My thoughts on the Pumpfun vs Bonk launchpad debate, and why I think that Pumpfun will ultimately win:

I know just reading that title many of you will be turned off by this, but try to keep an open mind when reading this.

A brief introduction:

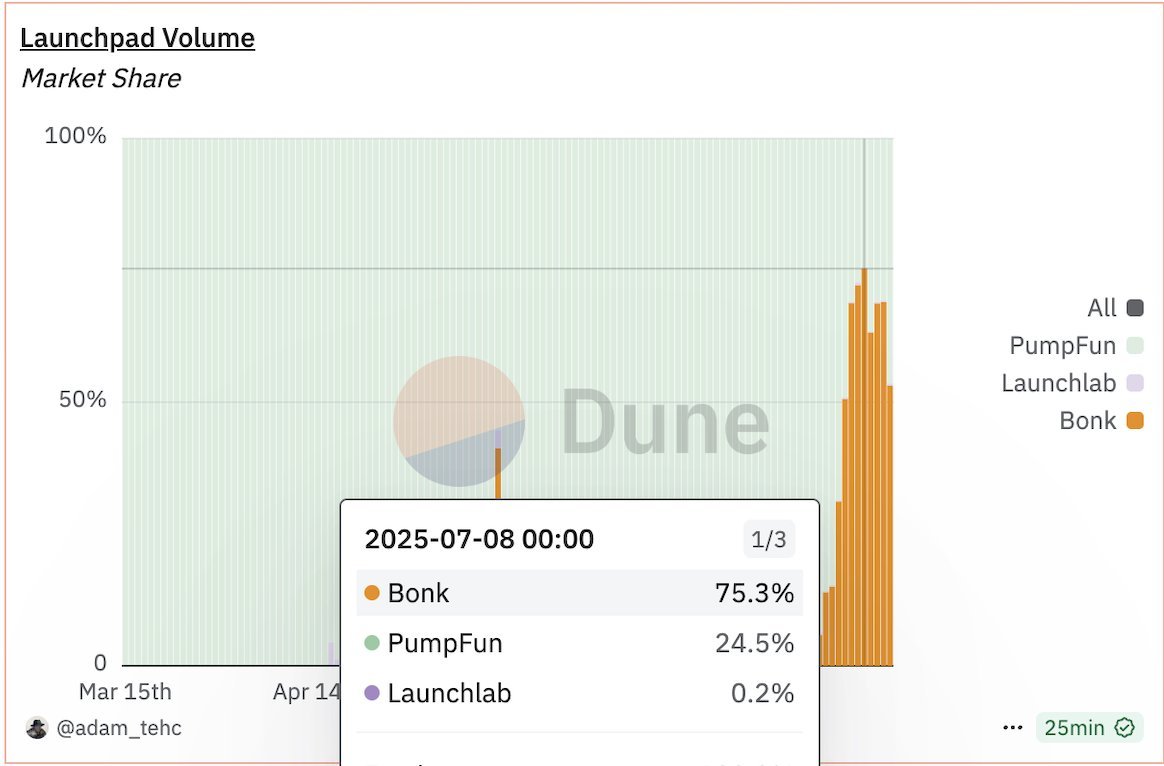

The memecoin launchpad sector on Solana is currently witnessing a realignment of market share, with Bonk emerging as the dominant player, as of now capturing over 60% of recent coin launch volume in the past week according to dune.

This has led many on crypto twitter to prematurely assert that Bonk will become the de facto standard for memecoin launches. However, such conclusions in my opinion conflate short-term momentum with structural weakness.

I guess I will share a more contrarian thesis that not many on CT share: that is that Pumpfun, despite its present market contraction, remains the more durable and systemically advantaged launchpad over the medium to long term.

The argument rests on two foundational pillars. First, Pumpfun’s position as the original launchpad to successfully scale memecoin deployment at velocity confers it a meaningful first-mover advantage, both in terms of network effects and cultural embeddedness. It withstood prior competitive threats such as Sunpump and many other KOL/Heavily Funded VC backed challengers and retains a loyal base of power users and traders.

Secondly, Bonks current dominance is tightly coupled to a fleeting meta, and speculative confidence drawn from the perceived stability of the Bonk KOL ecosystem.

This structure is inherently brittle; in my opinion the news/tweet meta and Bonk KOL stickiness/pull is part of a historically cyclical meta rotation that traders who have been long enough have seen all come and go.

