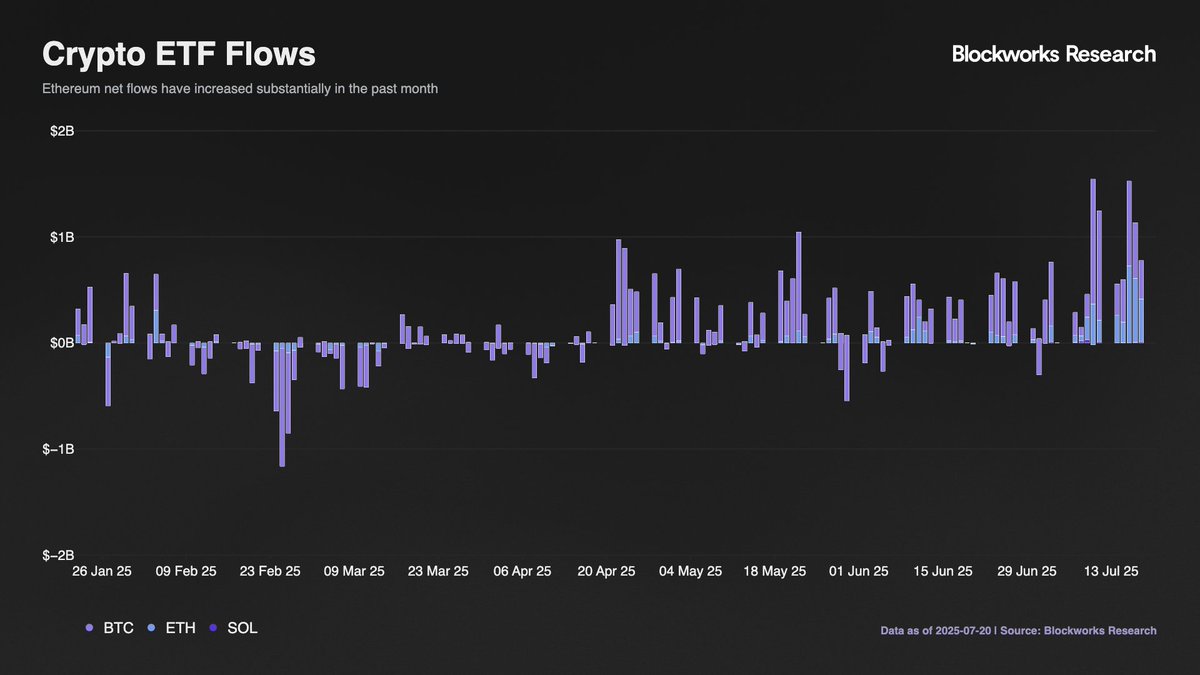

1/ July 2025 marked a turning point in crypto ETF adoption.

Ethereum ETFs broke records, attracting $3.24 billion in total net inflows for the month.

This surge signals a significant maturation of the market and growing institutional conviction in $ETH.

