Bitcoin has $1.3T in market cap but the majority of the tokens sit idle.

@Lombard_Finance is changing that.

They’re building on-chain capital markets for BTC, starting with LBTC, the fastest-growing yield-bearing token in crypto.

Here’s how they’re unlocking BTC 🧵👇

2/ Introduction

Launched in 2024, @Lombard_Finance introduced LBTC, a liquid, yield-bearing version of Bitcoin.

In just 92 days:

- $1B in TVL

- $2B+ liquidity across 12 chains

- 80% of supply active in DeFi

- Vaults activated $600M+ in new ecosystems

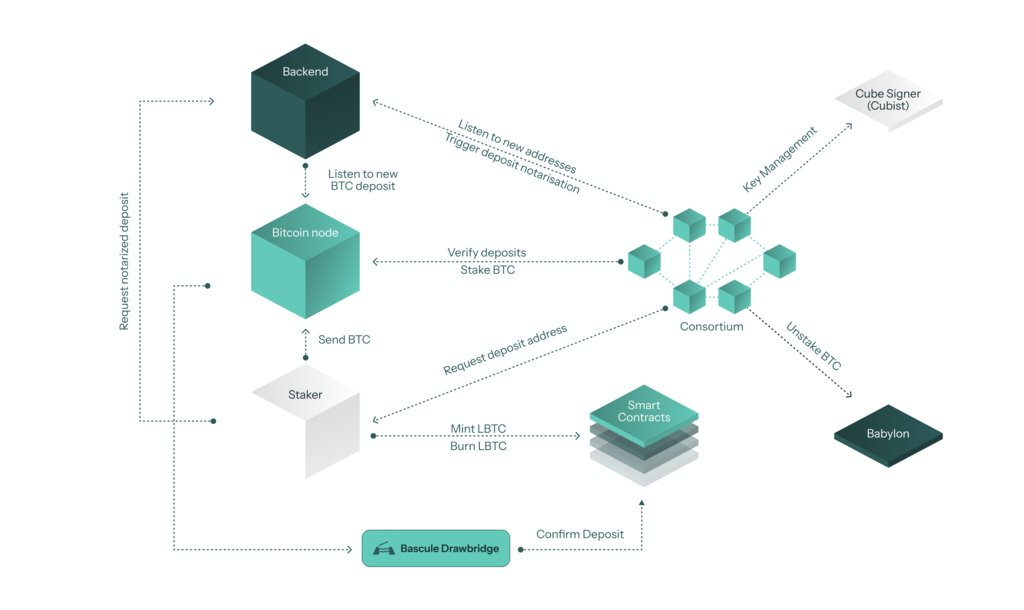

4/ Lombard x Babylon

Lombard builds on top of @babylonlabs_io which is like EigenLayer for Bitcoin.

Here’s how it works:

→ Users stake BTC

→ Babylon secures PoS networks

→ Lombard wraps staked BTC into LBTC, unlocking yield + DeFi liquidity

Everyone wins basically.

5/ But why not stake directly with Babylon?

Because native BTC staking means locked liquidity.

That’s exactly what @Lombard_Finance are fixing here:

→ LBTC is 1:1 BTC

→ Liquid

→ Cross-chain usable

→ Earns Babylon yield + Lombard Points

6/ The goal?

Be to Bitcoin what Circle was to stablecoins.

Lombard isn’t just building infra - they’re creating the liquidity flywheels and will eventually bring BTC fully onchain.

Seems that the mission has been successful so far.

7/ TL;DR

@Lombard_Finance is:

• Powered by LBTC

• Building on Babylon

• Unlocking staked BTC for DeFi

• Backed by top institutions

• Already powering $2B+ in liquidity

Is the idle BTC era coming to an end?

10.65K

192

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.