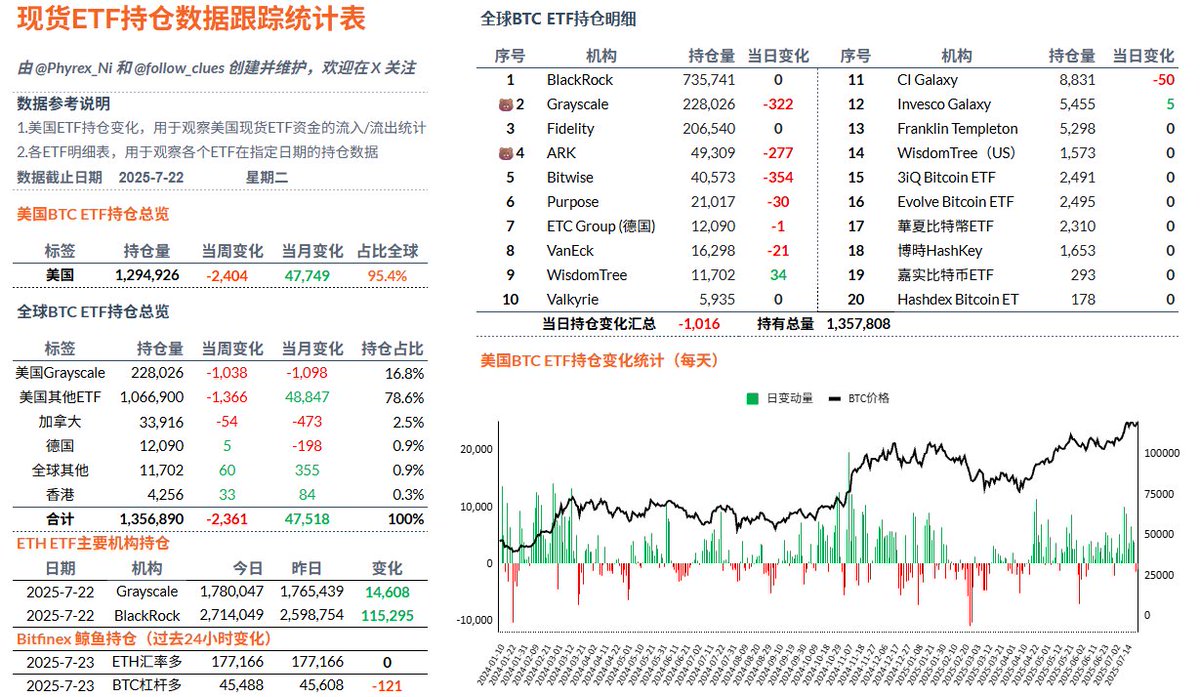

连续第二天 $BTC 现货 ETF 的数据出现净流出,虽然流出量也不大,但也说明了投资者的 FOMO 情绪在逐步的消退,价格的震荡频率会更高一些,而净流出的主要原因还是贝莱德的投资者连续第二天没有流入,数百枚 Bitcoin 的净流出对于 BTC 现货不会有什么影响。

但就像在周报中说的一样,目前 BTC 的上涨并不是因为购买力多强,而是因为抛售降低,所以当抛售上升,购买力下降的时候,自然价格就会有更多的震荡,但并未到改变 BTC 叙事的程度,市场的主要博弈还是在关税和货币政策上。

数据地址:

本文由 #Bitget | @Bitget_zh 赞助

76.95K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.