cash is the ugliest position in a bull market

until the music stops and you’re the only one left holding a chair

the art of holding cash when everyone else is chasing fireworks

most of crypto twitter calls you a coward the moment your portfolio is >50% stables

they’re wrong, and i’ll prove it

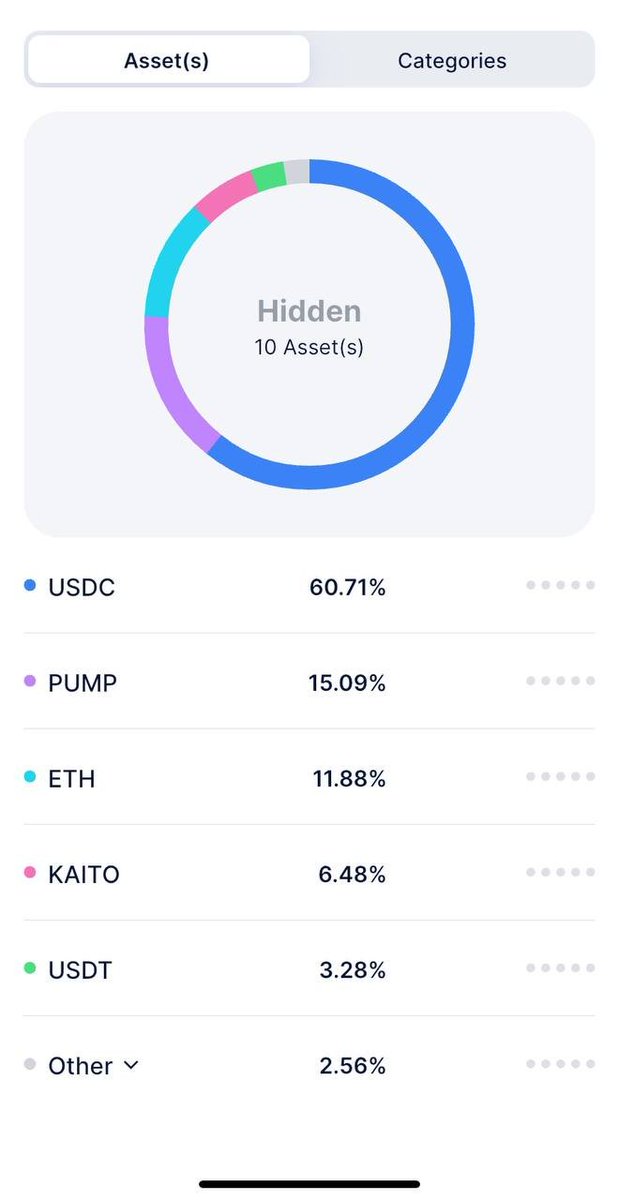

> 63% parked in stables

> 15% already in $pump

> 12% dead-weight $eth

> 6.5% riding $kaito points

> rest spread in dust

i’m not here to clip +20 % while btc can sneeze me -70%

i’m here for the 2021 rerun: public sales every week, 50-100x on day-one vouchers

so until that window opens:

• stables stay stables – dry powder for the first legit sale

• $eth sleeps until we get the staking etf headline. if it pops i rotate, if not it just sits

• next ticket i’m eyeing → $met (@MeteoraAG ) if the raise is fair. @LineaBuild sale right after if they copy arbitrum playbook

• no romance with mid-caps. either triple digit roi or i skip

simple rule: if the fdv at ico means a 2× move needs 3 billion of new money, i’m out

i’d rather earn zero in usdc than chase +20 % and pray btc doesn’t cough

wake me when the sale calendar looks like q1-21 again

1. why dry powder matters more this cycle

2021’s “buy anything and wait” meta is dead. the arena got bigger:

> funds rotate capital faster

> narratives expire in weeks, not months

> airdrop hunters nuke charts the second tokens unlock

sitting 60% in usdc today isn’t apathy, it’s optionality. every panic wick, every forced liquidation, every “rug” headline is a pending limit order waiting for your click

the guy who mocked stables on monday becomes your liquidity exit by friday

2. the three psychological traps of high-cash stacks

a) boredom guilt

watching a green candle without you onboard triggers fomo’s little cousin: 'idle guilt'. cure = track percentage drawdowns, not percentage run-ups history rewards entries on red weeks, not green ones

b) timeline shaming

- “he who hesitates is broke”. yes, twitter loves that quote. notice the loudest shouters never post their pnl

cure = mute, focus, repeat

c) the perfect entry illusion

cash hoarders often wait for 'the level of a lifetime' that never prints.

cure = ladder scale-ins. if 50% of your capital is stables, deploy 10% at each 15-20% dump

you’ll never nail bottoms, but you’ll always be in the arena

3. a cash-heavy framework that actually compounds

step 1: anchor with one high-conviction core

mine is $HYPE. maybe yours is $sol or $btc. keep it at 20% no matter what. reduces analysis paralysis

step 2: carve out 10% thesis tickets

right now mine are:

> @HyperliquidX

> @KaitoAI

> degen meme rotation ( @pumpdotfun )

strict stop = minus 30% from entry or 3 weeks of flat price, whichever comes first

step 3: preserve the holy 60% in usdc/usdt/dai

rules:

> yield farm if apy > treasury +4%

> @aztecnetwork or @RAILGUN_Project mixer once a quarter for fresh addresses

> allocate to new ico only if fdv/annual revenue < 30

4. when to flip the script and go risk-on

- look for three lights to turn green at once:

- btc dominance stalls for 10 consecutive days

- two new ico’s post >3x on day one and hold 2x a week later

funding flips negative across major perp pairs

that combo hasn’t appeared since q1 2024. when it does, drop cash ratio from 60 to 30 in a single shot

anything less is fighting trend momentum with water pistols

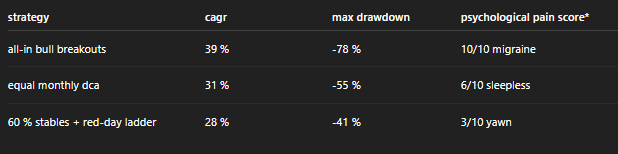

5. What history says about staggered entry vs full send

Back-tests on ETH from 2017-2024, monthly data:

You give up 3% annual CAGR for half the stress. Most won’t, I will.

*Pain = average days underwater / 30

6. closing riff

holding a fat stack of stablecoins doesn’t mean you’re bearish. it means you’re paying yourself in patience

eth 4k? hyper 75? rekt 500m cap? maybe

stay liquid, stay lethal

some call it day 1 of the bear

nah. we just slipped from price-discovery into a range. directionless chop before the next leg

this is still the opening chapter of a new bull. new metas, new narratives, different set of winners

up only is dead but up eventual is alive:

$eth → $4k?

$hype → $75?

$rekt → $500m mcap?

possible

until the range breaks, stack dry powder, track the fresh themes, stay nimble

My fav ct guys

/ @belizardd @DeRonin_ @kem1ks @splinter0n @terra_gatsuki @0xAndrewMoh @KingWilliamDefi @0xJok9r @0xDefiLeo @cryppinfluence @banditxbt @the_smart_ape @AlphaFrog13 @0xTindorr @CryptoVonDoom @eli5_defi @CryptoGideon_ @0x99Gohan @rektdiomedes

9.61K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.