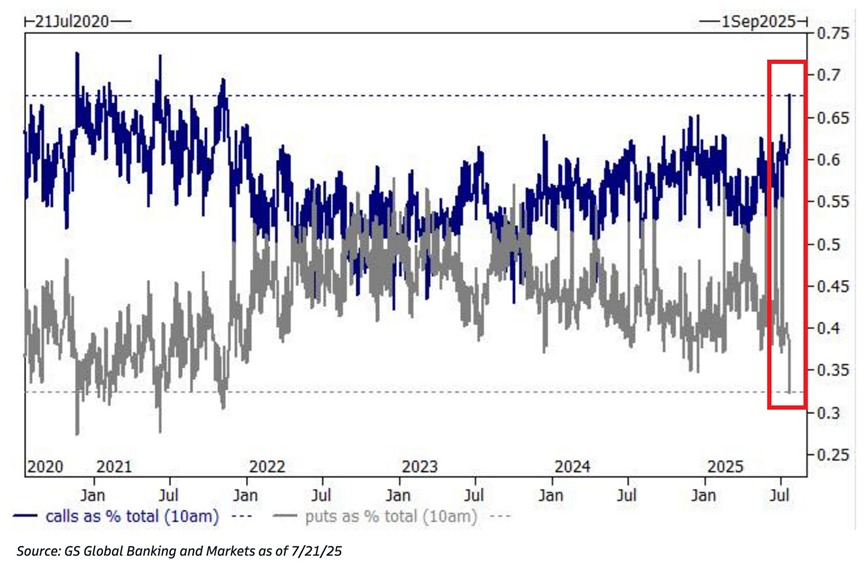

Risk appetite is through the roof:

Call options now reflect ~68% of all options market volume, the highest since 2021, according to Goldman Sachs.

This is only below the meme stock frenzy peak of ~72% in 2020-2021.

By comparison, this percentage hit ~42% at the lowest point during the 2022 bear market.

Meanwhile, Opendoor’s, $OPEN, dollar volume traded as a share of its closing market cap hit a record 298%.

This is nearly as high as Gamestop’s, $GME, peak volume of 316% on January 25th, 2021.

Speculation is back in full force.

Show original

84.49K

584

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.