SunPump vs Pumpfun - Mid 2024

In assessing the long-term viability of any protocol, survivability through paradigm shocks offers a more reliable indicator than temporary market share.

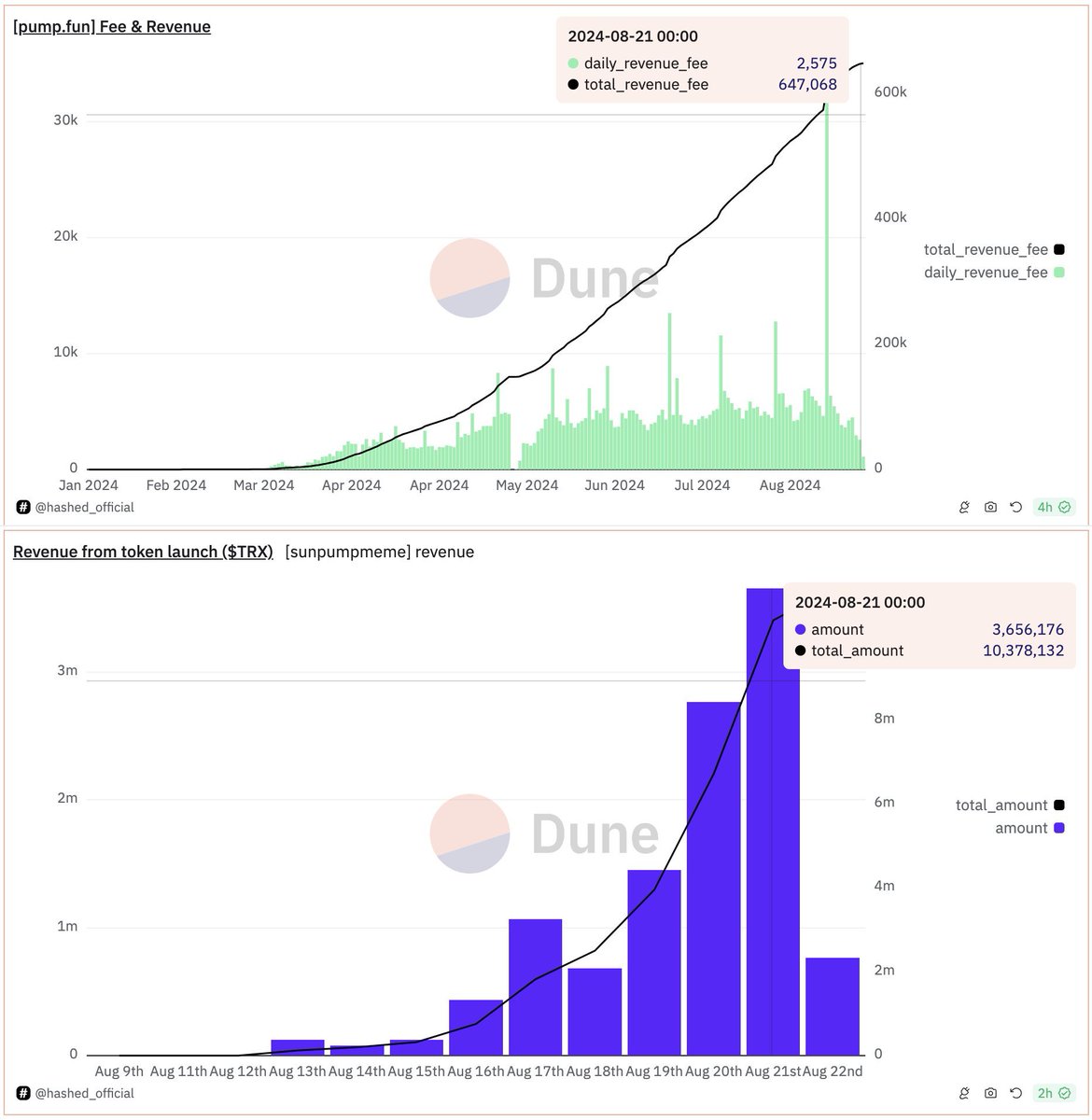

The brief yet intense episode involving SunPump a hyper-aggressive, copycat launchpad introduced by Justin Sun in around mid 2024 serves as a compelling stress test of Pumpfun’s "stickiness". Despite SunPump’s momentary success in capturing significant market attention, Pumpfun ultimately emerged from the challenge not only intact but further entrenched.