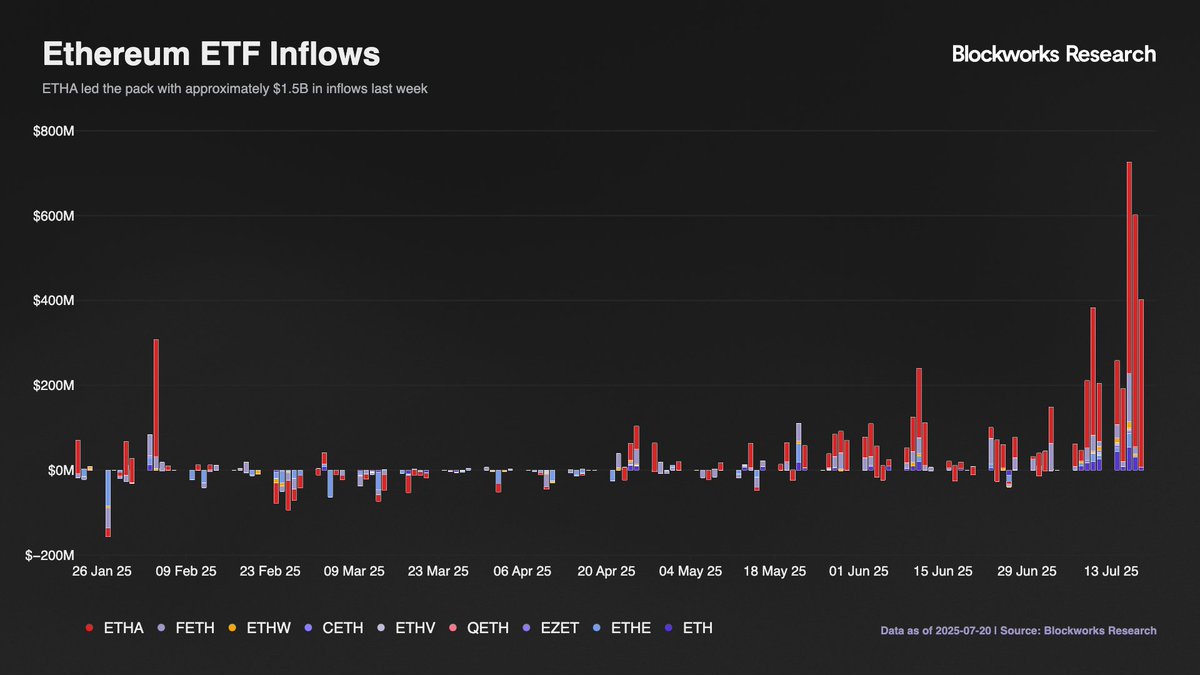

2/ The daily flow data reveals sustained demand. The peak was reached on July 16 with a record $726.6 million single-day inflow.

This momentum was maintained with multiple days exceeding $400M, showcasing consistent institutional accumulation throughout the month.

3/ BlackRock’s iShares Ethereum Trust ($ETHA) has emerged as the clear market leader.

The fund single-handedly attracted over $8 billion in July inflows, growing its total Assets Under Management (AUM) to $8.8 billion and demonstrating robust institutional confidence.

4/ This inflow dominance was driven by deep institutional demand, not just speculative trading.

Throughout July, corporate treasuries added over 600,000 $ETH to their balance sheets, and significant whale activity drew down exchange reserves to critically low levels.

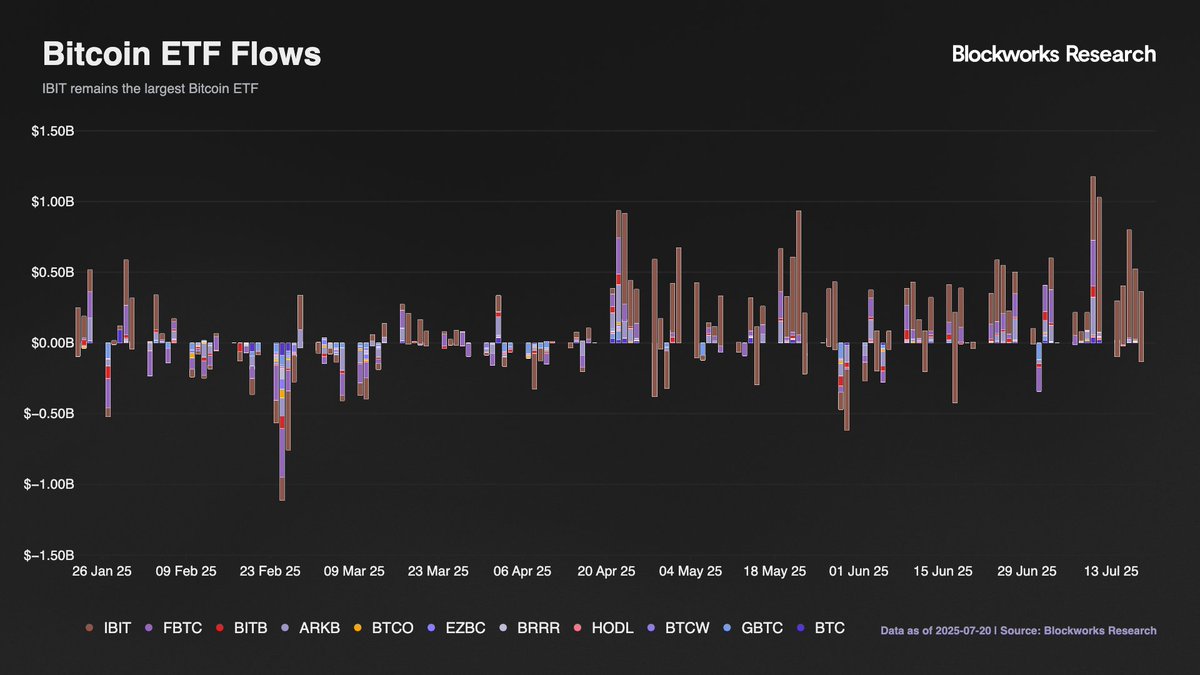

5/ $ETH ETFs outpaced their Bitcoin counterparts for the first time.

On July 17, Ethereum ETFs captured $602 million compared to Bitcoin's $522.6 million, marking a potential paradigm shift in institutional asset allocation strategies.

6/ Future catalysts are already on the horizon. BlackRock has filed with the SEC to add staking capabilities to its $ETHA ETF, which could introduce a yield component for investors.

This, combined with advancing regulatory clarity from acts like the GENIUS and CLARITY Acts, strengthens the long-term outlook.

7/ In conclusion, the July performance has solidified $ETH as a core institutional asset.

Subscribe to Blockworks Research to get full access to crypto ETF data.

3.8K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.