6 of Intern's favourite YTs now 🧵👇

Note: non-medical advice for the health of your portfolio, these are mere toilet ramblings of an intern in between his main task of coffee runs

1️⃣ YT-USDS

$SPK up more than 3x in less than a week which makes this short-dated YT an extremely attractive play for some fast action $SPK / Spark Points stacking 👇

ICYMI $SPK has MASSIVELY repriced with a WoW gain of +194%.

This makes the near-dated YT-USDS pool EXTREMELY interesting as a high delta play on $SPK price action. With maturity in our sights, it's also VERY straightforward to calculate end points AND breakeven threshold for 🪂 allocation.

Let's take a look 👇

______________________________________________________

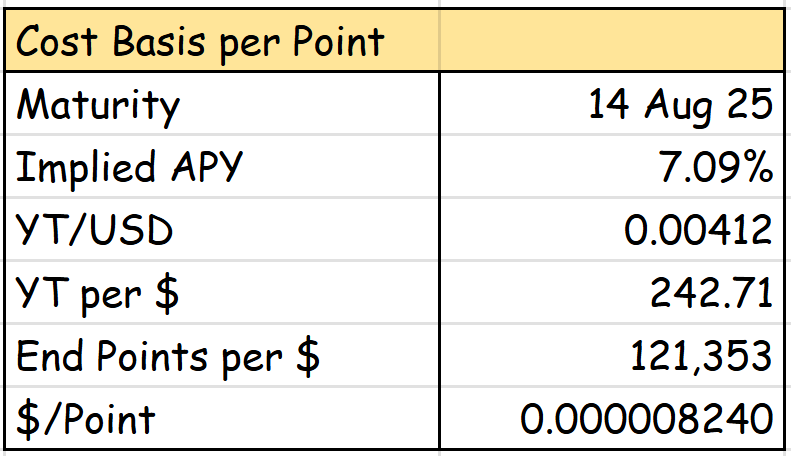

Step 1: Calculating YT-USDS' cost basis per point

The current USDS pool prices Implied Yield at 7.09% APY, meaning $1 gets you ~$242 of principal exposure.

Each $ is farming 25 $SPK points PER DAY which adds up to ~120k points at 🪂 date since the snapshot is taken on 12 August as per @sparkdotfi's docs.

This gives us our cost basis per $SPK point ($/Point).

______________________________________________________

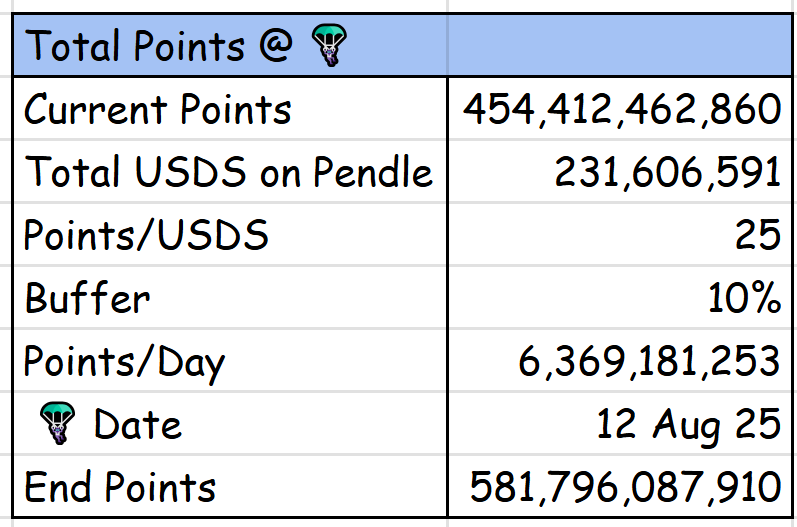

Step 2: Calculating Total Points @ 🪂 Date

Kudos to Spark for maintaining real-time point tracking which gives us the basis for Current Points.

From there, we know there's ~$230m in @pendle_fi SY-USDS contract that's earning 25 Points/$/day.

After applying a 10% buffer (assuming 100% of deposits are receiving the 10% referral boost), the intern conservatively predicts ~580b $SPK points at maturity.

