Keeping other parameters unchanged, if ETH rises to $5000, the mNAV of SBET will only drop to around 1.8, maintaining a premium level similar to MSTR.

This means that with $ETH moving from 3100 to 5000, the momentum is strong, at least stronger than MSTR.

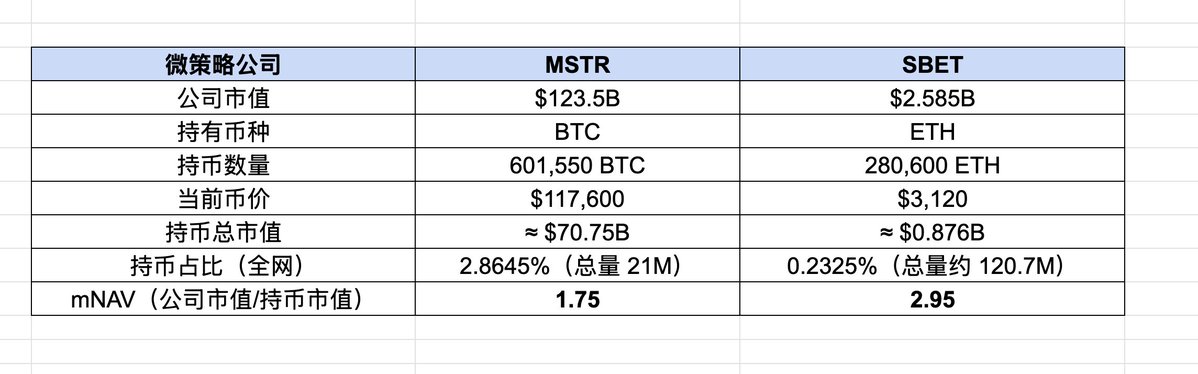

MSTR vs SBET Data Comparison (BTC MicroStrategy vs ETH MicroStrategy)

Currently, #MSTR's holding ratio is 2.8645%, while #SBET's holding ratio is only 0.2325%, a difference of 12 times, and the company's market capitalization differs by 47 times.

SBET's current mNAV is in the range of 2.5-3.5, higher than MSTR's 1.75, indicating that the market gives SBET a higher valuation premium. This premium also provides SBET with greater motivation to continue accumulating ETH, and the buying pressure for ETH will continue.

6.22K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.