Is it the summer of DeFi 2.0, guys? 😂

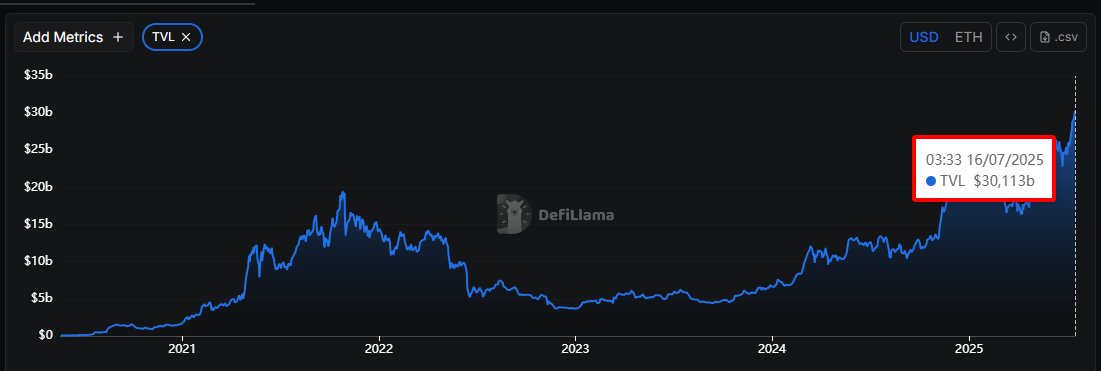

The TVL of $Aave has surpassed 30 billion dollars.

Lending protocols like $AAVE, $COMP, and $MORPHO are truly yield printing machines, based on collateral mechanisms and market interest rates, not on fake token incentives.

TVL increase = real capital inflow.

DeFi is really making a comeback, especially in the Lending/Borrowing sector, which is a pillar from real life to here, you have to borrow first before doing anything 🤣

The veterans are back, right? Unlike us newbies who jump straight into futures with x500 leverage, those who have been around know to start with lending first =))

Show original

13.04K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.