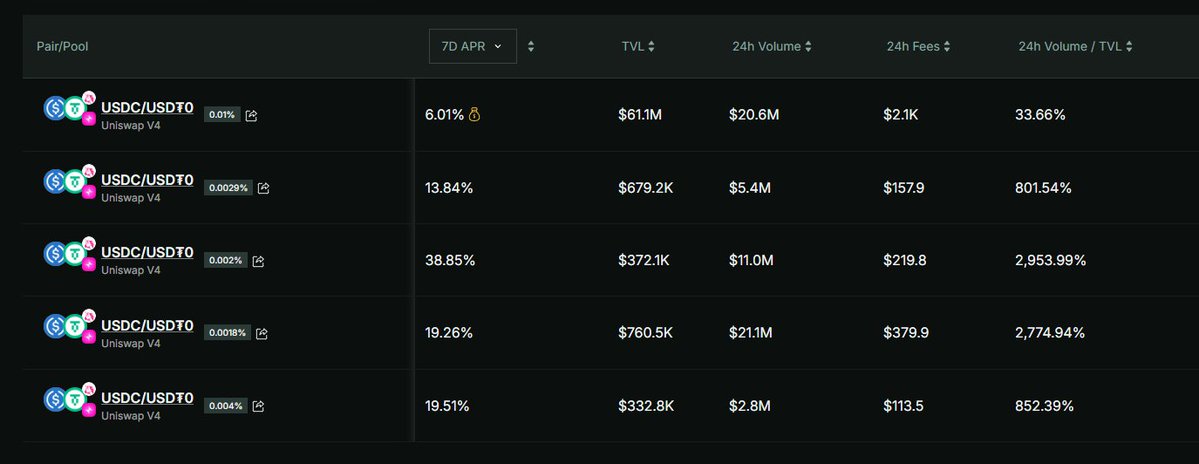

With Uniswap v4, the introduction of multiple fee tiers per pair has opened up new strategies for LPs to optimize yield.

Take the $USDC/ $USDT (0.002%) pool as an example:

It currently offers an impressive 38.85% APR

With only ~$372K in TVL

And a massive 2,953% volume/TVL ratio

The ultra-low fee attracts large volumes, which in turn boosts fee generation — even for stable pairs.

This shows how smaller fee tiers, when paired with high efficiency, can outperform larger pools in raw yield.

LPs now have more tools than ever to fine-tune their risk/reward.

#UniswapV4 #DeFi #KrystalApp #LiquidityProvision

Show original

2.99K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.