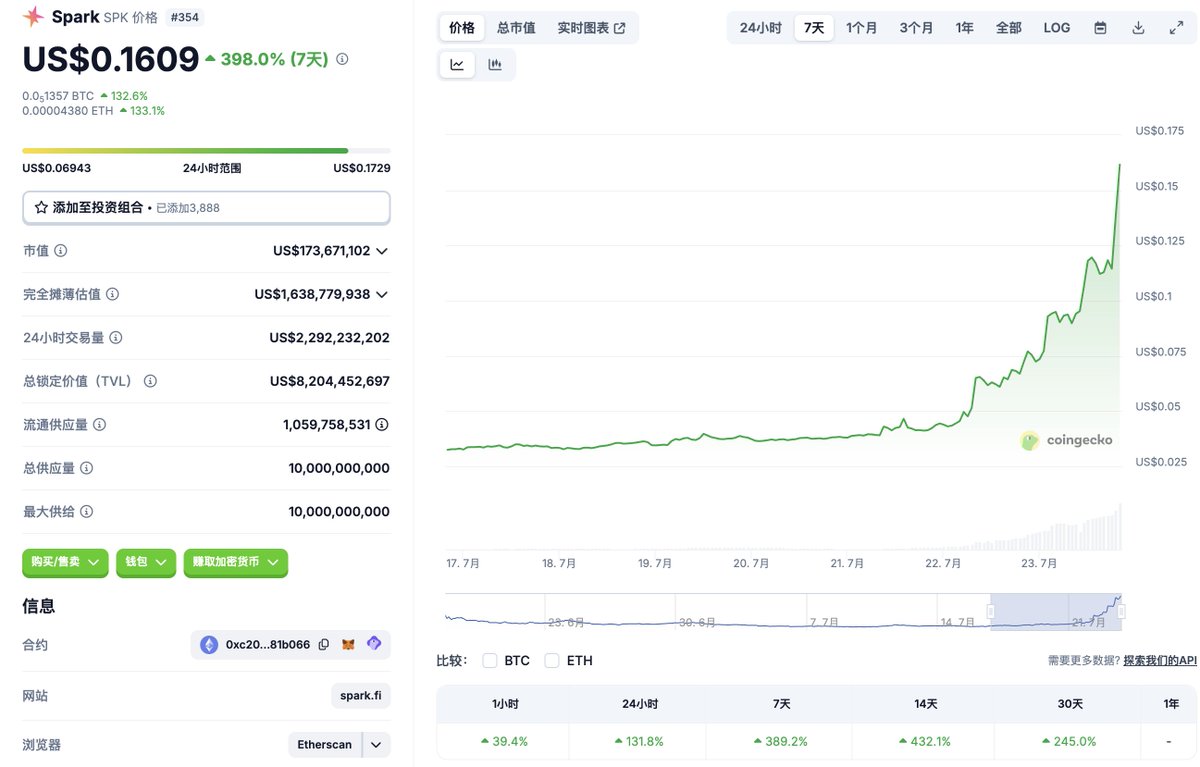

$SPK has risen over 100% in a single day. Taking this opportunity to discuss the situation of Spark and the entire lending market:

1. Valuation:

There was definitely some undervaluation before, but this surge is likely due to high control. Currently, the FDV (1.6 billion) is close to Morpho (1.9 billion). Of course, the market cap is still relatively low, and rationally speaking, it’s about right. It could surge further, but the volatility makes it unpredictable.

2. Position and Development:

This is not FUD; I personally still pay attention to its development. From a fundamental perspective, relying on MakerDAO, the TVL is definitely not lacking, and this alone is a moat.

However, it’s currently quite difficult to capture Aave's market. Essentially, it’s in T2 with Morpho and Compound, and below T3 are Euler and Silo. The lending space is very competitive, but now with compliant stablecoins and RWA expectations, there are new topics emerging.

If these two new topics unfold, it could essentially benefit the entire lending market. For the current landscape, changes may not be significant unless a project can secure very good resources. In that case, overtaking is possible, but as it stands, Aave still holds the most advantage. Spark also has potential because MakerDAO is involved with RWA, so this is worth keeping an eye on.

TVL 4.8 billion, the third-ranked lending protocol, Spark $SPK surged 80% in a single day, with almost no discussion on the timeline. Instead, the screen is filled with hype during the bull run, it seems the market is really light.

118.91K

74

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.