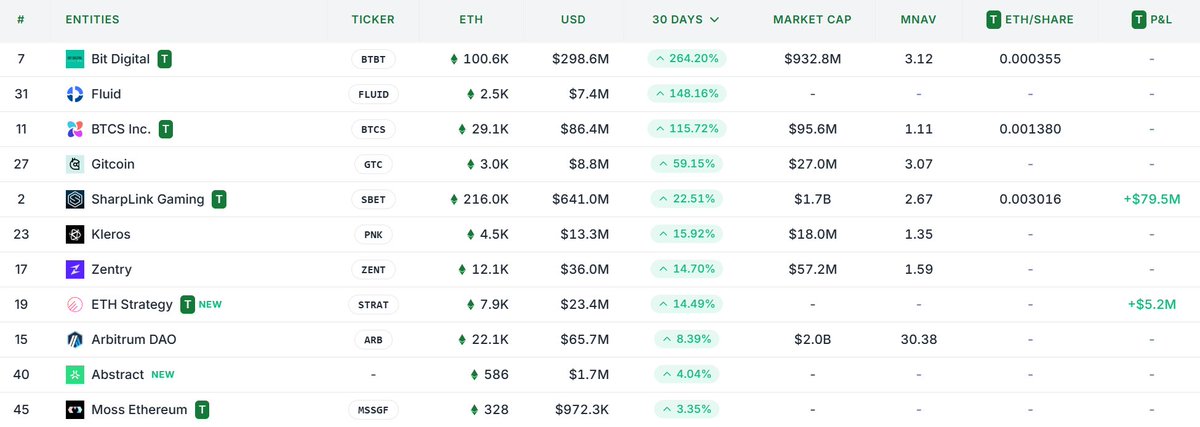

The launch of a project like PUMP is usually the end of a narrative. SOL may soon be over, meme will also be over, platform innovation is exhausted, the market is tired of meme aesthetics, and soon it will be time to change gears No matter how you think about it, Ethereum will win 1. Defi faucets: morpho, aave, and pengu, the leading copycat of coin stock ETF IP, also originated from Ethereum 2. The out-of-circle narrative refers to the market in 20~22 years, and the upper limit of the market value of copycats will be greatly increased 3. PoS interest-bearing attributes, carrying large funds outside the circle 4. The current price does not exceed the cost line of the big car SharpLink too much (excluding the discounted price OTC, the average public data is between 2667 and 2900), and there are still several car heads that are constantly increasing their positions. A bunch of micro-strategy imitation disks only look reliable in ETH 5. The SOL/ETH exchange rate is high, and the...

Show original

61.78K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.