______________________________________________________

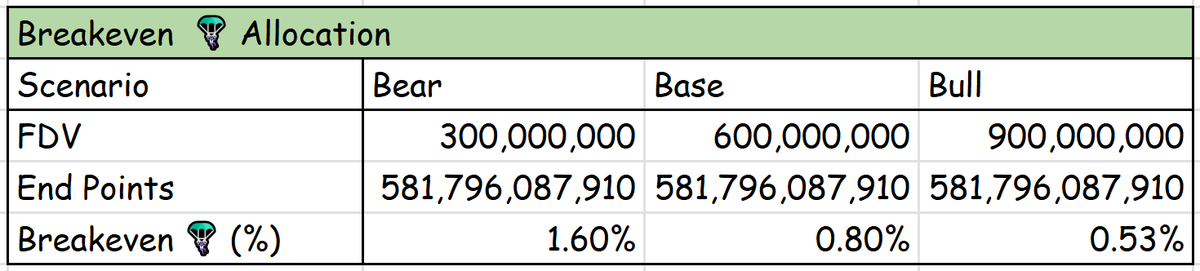

Step 3: Calculating Breakeven 🪂 Allocation

We know:

👉 Some % of $SPK supply will go to $SPK point

👉 Est. number of $SPK points at 🪂 date.

What we don't know is:

👉 $SPK's FDV at maturity

👉 🪂 Allocation to be given to $SPK Points

What I can do is present the BREAKEVEN 🪂 (%) based on different $SPK FDVs:

📌 300m FDV → 1.60% 🪂

📌 600m FDV → 0.80% 🪂

📌 900m FDV → 0.53% 🪂

Based on your expectation of $SPK's FDV and the actual 🪂 allocation to point holders, you can make a good assessment of the RoI for buying YTs!

______________________________________________________

Fun Notes:

This is one of the first cases where the 🪂 is fully concentrated to Pendle users, meaning RoI of said 🪂 is inversely related to USDS supply on Pendle.

With USDS supply settling, it ultimately means MORE 🪂 per $ - perhaps more so than my original projections 🧐

______________________________________________________

Now of course, the intern will NEVER tell you what to buy and when to buy it. It's now up to you to:

1. Predict $SPK FDV

2. Predict 🪂 Allocation

3. Win

It's up to you now little guy.

NFA NLA NMA MDMA

Pendiddler

2️⃣ YT-USDS (SPK Farm)

In a similar vein and logic but with more clarity on exactly how much $SPK you'll be getting (just look at the Underlying APY)

9,900% Long Yield APY at time of writing

what a 200% rally does to a mf

@sparkdotfi YT-USDS (SPK Farm) had just gone from a 95% win rate to a well... okay the win rate is still the same BUT everyone is winning much HARDER than before

3,290% Long Yield APY at time of writing

And if you bought earlier at a lower entry, your Pendle YTs could be pumping out yield at a rate of 5 digit APYs now from $SPK 🫣

3️⃣ YT-gUSDC

Market up? Market down? Doesn't matter.

As long as there's volatility and the market is actively trading, the first thing your mind should turn to is @GainsNetwork_io gUSDC.

As you can see, thus far gUSDC Implied APY (green line) has never been lower than the Underlying APY (purple line) aside from ONE occasion.

With the market being on a run, gUSDC is raking in even more yield now.

132% Long Yield APY at the time of writing.