SunPump’s rise was rapid. It leveraged Justin Sun’s network and his own "pull" as a KOL, and an injection of capital from DWF Labs and market making on their "hero coins" such as WUKONG etc, the platform briefly surpassed Pumpfun in daily token launches and volume.

At its peak, SunPump launched over 62,000 tokens within its first two weeks, for a short time it outpaced Pumpfun’s typical throughput. This was not merely a temporary "just another launchpad" SunPump posed a credible existential threat, drawing away users, liquidity, and attention from what had previously been the undisputed leader as THE memecoin launchpad.

Yet, by late 2024, Pumpfun had reclaimed its position as the dominant launchpad, both by volume and by revenue. The reasons for this reversal are instructive. First, Pumpfun’s user base, while initially reactive to novelty, ultimately reverted to a familiar, time-tested UI/infra. This suggests a degree of platform loyalty rooted not in hype driven by Xs on competing launchpads, but in UX fluency, and reliability. Second, the ephemeral nature of SunPump’s success exposed its foundational weakness: its growth was entirely dependent on external capital and KOL involvement, lacking the organic traction and community stickiness that Pumpfun had cultivated over months.

The SunPump episode thus stands as more than a historical footnote it is pumpkins resilience moment. While many platforms can dominate during bull meta surges, far fewer can reassert themselves once the speculative tide recedes. Pumpfun did exactly that, absorbing the shock of a highly capitalized, KOL-driven competitor, and emerging with its brand, infrastructure, and user network not only intact, but expanded.

Meta Stickiness and waning KOL influence

Tweet‑Meta Launches & The Life Cycle of KOLs

Both Pumpfun and Bonk operate currently within a meta where launch volume and token creation count is all surrounding the tweet meta.

This tweet meta (one I personally find disgusting and boring) actually started on pumpfun and then with bonks surge the two began pvping on launches between bonk and pump coins with same base tweet, ending up today with total bonk dominance in this meta.

But how did Bonk achieve dominance in this meta? This was by their what I refer to as "ecoKOLS" ecosystem KOLs that is. For example Solport Tom and Bonkguy, both of which tweet with the knowledge that each single tweet that they put out will be tokenised (I like the both of them and this is not a critique of them but mores of the traders)

Nonetheless, they will tweet XYZ and XYZ coin will be launched on bonk, traders can accept and hold through multi wallet clusters selling because these ecoKOLs sometimes will reengage with the coin or project later.

This aspect in the tweet meta is non-existent in pumpfun. So it makes sense for tweet coins from Tom, or Unipcs to be bidded, and this translates to other coins within this meta.

Eg. a tier 1 influencer such as Elon musk tweets or breaking news will be deployed on bonk just because of the fact that the OTHER tweet coins from bonkguy and tom etc perform well. So for devs it makes more sense to deploy on bonk. But this meta is transient in my opinion and people will get bored of it through how optimised it has become.

Also another important point to consider is that all KOLs pull wanes to a certain extent. So betting on Bonk as of now as the launchpad successor relies on you believing the following:

1. Bonk can exist outside of the Tweet Meta and foundation backed coins

2. EcoKOLs don't lose their pull

Both of which seem hard for me to believe..

Problems with the Token

Bonk ties itself to the existing $BONK token, which has strong brand value and benefits from buybacks and burns. But this model has a structural limitation: if Bonkfun wants to raise serious capital for expansion team, infrastructure, incentives it only has only one option.

That is to sell BONK from its treasury (which puts selling pressure on the very token it’s trying to support negating any "flywheel effect")

That means Bonk’s so-called “flywheel” is mostly cosmetic. It’s dependent on maintaining optics and momentum but lacks the financial flexibility to scale without hurting its own token or diluting its value proposition.

Conclusion

While current sentiment overwhelmingly favors Bonk, a deeper examination reveals that its dominance is rooted in transient meta conditions. These forces, while powerful in the short term, are inherently unstable. They depend on the continued attention of a migratory KOL class.

By contrast, Pumpfun has demonstrated resilience across multiple market regimes including the high profile SunPump challenge and has retained core traction without relying on external narratives or ecosystem subsidies.

In memecoins, as in markets more broadly, narratives may drive volume, but only structure sustains ecosystems. Pumpfun is built for the long game.

Show original

33.63K

179

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.