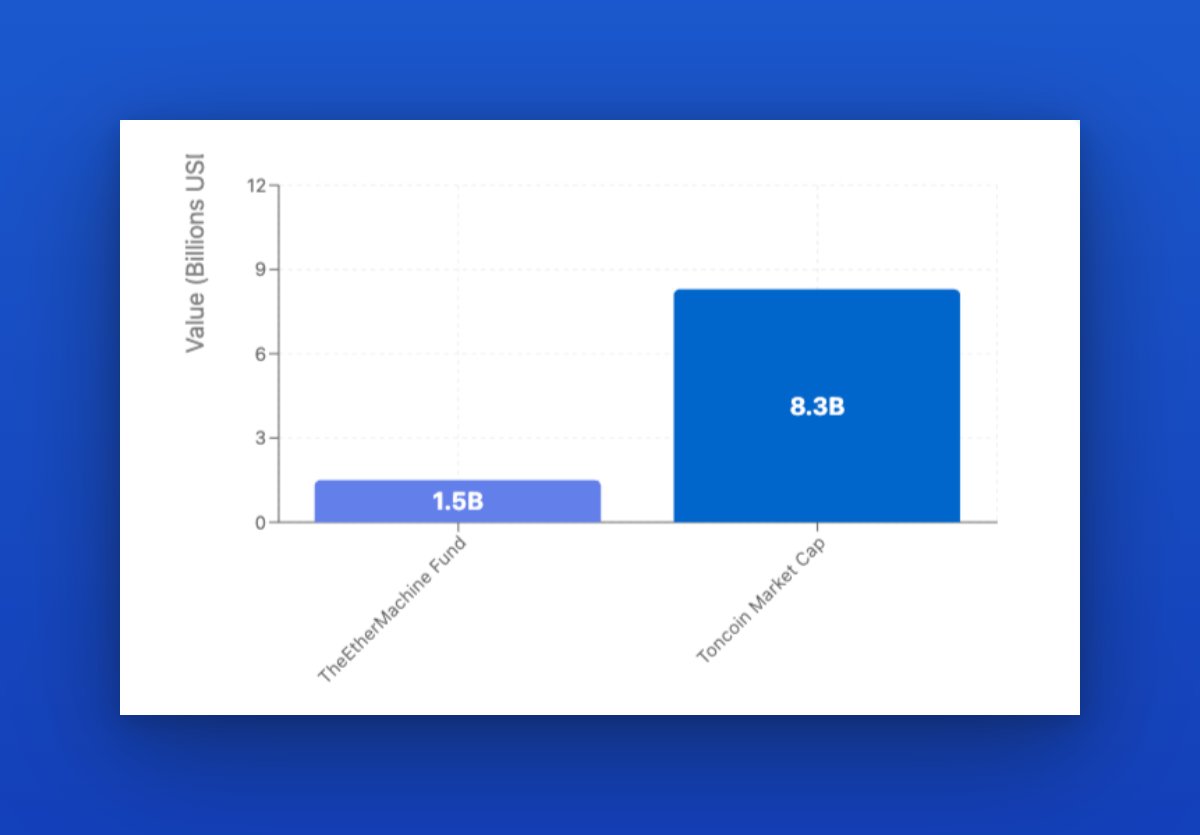

Yesterday, the @AK_EtherMachine at @TheEtherMachine announced $1.5B DAT for the company in the US Stock market.

I know most of my audience focuses on @TON_Blockchain and @Telegram, and since we are not well-known outside of the $TON world, what does $1.5B mean?

It's 18.5% of the current market cap of TONcoin.

"Dude, wake up!"

This means: if you just bought $TON three years ago (like me), your ROI will be much lower than the market beta (aka $BTC or $ETH).

Why? The short answer is the overselling by whales or early investors. But I also think the ecosystem projects lack enough confidence in "market cap management," which leads to an insufficient "positive" cycle or flywheel effect.

