📊 State of Crypto - T2 2025

Amid the explosion in Bitcoin prices, records on stablecoins, and the emergence of new L1s, @TheBigWhale_ has analyzed dozens of indicators to deliver the key trends to you.

🧵 Here’s what to remember.

The crypto market has regained strength

Total capitalization: +800 billion $

Bitcoin ETF: +12.7 billion $ raised

Ethereum ETF: +2.6 billion $

👉 The rebound started right after Trump's announcement of a customs moratorium on April 9

Bitcoin: new peak at $113,000

Bitcoin recorded a 52% increase in Q2

Public companies bought more than ETFs: 131,000 BTC vs 120,000.

👉 Our model shows that the average purchase remains below $50,000 per BTC

We analyzed over 20 technical indicators to build this report

Hashrate, mining profitability, investor cohorts, P/E, FDMC/WAU, real yield…

👉 A thorough job to identify structural trends

Ethereum is making a strong comeback with +58%

The asset is the best performer among large market caps

👉 A resurgence driven by ETFs, legal clarity (not a security), and a TVL increase of $22 billion over the quarter

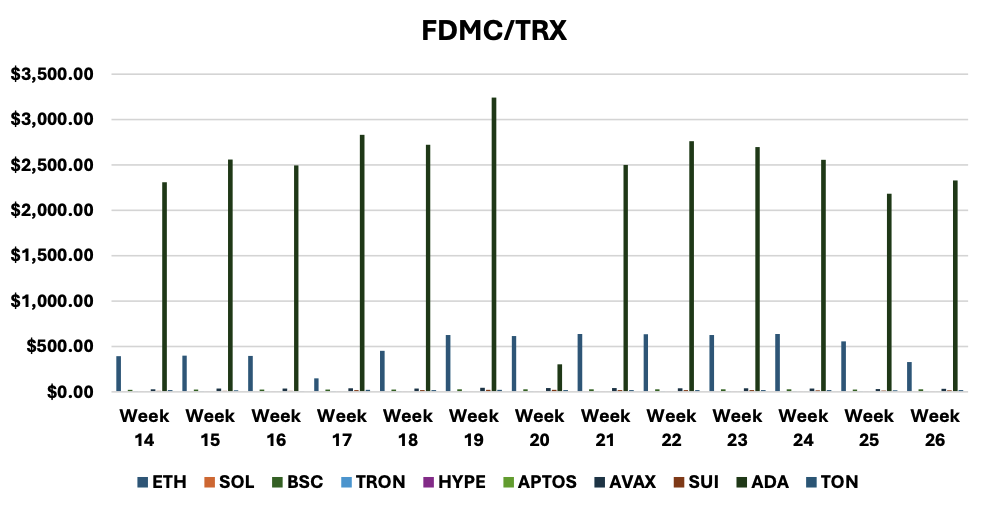

The FDMC/Transaction indicator shows that some blockchains are overvalued.

Cardano remains the outlier with over $2400 in valuation per annual transaction.

👉 Conversely, Hyperliquid shows $0.16 per transaction.

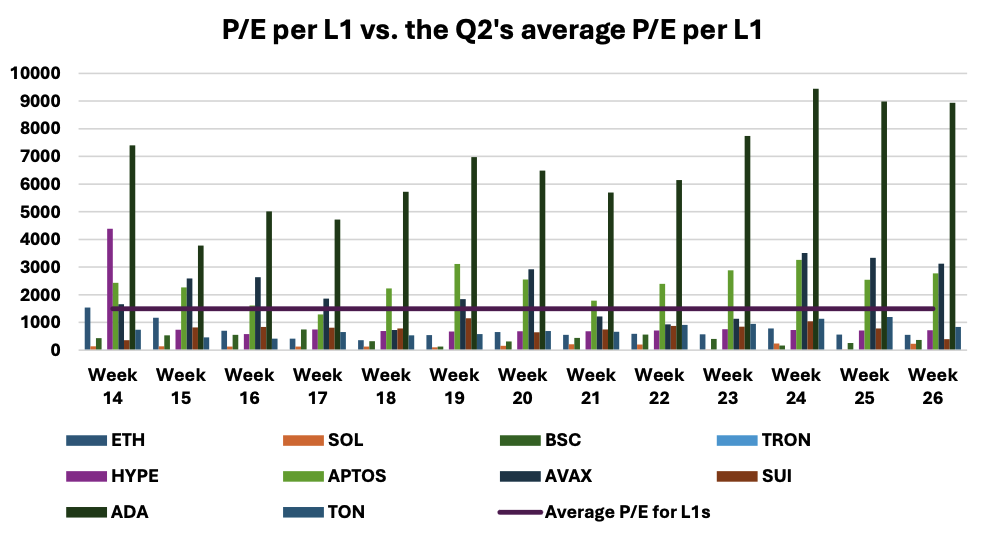

Tron remains the most profitable chain

With $984M in fees captured in Q2, Tron is far ahead

👉 The P/E ratio is at 6.33, far from the average (1,496) or Cardano (6,636)

Valuation = return to earth

The decline in P/E ratios and user valuation ratios shows that the market is returning to more rational levels

👉 Less speculation, more real use

In summary

– BTC & ETH outperforming thanks to ETFs

– Hyperliquid is a new challenger

– Tron remains a cash machine

– Stablecoins are increasingly used

– Valuations are normalizing

17.33K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.