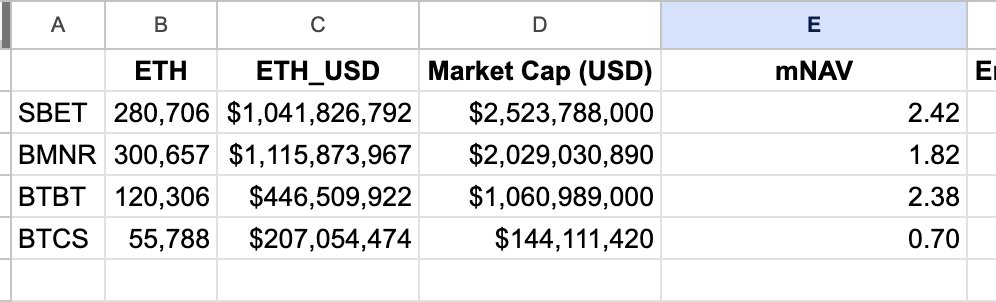

Looking at top 4 ETH treasury companies rn, mNAV is reasonable ~2x. This is close to MSTR's and thus fair.

It is odd that they're trading at fair multiple of BTC-backed treasuries despite more volatility and higher upside when ETH appreciates in the short-term. Remember, also, that as they accumulate, ETH will experience supply shocks which will reflexively "overshoot" their mNAV.

To me, this is an opportunity: as ETH shoots to $10K, mNAV collapses, and market reacts by playing catch up. This overshoots mNAV to a range of 5x-10x at which point, profit-taking makes sense.

If this happens, then SBET would be trading at $14B (14x from here). You can be more conservative w/ ETH (only $5K) and/or lower peak mNAV but the conclusion still the same: all four are under-valued.

Thinking 50% in SBET and then 50% across the other three, with a bias for BMNR and BTCS due to their low mNAV. Options with 3mo to 6mo expiry.

Show original

2.99K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.