Why my bias has shifted from offensive to neutral:

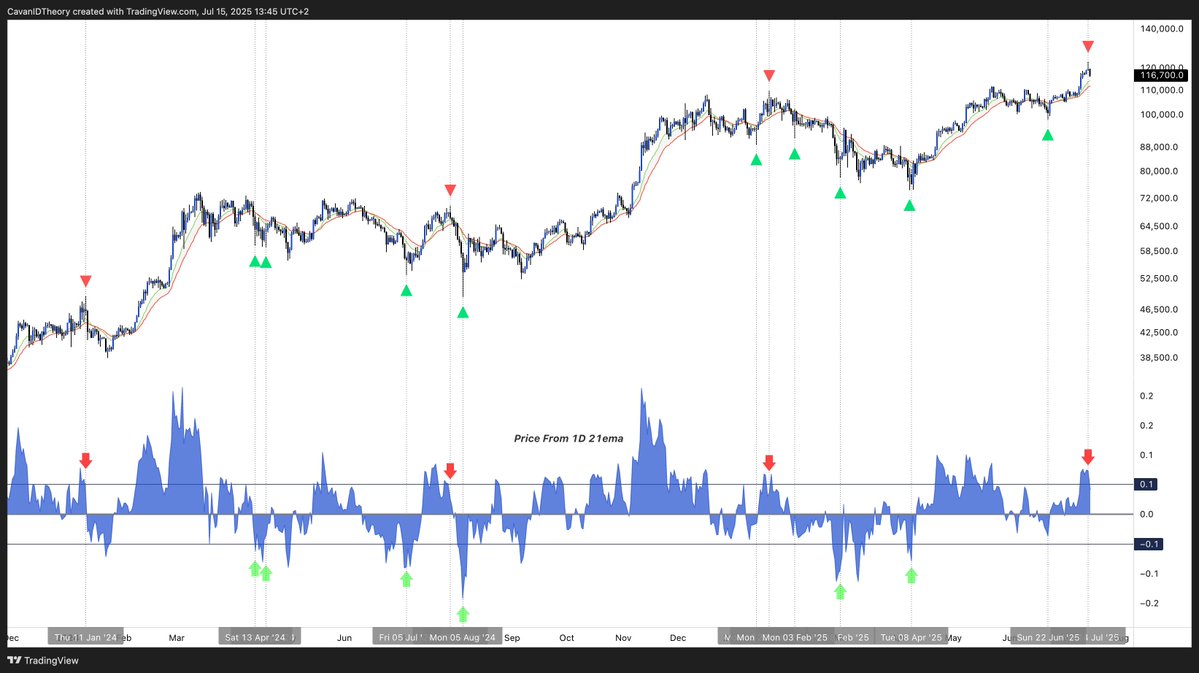

I have an indicator that assesses candles and helps me identify local inflection points. The heuristic for signal is as follows:

1) The full candle range (from wick low to high) is greater than 1.4× the average range of the last 14 candles; this ensures I look at candles that are significantly larger than usual (candles of significance, let's say)

2) The wick in the reversal direction (upper wick for a top, lower wick for a bottom) is more than 50% of the full candle size; which suggests price was strongly rejected in the direction of the wick

3) The wick must take out the prior 14-bar high (for a top) or prior 14-bar low (for a bottom); helping understand if the candle is at a local extremity

In addition, to help understand where price is relative to a shorter-term mean, the bottom pane shows price % from 1D 21ema, and marked zones where price extends > 10% +/- from this mean.

When we have overextension, combined with the candle heuristic outlined above, it typically indicates a local inflection point.

With this in mind, that yesterday may potentially be a local inflection point, then the next question is where should we expect price to head from there…

A mean reversion towards 12/21ema bands is potentially on the cards; they currently sit at 112k-114k (see previous examples where the heuristic rules have been met, likely we revisit the bands).

If we do experience a mean reversion towards the bands (112k-114k), this is also confluent with the range highs, at that point we have to wait and see how much demand lies in that area. I expect bulls to step in rather meaningfully should we go there.

When bitcoin has broken the range highs this cycle, those highs have been left for dust, so if we were to see price revisit the highs so soon after breaking out, it would be rather different from other breakouts this cycle. And especially given the break happened in summer (usually a low vol environment) it may be quite hard for us to sustain momentum up past the highs set yesterday. A -10% correction so soon after the breakout really dampens momentum, period.

