On Friday, SharpLink Gaming $SBET experienced a significant pullback, dropping from an opening high of $39 to $29, a decline of over 20%.

The reasons behind this, aside from profit-taking, are more related to the drop in June, as the ATM (At-the-Market) issuance limit expanded from the original $1B to $6B, which directly broke the previous dilution ceiling, raising market concerns.

I actually explained some of the reasons for this in my previous tweets:

1⃣️ The additional financing through issuance is necessary to acquire funds to buy ETH, thereby surpassing BMNR to become the top coin holder.

2⃣️ Is continued issuance good or bad? This is a very critical question: Can SBET increase the ETH content per share through continued ATM financing + buying ETH?

If this is something expected, why is the market so panicked? I think one reason is that the speed and magnitude of the financing breakthrough exceeded everyone's expectations.

In fact, since May, $SBET @SharpLinkGaming has already conducted three rounds of financing, raising over $800 million. However, the spending rate is too fast, and this money has all gone into ETH for interest. Facing the watchful $BMNR, it is necessary to strike earlier and faster to gain funding and market attention.

According to U.S. securities law, there are clear registration financing limit restrictions, where the "$1B limit" applies to certain small issuers, which also applies to SharpLink Gaming.

SBET submitted a new S-3/A filing to apply for breaking this financing limit and raising another $6 billion from the market.

Will the application definitely be approved? The answer is no.

1⃣ The S-3 registration form allows financing, but within 12 months, it can raise no more than 1/3 (about 33.3%) of its Public Float.

📌 Current data for SBET:

Market cap: approximately $2.79B, Public Float estimated at 85% ≈ $2.37B. Baby Shelf financing limit ≈ $2.37B × 1/3 ≈ $790M.

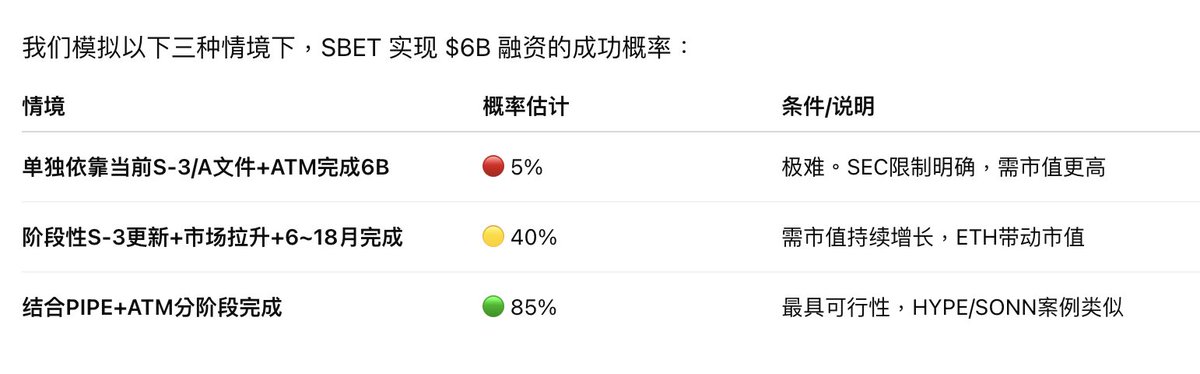

$6B is $6 billion, which is far too much, exceeding more than twice the entire company's market value. I had AI evaluate several achievable paths and their respective success rates.

So:

➡️ This dilution is unlikely to happen all at once;

➡️ The $6B financing target seems more like a strategic upper limit rather than a one-time action;

Using PIPE, strategic investments, mergers, etc., along with phased ATM usage, is the high-probability path to realization;

➡️ If ETH surges, SBET can use the rising market value to "roll" and unlock higher ATM space, which is a realistic operational path.

Thanks to @bruce_aiweb3 for the addition. SBET indeed proposed a key resolution in its July 24th shareholder meeting notice: to increase the number of authorized common shares from the current 100 million (100M) to 500 million (500M).

The proposal to increase to 500 million shares is a prerequisite for whether this 6B ATM can be initiated. The public float must meet the threshold of the S-3 Shelf Rule.

If this capital expansion + stock price support + successful execution of the ATM raises the public float, it can bypass the Baby Shelf Rule restrictions and fully implement the 6B financing plan.

Of course, there are also some conversion issues, including that authorized capital does not equal circulating shares, and when to sell how much to meet the requirements. We'll see as we go, and write as we observe.

45.65K

77

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.