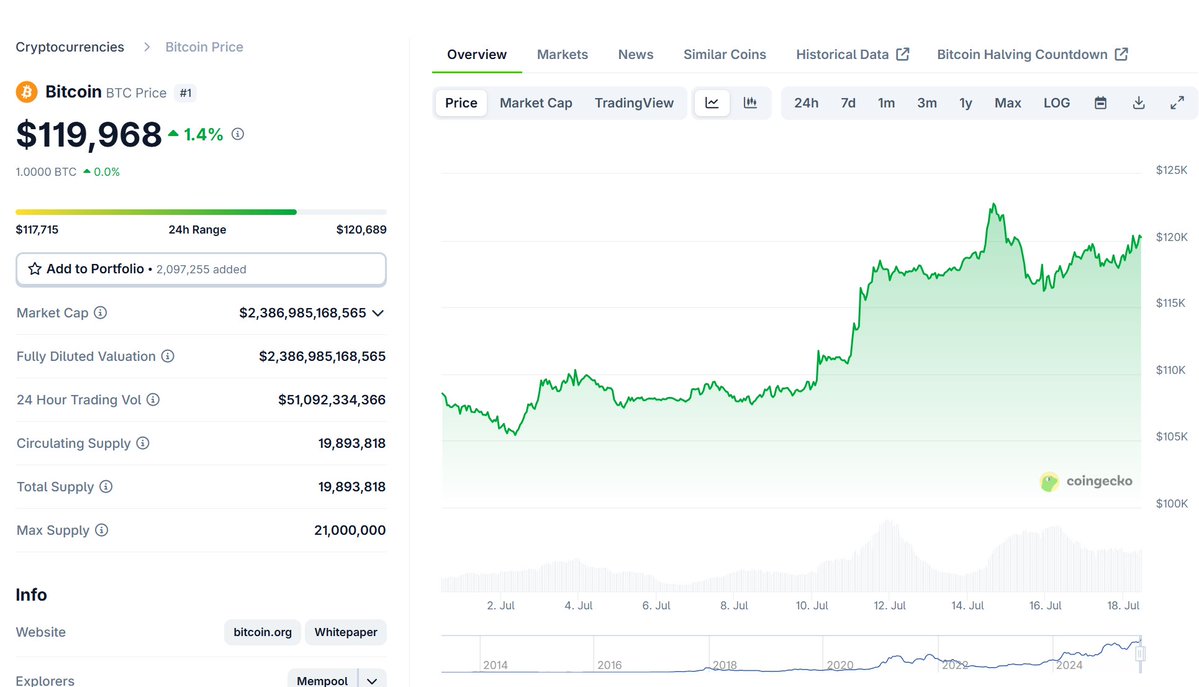

5️⃣ YT-sUSDe

It's simple - market up, $BTC up (not to mention $ENA too) means sUSDe up up uppppp 🚀

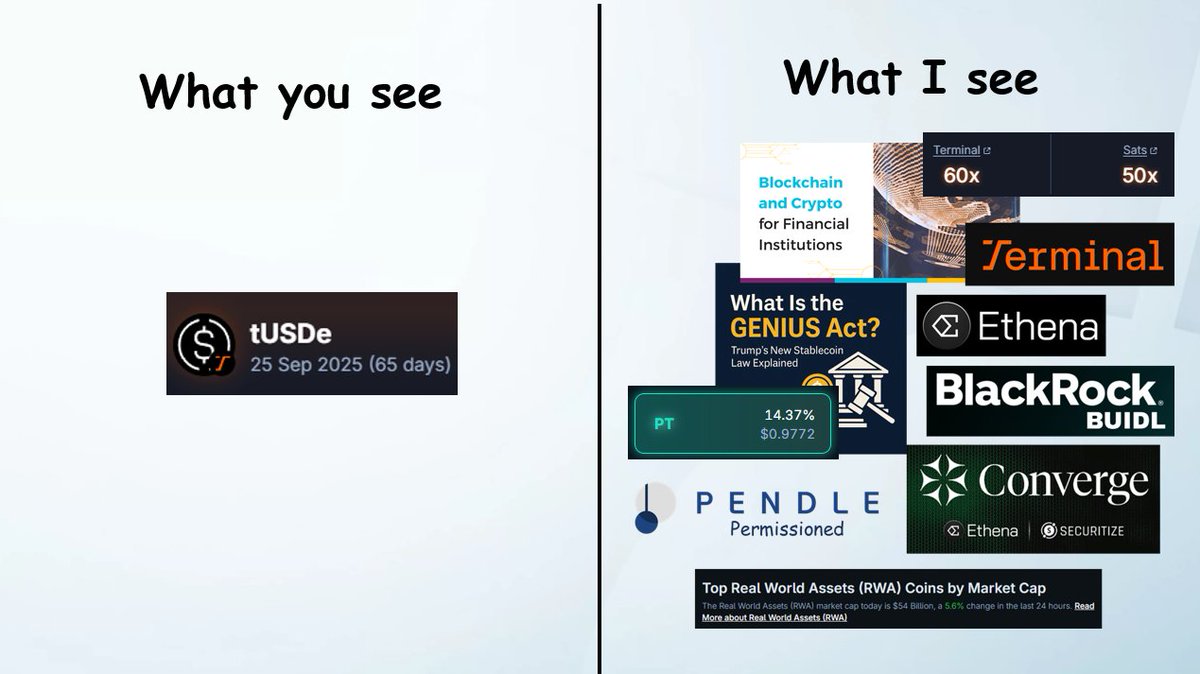

6️⃣ YT-tUSDe

$ENA is up big, Terminal is basically part of the Ethena ecosystem (i.e. ENA beta)

Couple ALL of these with the fact that Terminal is setting up for the rails for TradFi insti money? 😮 💨

"What we're looking at here, what you're buying here is not just "another stablecoin", it's the friggin gateway to DeFi yields for TradFi institutions"

Terminal tUSDe is being massively overlooked now 😴

Aside from sUSDe (Jul 2025) which is expiring next week, this is the highest @ethena_labs fixed yield now at 14.37%

Momentum-wise, this has the argument to be the most narrative-charged stablecoin:

🔹RWA + stablecoin exposure, both of which are picking up thanks to friendly regulations (especially in the US) and increased attention from our TardFi friends

🔹Key player in the "Pendthena" ecosystem, which will form the liquidity hub and foundation for Pendle Permissioned + Ethena's iUSDe (KYC-compliant version of sUSDe)

🔹YTs are tempting too considering $ENA is up ~44% in the past week and this has one of the highest 50x Sats exposure + Terminal Roots, which again both of which are part of the Ethena ecosystem

What we're looking at here, what you're buying here is not just "another stablecoin", it's the friggin gateway to DeFi yields for TradFi institutions.

18.76K

64

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.