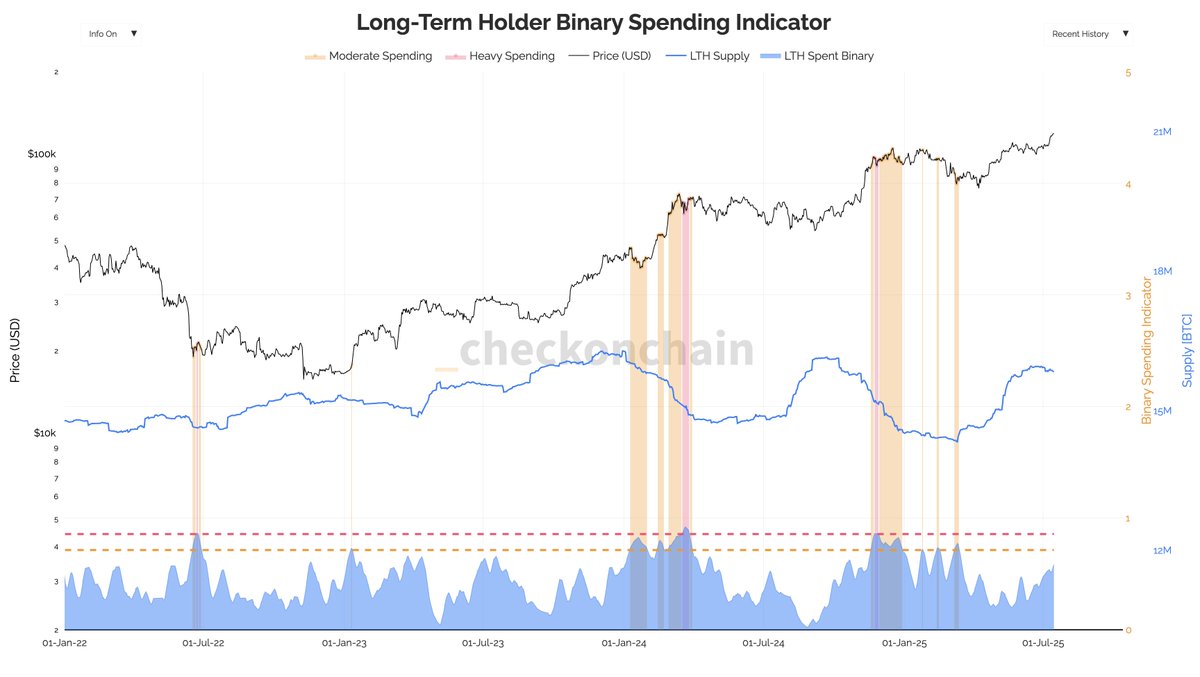

We are also starting to see LTHs pick up their spending pace once again, which is very usual post range breakout, the coins that were accumulated into weakness are distributed into strength. We have to consider the impact should this distribution take place into waning volume/demand.

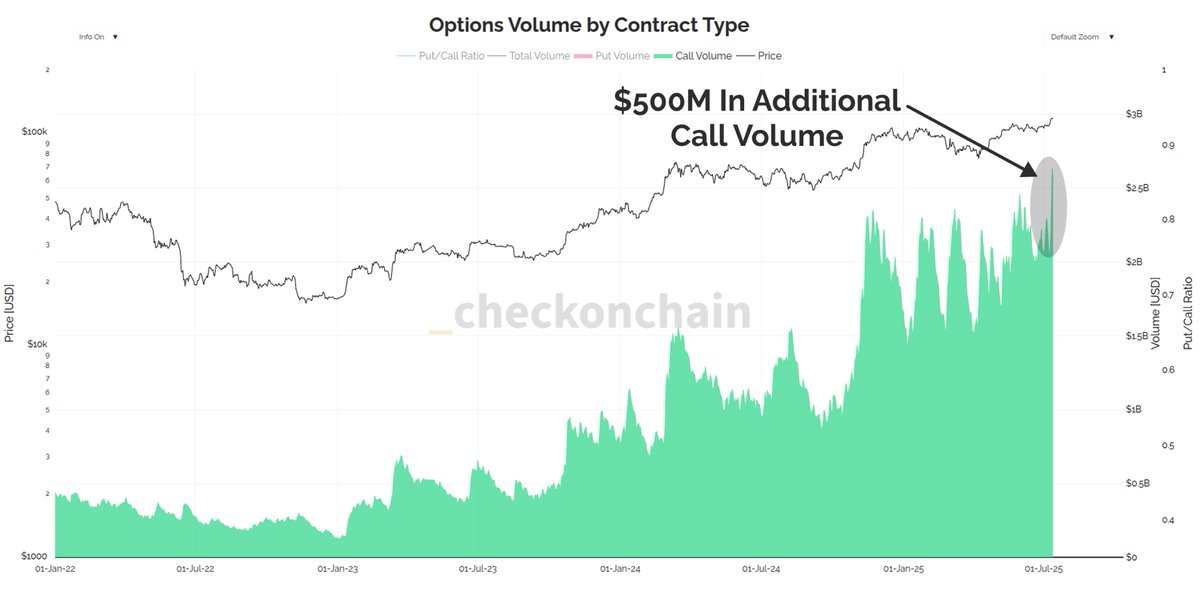

In recent days, we saw a massive spike in call volume. Options market isn't my forte, but usually a sign to pay attention if in an offensive position.

(chart by @_Checkmatey_)

HY spreads widened again yesterday, which have now widened 17bps since 3rd July. Whilst still relatively tight at 2.97, the trend, and acceleration/deceleration of the trend (2nd derivative) is what I deem important, and it looks like the recent contraction in spreads (which is risk conducive) may be waning. Too early to call anything here but important to monitor this trend as it provides a canary for risk appetite and also helps reflect market liquidity dynamics.

The big-picture bull case remains; nothing has changed on that front. Own debasement hedges! However, this is a tactical shift in bias given the reasons outlined above; my base case is much higher come the end of the year, but I'm now less confident we get an aggressive uptrend in July/aug. I think it is now becoming more likely we will see it post summer. Hence a shift towards "neutral".

As we are entering the latter stages of the cycle, we may see an ETH rally in coming weeks/months, even if bitcoin doesn’t trend, very open to this idea given the tailwinds ETH currently has going for it, and ETH is in a completely different place to Bitcoin right now.

A strong ETHBTC trend may provide enough confidence for people to move down the curve in alts too, in this scenario, we see a meaningful drop off in bitcoin dominance and mini alt season.

The invalidation of the neutral stance outlined above is simply bitcoin convincingly breaking the highs we set yesterday.

As always, I'm open-minded to any outcome and simply sharing what I'm seeing.

Show original

19.41K

249

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.