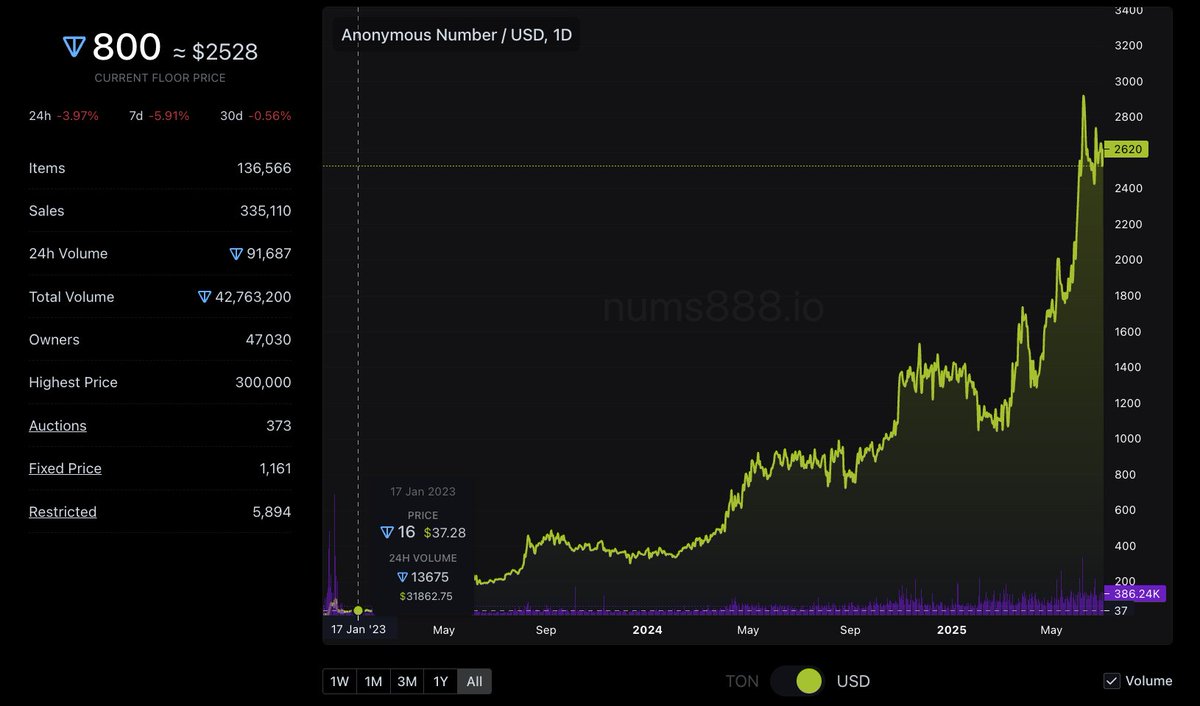

Of course, this is all in hindsight; if you started buying +888 NFT phone numbers two and a half years ago, your ROI would be approximately $40 -> $2,600.

It's 65x in 2.5 years.

This is also why I am very optimistic about the gift market -- because it is a new independent ecosystem that relies on @telegram's social attributes.

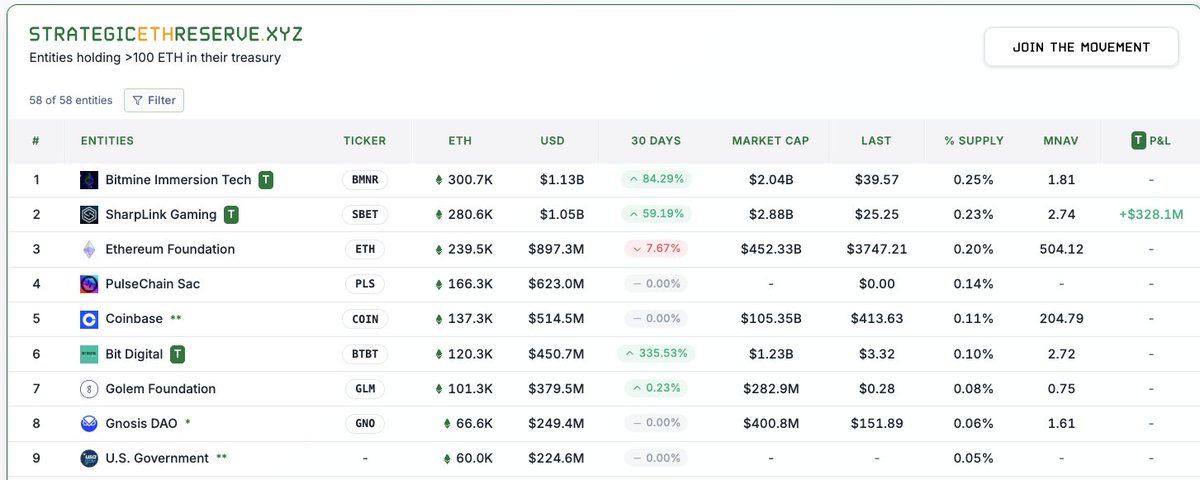

Comparison table with other $ETH DAT:

Nice works, @fabdarice

5.1K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.