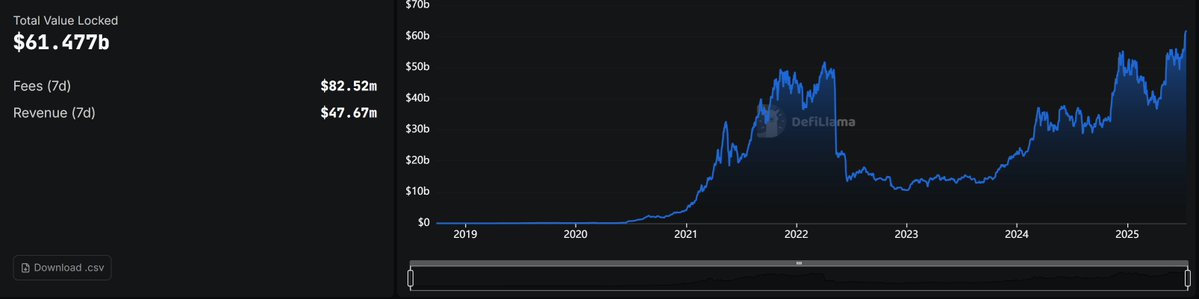

Lending markets hit a new ATH, breaking the $60 billion mark.

But one thing that hasn't been talked about much is the idle capital sitting on these lending markets.

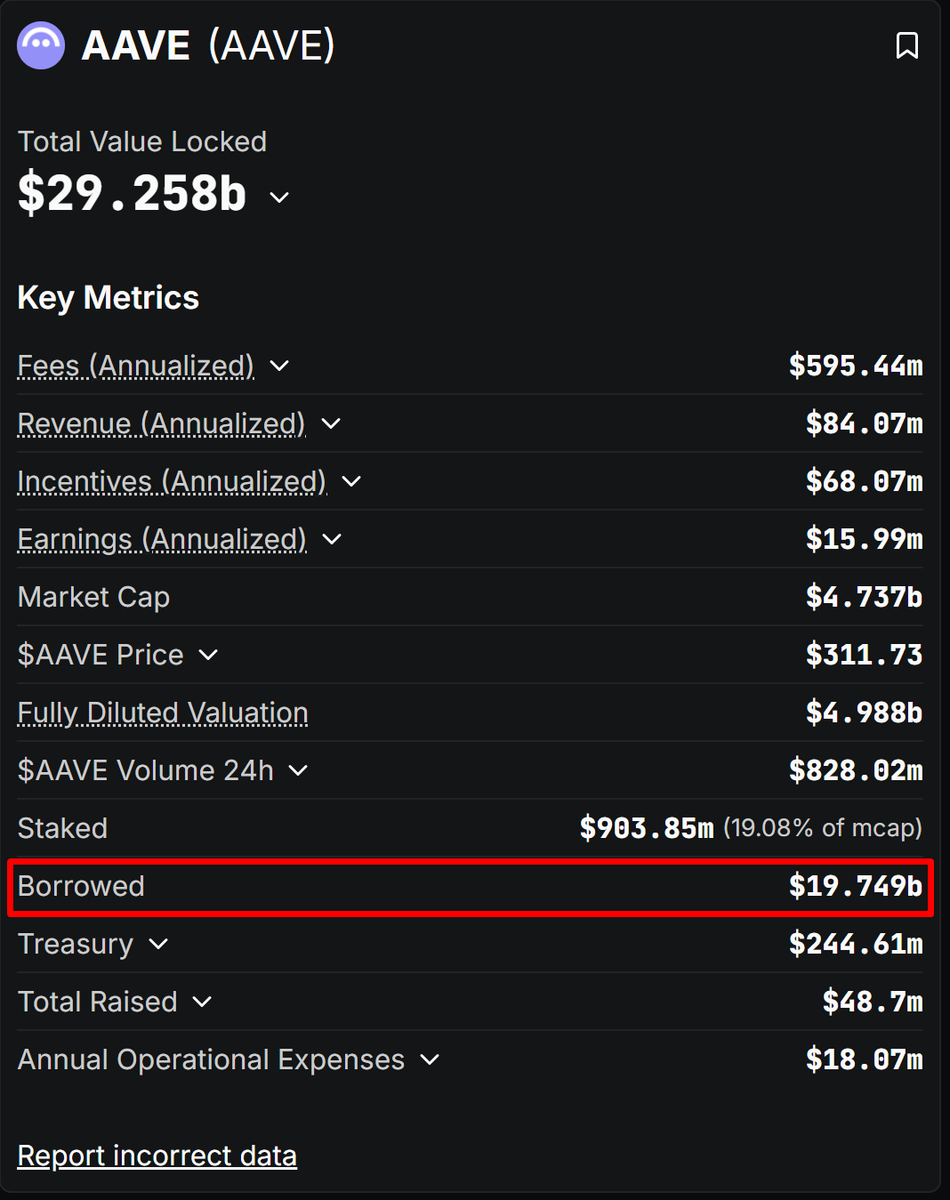

Take a look at @aave, for instance. It stands out as the big player in the lending sector and has the most utilized pools.

However, over 30% of capital is still sitting on Aave and not yet borrowed.

The further we go down the leaderboard, the wider this margin gets...

And that’s why I love the idea @0xSoulProtocol is presenting. They're building a unification layer for lending markets to become more composable.

In the current iteration, this is hard to achieve. How can you make JustLend (a lending protocol on Tron) composable with Aave?

So they built from the ground up, using a modular architecture that can connect these chains into one interface and allow users to move seamlessly across chains, taking advantage of the best opportunities they see.

I won’t say that designing this will be easy, but if @0xSoulProtocol succeeds, they might unlock a huge chunk of dormant capital in the lending sector.

Show original

10.95K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.